Euronext Amsterdam's Growth Companies With High Insider Ownership For October 2024

As European markets show signs of optimism with the STOXX Europe 600 Index rebounding on hopes for interest rate cuts, investors are keenly observing the potential impact on growth companies across the continent. In this context, Euronext Amsterdam's landscape offers intriguing opportunities, particularly among growth companies with substantial insider ownership, which can indicate confidence in a company's future prospects.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

Name | Insider Ownership | Earnings Growth |

Envipco Holding (ENXTAM:ENVI) | 36.7% | 82.7% |

Ebusco Holding (ENXTAM:EBUS) | 31% | 107.8% |

MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

Basic-Fit (ENXTAM:BFIT) | 12% | 77.7% |

CVC Capital Partners (ENXTAM:CVC) | 20.2% | 31% |

PostNL (ENXTAM:PNL) | 35.6% | 36.4% |

We'll examine a selection from our screener results.

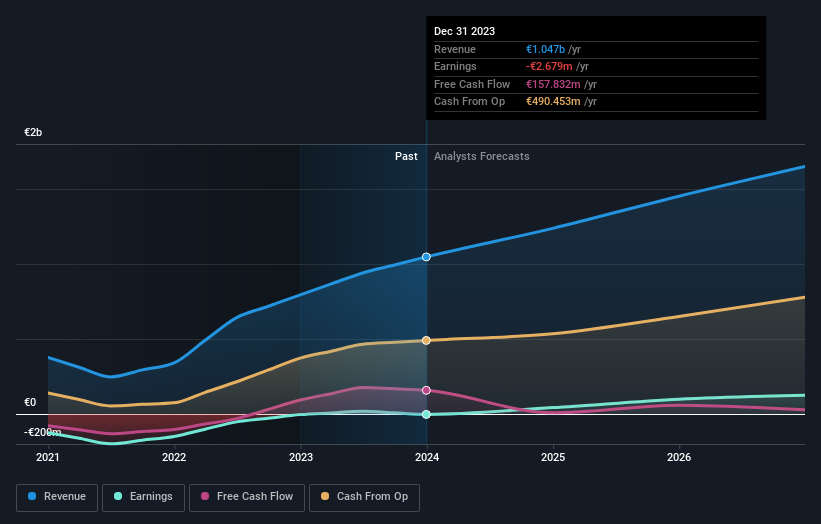

Basic-Fit

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., along with its subsidiaries, operates fitness clubs and has a market cap of €1.63 billion.

Operations: The company's revenue segments consist of €505.17 million from Benelux and €626.41 million from France, Spain & Germany.

Insider Ownership: 12%

Earnings Growth Forecast: 77.7% p.a.

Basic-Fit has demonstrated strong revenue growth, reporting €584.76 million for H1 2024, up from €500.42 million a year ago, with net income turning positive at €4.18 million. Despite lower profit margins and interest payments not being well covered by earnings, its earnings are forecast to grow significantly over the next three years. Recent activist pressure from Buckley Capital Management highlights potential strategic opportunities to unlock shareholder value through a sale or restructuring of the company.

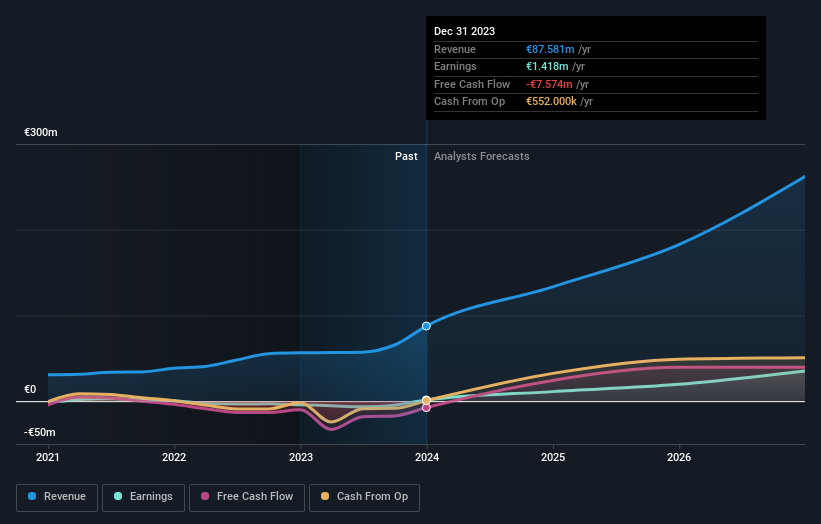

Envipco Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers in the Netherlands, North America, and Europe with a market capitalization of €299.99 million.

Operations: The company's revenue primarily stems from its activities in designing, developing, manufacturing, assembling, marketing, selling, leasing, and servicing reverse vending machines for the collection and processing of used beverage containers across the Netherlands, North America, and Europe.

Insider Ownership: 36.7%

Earnings Growth Forecast: 82.7% p.a.

Envipco Holding has shown substantial revenue growth, with H1 2024 sales reaching €54.01 million, up from €26.89 million the previous year, while net losses narrowed significantly. Despite high share price volatility and past shareholder dilution, its earnings are forecast to grow at a robust 82.7% annually over the next three years, outpacing market averages. Recent board changes include Ms. Charlotta Gylche's appointment and Mr. George Katsaros' resignation due to health reasons.

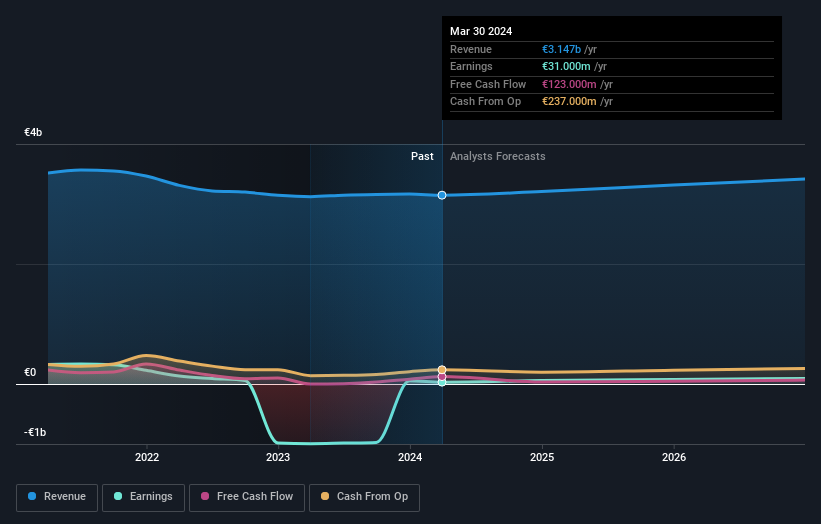

PostNL

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally, with a market cap of €619.61 million.

Operations: The company's revenue is primarily derived from its Parcels segment (€2.28 billion) and Mail in The Netherlands (€1.35 billion).

Insider Ownership: 35.6%

Earnings Growth Forecast: 36.4% p.a.

PostNL has shown modest revenue growth, with Q2 2024 sales of €793 million, up from €768 million the previous year. Despite a net loss for the first half of 2024 and high debt levels, its earnings are forecast to grow significantly at 36.38% annually over the next three years, surpassing market averages. However, revenue growth is expected to lag behind the Dutch market. Insider trading activity remains stable with no substantial buying or selling reported recently.

Next Steps

Click here to access our complete index of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTAM:BFIT ENXTAM:ENVI and ENXTAM:PNL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]