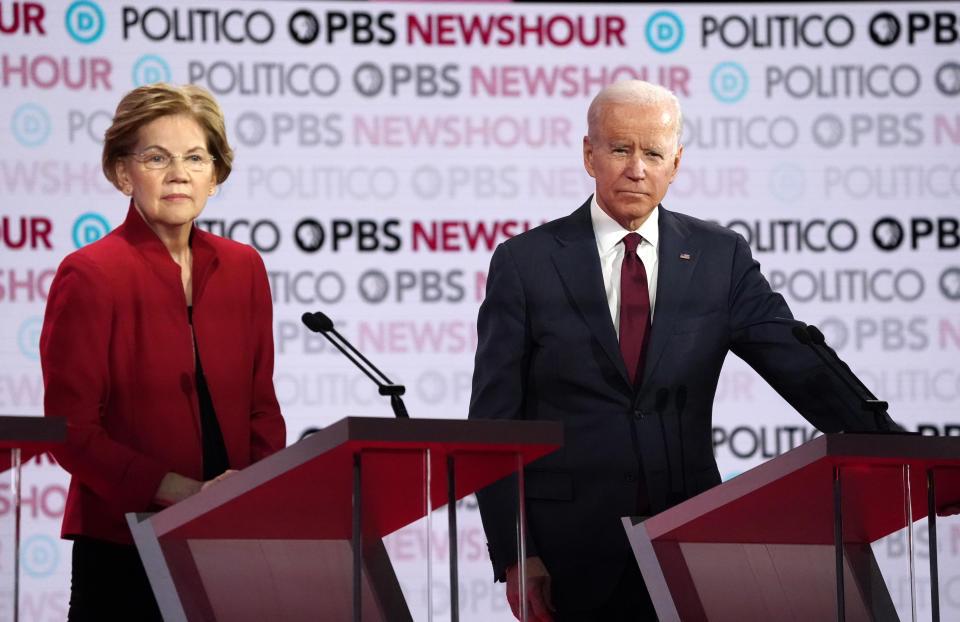

New Warren plan takes aim at bankruptcy (and Biden)

On Tuesday, Sen. Elizabeth Warren released a new plan that would make it easier for people facing immense debt to seek protection through bankruptcy.

The plan highlights what has long been a signature issue for the Massachusetts senator. Its release — 27 days before the Iowa caucuses kick off the presidential primary season — also sets up a direct contrast with one of her main rivals: former Vice President Joe Biden.

In 2005, then-Sen. Biden voted for the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 which Warren fought against. The bill was sponsored by Republican Sen. Chuck Grassley and signed into law by President George W. Bush. It was opposed by most Democrats, including then-Sen. Barack Obama.

The 2005 bill has long been in Warren’s crosshairs and her latest plan is no exception. She has said that the bill was what inspired her to get into public service. After a rally in April, she reportedly said that she got directly involved in politics “because [families] just didn’t have anyone and Joe Biden was on the side of the credit card companies.”

The 2005 bill

The 2005 bankruptcy bill made it much harder to declare Chapter 7, which is the kind of personal bankruptcy that allows consumers to sell their assets to pay debts, after which their slate is clean. The bill added a means test designed to steer more people into Chapter 13 bankruptcy, which creates a multiyear payment plan, added hefty requirements for paperwork, credit counseling, requirements for attorneys, and spending limitations during the bankruptcy process that critics argue places an undue burden on families with children.

The law was pursued because some members of Congress believed too many people were filing for these protections and abusing the system.

After the bill passed, bankruptcies went down 50% but the numbers of insolvent people rose by 25%, Warren says, which caused 800,000 mortgage defaults and 250,000 foreclosures.

A signature issue

Bankruptcy has long been a signature issue for Warren, even before she got into politics.

As a law professor, Warren studied bankruptcy and found that even experts had never really dug into the data. Examining thousands of bankruptcy documents from courthouses across the country, Warren found that most bankruptcy incidents don’t stem from a shirking of responsibility, but rather bad luck.

“The data showed that nearly 90% of these families were declaring bankruptcy for one of three reasons: a job loss, a medical problem, or a family breakup,” she wrote.

Warren also wrote a 2004 book called “The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke,” with with Amelia Warren Tyagi, her daughter. The book focused on personal bankruptcy and economic insecurity.

Warren’s plan

Warren’s plan would do away with a few things in the 2005 bill that make declaring bankruptcy so difficult. First, it would remove means testing, which forces people making more than their state’s median income to file for Chapter 13 bankruptcy and involves a multiyear payment plan instead of liquidation of assets and a clean slate.

Warren’s plan would get rid of Chapter 13 and use a new system in which consumers surrender all non-exempt property in exchange for having their debts “discharged.” Consumers could also target specific financial problems through bankruptcy while continuing to pay other creditors. The plan would also make it easier to keep homes and cars — two things that are critical for rebuilding a life after bankruptcy.

The plan also attacks paperwork that Warren deems as unnecessary, costly, and ineffective, as well as credit counseling requirements, which are expensive and without evidence of utility.

The bill would also change what debts can be discharged. Public student loans, for example, can’t be discharged without showing “undue hardship,” and the 2005 bill added the same protections for private student loans.

“My bankruptcy reform plan ends the absurd special treatment of student loans in bankruptcy and makes them dischargeable just like other consumer debts,” Warren wrote.

Warren’s plan also addresses racial and gender disparities in the bankruptcy system, which affects non-white families more than white ones.

At the same time as all of these changes, Warren’s plan also addresses the abuse concerns that, at least nominally, may have prompted the 2005 law.

“Creditors could seek to dismiss a case or object to an individual’s discharge on grounds of abuse, and they would have an easier time proving abuse for higher-income debtors,” she wrote.

And for one area, known as the “Millionaire’s Loophole,” Warren would close it, preventing some wealthy individuals in states like Delaware to get debt relief while shielding assets via trusts.

A series of shots at Biden

Warren had more pointed criticism of Biden at a recent speech at the New Hampshire Institute of Politics. She focused the speech on her background, especially her role in creating the Consumer Financial Protection Bureau, and called out Biden on the issue of wealthy donors.

“Unlike some candidates for the Democratic nomination, I'm not betting my agenda on the naive hope that if Democrats adopt Republican critiques of progressive policies or make vague calls for unity that somehow the wealthy and well-connected will stand down,” she said.

Her new bankruptcy plan is somewhat more indirect. Biden’s name, for example, never appears in the plan although the document notes that the 2005 law was passed with “some Democratic support.” Warren has been calling out Biden, by name, for his support of the bankruptcy bill since before it even passed.

The new plan is a part of Warren’s search for a lift for her campaign after a rocky few months on the fundraising and on the polling fronts. On Monday, she announced that former candidate Julian Castro, a former rival, is now a supporter and will be joining her for upcoming events in New York and Iowa.

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann. Ben Werschkul is the DC producer for Yahoo Finance. Follow him on Twitter @benwerschkul.

The first thing to do after you're involved in a hack, according to experts

Elizabeth Warren's message for final sprint before Iowa: 'I believe in markets'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance