EV battery developer QuantumScape begins trading on NYSE

QuantumScape (QS), a battery developer for electric vehicle use, began trading on the New York Stock Exchange today following a SPAC merger. Shares of the San Jose-based company were up 49% in early trading during.

QuantumScape is aiming to commercialize its solid-state lithium metal batteries which it claims provide a greater range, a much faster charge time and are safer and more cost effective than conventional technologies used today.

The company is backed by Microsoft (MSFT) co-founder Bill Gates and Volkswagen (VOW.DE). Former Tesla (TSLA) Chief Technology Officer JB Straubel is currently a QuantumScope board member.

Production of the batteries is several years away with Volkswagen aiming to install them in vehicles by 2025.

QuantumScape’s founder and CEO Jagdeep Singh told Yahoo Finance Live, “We’re really at the cusp for the beginning of this massive transformation” into electrification of vehicles.

“Whoever wins the battery battle, so to speak, is going to be looking at, in our opinion, a multi hundred billion dollar company,” said Singh prior to the listing.

“We think that solid state technology is the technology best poised to win this battle over the long run,” he added.

‘Higher density’ and ‘faster charge time’— 15 minutes

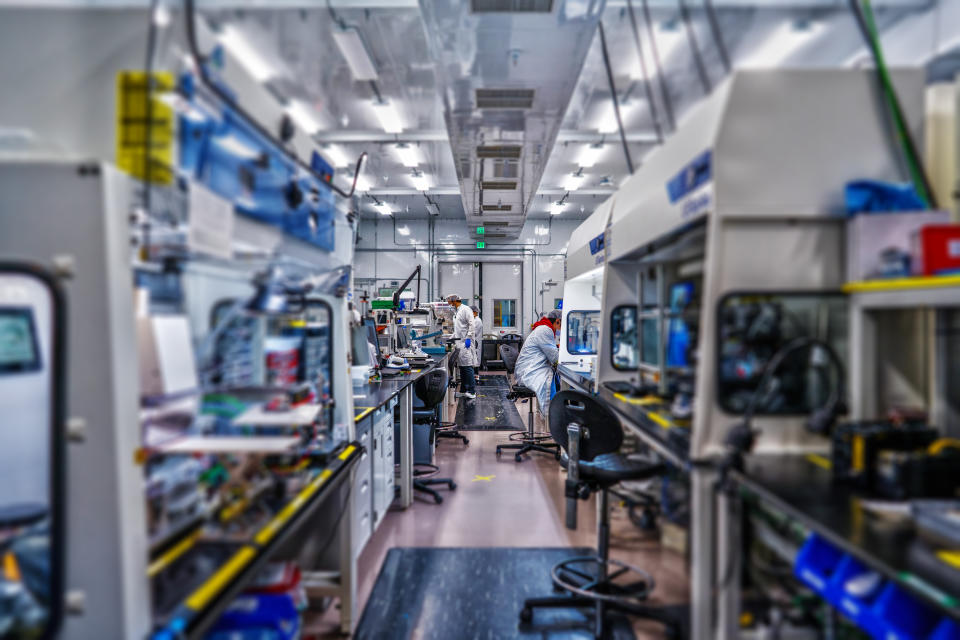

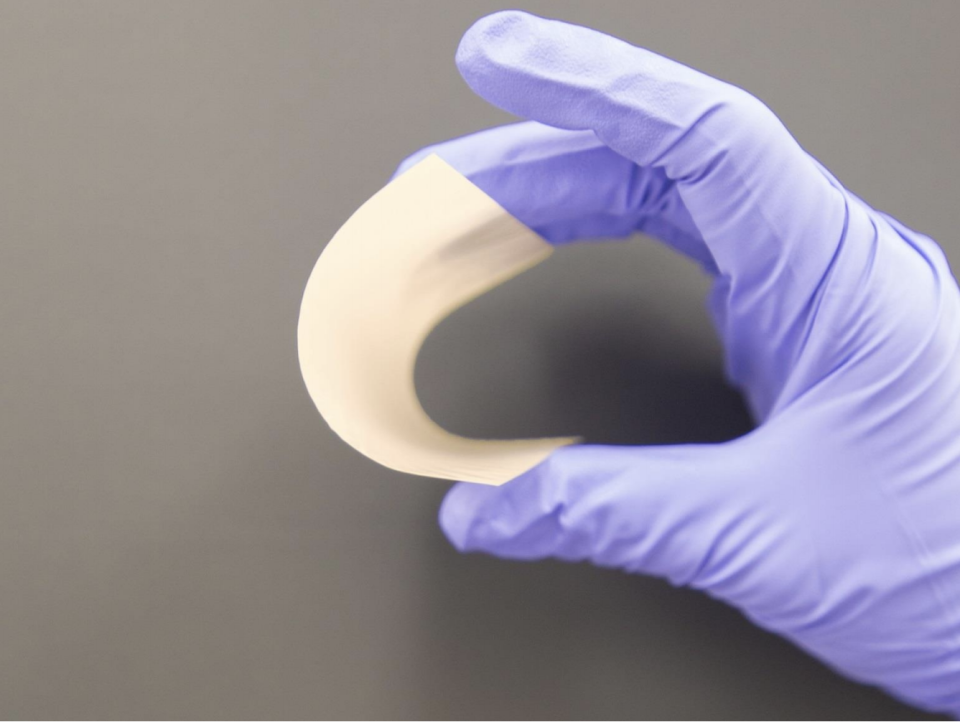

Since 2010 the company has been developing its solid-state lithium battery. This is different than conventional batteries which are based on liquid or gel electrolytes - the medium through which lithium-ions move up and down in the battery. QuantumScape batteries replace that liquid with a solid material known as the ‘solid-state electrolyte’.

“By doing that we can basically get higher energy density, so more range for a given charge, faster charge times - a 15 minute charge, instead of say an hour at best, and a safer operation because the material itself is non-flammable,” said Singh.

He believes faster charge times and a 300-500 mile range per charge will put QuantumScape batteries one step closer to competing with gasoline-run vehicles.

“The reason why today's EV penetration stands at 2% instead of a 20% or 80% we believe is because today's batteries just aren't competitive with the combustion engine. And that's what we're competing with this combustion engine, not other batteries,” he added.

Ines covers the U.S. stock market. Follow her on Twitter at @ines_ferre

Arrival, the latest EV company set to enter the public markets

NIO earnings: Chinese EV maker beats on revenue in the 3rd quarter