Elizabeth Warren scares Wall Street for good reason

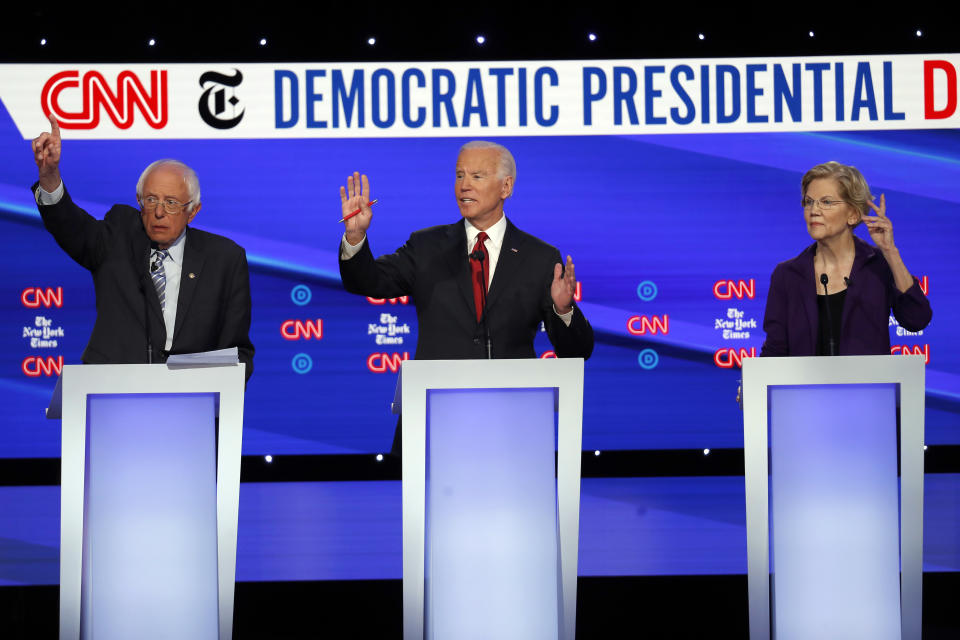

At Tuesday’s Democratic debate, Sen. Elizabeth Warren asserted that only corporations and the wealthiest Americans will see their tax bills rise to pay for her boldest campaign promises – universal childcare, Medicare for All, and student debt cancellation. Hard-working middle-class families will be spared, she said.

Warren is officially leading the 2020 race – she overtook Joe Biden in the latest Quinnipiac poll, though by a slim margin (30% vs. 27%) – and that’s scary to big business, which she has long characterized as having oversize influence on the overall economy.

Sectors such as financials, health care, and tech have expressed particular concern at the prospect of a Warren presidency.

“I'm really shocked at the notion that anyone thinks I'm punitive,” Warren said at Tuesday’s debate.

“Look, I don't have a beef with billionaires. My problem is you made a fortune in America, you had a great idea, you got out there and worked for it, good for you,” she said. “You built that fortune in America. I guarantee you built it in part using workers all of us helped pay to educate. You built it in part getting your goods to markets on roads and bridges all of us helped pay for. You built it at least in part protected by police and firefighters all of us help pay the salaries for. And all I'm saying is, you make it to the top, the top 0.1%, then pitch in two cents so every other kid in America has a chance to make it.”

Convincing the ultra-wealthy, big businesses and investors that paying a higher share of taxes is good for the country will take more than a well-timed soundbite from the debate stage.

A Trump victory is viewed by most investors (61%) as good for stocks, according to a recent RBC Capital Markets survey. Two-thirds of respondents expect President Trump to get re-elected in 2020, but doubts are creeping in. A dwindling share of respondents think Trump will get re-elected, while a growing number think Warren will lead the Democratic ticket.

Warren’s ascent is making many investors nervous because they viewed a Biden 2020 win as a neutral event for markets. Their views on stocks and returns for portfolios turns negative should Warren or another Democratic candidate other than Biden be the victor; 89% of investors said electing a Democrat other than Biden would be bearish or very bearish for U.S. equities, according to RBC Capital Markets.

Wall Street interest in Warren

Although investors love to talk football with their money managers, over the past few weeks, Warren is the one who has captivated clients’ attention, says Height Capital Markets senior policy analyst Benjamin Salisbury.

“There’s been an intense recent interest in Sen. Warren as her standing in the polling has risen. [Investors] playing a little bit of catch up on getting up to speed on her specific policy proposals,” says Salisbury. Given that Warren’s policies would be a significant departure from Trump’s, investors are beginning to gauge what the risks and opportunities are.

While the CEOs of America’s biggest corporations have decried the negative impact of Trump’s tariff policy on sales, hiring and capital investments, Warren has not advocated for a reprieve from the financial pain inflicted on corporate America. Rather, her plans could cut further into profit margins of corporations.

Warren’s plan to reform America’s labor laws is a sharp departure from the status quo for chief executives – for instance, they would limit the amount of stock executives can sell in their own companies, while raising wages for workers and boosting unions’ bargaining power.

Warren has long sought to weaken big business and boost regulation as a way to protect consumers and workers, and her plans as presidential candidate would arguably do the most to overhaul the way businesses operate.

Threat to financial sector

Investors view Warren as a threat to the financial sector because of her various proposals to overhaul what she views as Wall Street’s stranglehold on the U.S. economy.

“Elizabeth Warren would be a fairly significant negative for the financial services sector broadly,” says Heights Capital Markets Senior VP Edwin Groshans. “I think some captains of the finance industry will either stop support for Democrats entirely or to a large degree, and some will actively support Trump over Warren. They’ll switch parties basically.”

Warren’s “Stop Wall Street Looting Act” would overhaul the way private-equity firms do business, making it harder for them to make money when they buy a company that fails.

In a recent note, Oppenheimer senior analyst Chris Kotowski said Warren’s proposal would become known as the “Don’t Invest in America Act” if it were enacted. He wrote that making private equity funds directly responsible for all of a portfolio company’s liabilities amounts to “foreclos[ing] wide swathes of the American economy from investment, certainly by the PE sponsors directly.”

Investors also take issue with her support of the 21st Century Glass Steagall Act which would separate commercial banking from investment banking. It could impact major firms like JPMorgan Chase, Bank of America, and Citigroup if they were forced to split up.

Warren’s proposed student-loan debt forgiveness program is also viewed as a threat because it would strike at lenders’ profit centers. Groshans says that assigning blame to lenders is misplaced.

Negative sentiment among investors of pharmaceutical manufacturers, health insurers, and providers has primarily been driven by Medicare-for-all proposals over the past six months, according to Height Capital Markets.

“Medicare for all is the gold standard,” Warren said in Tuesday’s debate. “It is the way we get health-care coverage for every single American, including the family whose child has been diagnosed with cancer, including the person who's just gotten an MS diagnosis. That's how we make sure that everyone gets health care.”

A Medicare-for-all-type system is seen as eliminating insurers, taking patents away from drug companies, and reducing rates for health care providers, Hammond says. Health-care stocks would be vulnerable if, for instance, a government run health-care program eliminated private insurers’ business. The sector came under pressure earlier this year when Medicare for all momentum picked up.

Rhetoric against the health care sector will likely intensify during the race. Hammond views Warren’s strategy of being more vague on health care than other issues as shrewd. “When health care is the No. 1 issue in these debates but you’re only given 30 seconds to discuss it, then any plan just gets immediately torn apart and misinterpreted,” he said. “It’s subject to one-liners and so staying away from the actual specifics on this issue, in particular, I think is politically brilliant,” he says.

Nightmare scenario for Big Tech executives

Tech executives, not surprisingly, wouldn’t giving a warm welcome to a Warren presidency. “If she became president, I think [Facebook CEO Mark] Zuckerberg should buy an apartment, probably somewhere in the Beltway, because I think he’d be spending a lot of time there,” Dan Ives, a tech analyst at Wedbush Morgan, told Yahoo Finance. It should be noted that despite Warren’s rise in popularity, many say it’s doubtful some of her big initiatives targeting big business would get enacted, given pushback from Congress; some could get watered down.

Warren has been pushing for the breakup of big tech including Amazon, Google, and Facebook. Recently leaked audio of Zuckerberg discussing what he would do if she got elected shows a clear concern. “If she gets elected president then I would bet that we will have a legal challenge,” he said.

While executives fear a Warren presidency, Ives says the biggest risk to tech stocks is China. “Biggest risk to tech stocks it’s the tariff situation with Trump. So if that was removed [by a Warren administration], you could argue that’s a positive.”

More from Sibile:

Eric Trump: China is one of the reasons Donald Trump ran for president

Jobs report: Here’s why you’re not earning more despite record low unemployment

Why Wall Street may be ‘way too sanguine’ about Trump impeachment risks

China leveraging Trump impeachment ‘desperation’ in trade talks

Democratic lawmaker on Trump impeachment inquiry: ‘We have no choice’

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.