Essex Bio-Technology And Two More Leading Dividend Stocks In Focus

As global markets navigate through a landscape marked by fluctuating inflation rates and cautious monetary policies, investors are increasingly looking for stable returns, making dividend stocks a compelling focus. In Hong Kong, amidst the broader economic challenges reflected in recent index performances, dividend-yielding stocks such as Essex Bio-Technology offer an avenue for potentially steady income in uncertain times.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 7.80% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.65% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.88% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 8.98% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.02% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 7.84% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.90% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.39% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.17% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.68% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

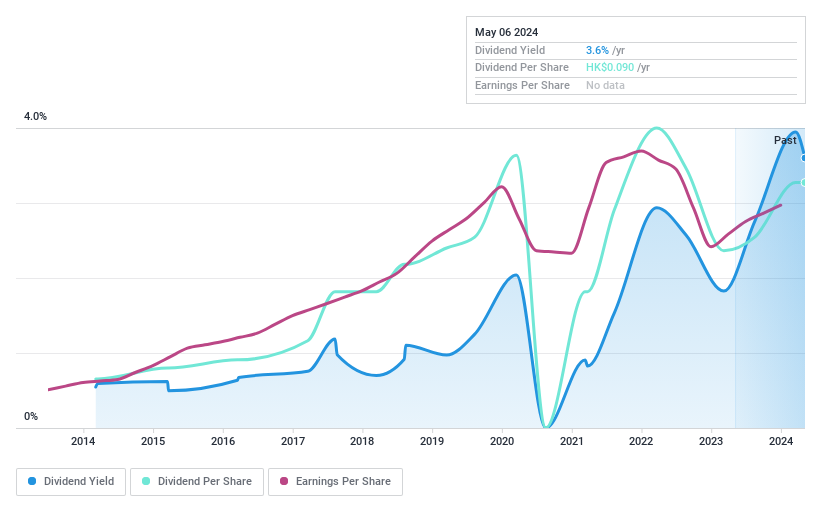

Essex Bio-Technology

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, distributes, and sells bio-pharmaceutical products primarily in the People's Republic of China and Hong Kong, with a market capitalization of approximately HK$1.46 billion.

Operations: Essex Bio-Technology Limited generates revenue primarily through its Surgical and Ophthalmology segments, with earnings of HK$953.16 million and HK$753.39 million respectively.

Dividend Yield: 3.5%

Essex Bio-Technology has shown a mixed performance in dividend reliability, with payments experiencing significant volatility and inconsistency over the past decade. Despite this, recent increases in dividends, including a final dividend of HK$0.045 per share for 2023, indicate some positive movement. The company's Price-To-Earnings ratio at 5.3x is attractively below the Hong Kong market average of 9.7x, and its earnings have grown by 22.1% over the past year. Additionally, both earnings and cash flows comfortably cover its dividend payouts with ratios of 18.6% and 24.2% respectively, suggesting sustainability if current financial health is maintained.

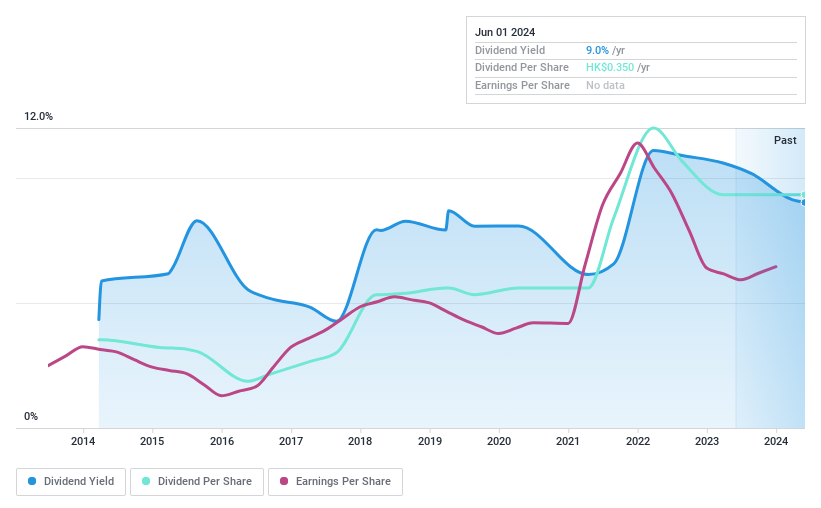

S.A.S. Dragon Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S.A.S. Dragon Holdings Limited operates as an investment holding company that distributes electronic components and semiconductor products across various regions including Hong Kong, Mainland China, Taiwan, the USA, Vietnam, Singapore, and Macao with a market capitalization of approximately HK$2.43 billion.

Operations: S.A.S. Dragon Holdings Limited generates revenue primarily through the distribution of electronic components and semiconductor products, totaling HK$22.37 billion.

Dividend Yield: 9%

S.A.S. Dragon Holdings declared a final dividend of HK$0.25 per share for 2023, reflecting a commitment to shareholder returns despite its unstable dividend history and volatile payments over the last decade. The company's dividends are well-supported by earnings and cash flows, with payout ratios of 54.2% and 21.2% respectively, suggesting prudent financial management relative to its modest year-over-year earnings growth of 0.9%. However, trading at 22% below estimated fair value could indicate an undervaluation issue or investor caution due to past dividend inconsistencies.

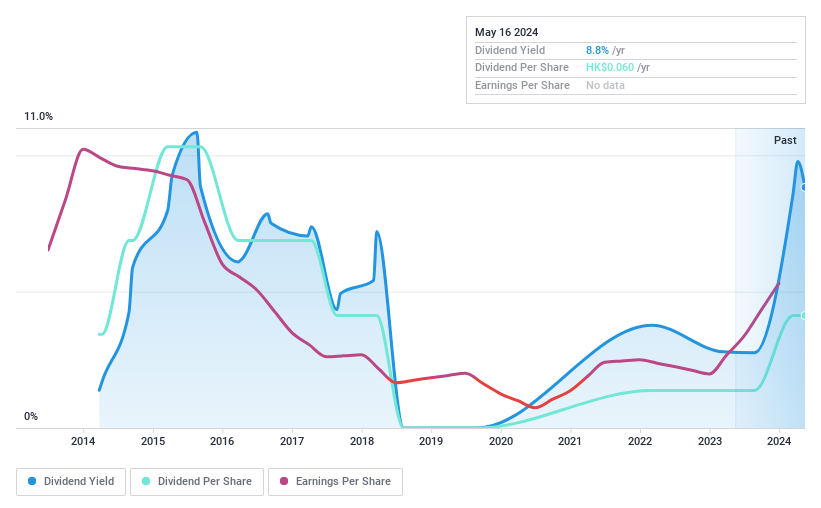

Playmates Toys

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Playmates Toys Limited operates as an investment holding company, focusing on the design, development, marketing, and distribution of toys and family entertainment products, with a market capitalization of approximately HK$0.84 billion.

Operations: Playmates Toys Limited generates revenue primarily from its toys and family entertainment activity products, totaling approximately HK$1.11 billion.

Dividend Yield: 8.5%

Playmates Toys, despite a volatile dividend history, offers an attractive yield of 8.45%, higher than the Hong Kong market average. Recent earnings surged to HK$221 million for Q1 2024 from HK$73 million in Q1 2023, supporting dividends with a low payout ratio of 26.4% and a cash payout ratio under control at 82.6%. However, the inconsistency in past dividend payments suggests caution, even as recent performance indicates potential stability.

Navigate through the intricacies of Playmates Toys with our comprehensive dividend report here.

Our valuation report unveils the possibility Playmates Toys' shares may be trading at a discount.

Where To Now?

Click here to access our complete index of 89 Top Dividend Stocks.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1061 SEHK:1184 and SEHK:869.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]