Everything you need to know about initial coin offerings

A tech company you’ve never heard of raised more than $150 million last week—in just three hours.

It was yet another initial coin offering (ICO), a new method of raising funding that has exploded in popularity for businesses in the cryptocurrency space.

The Bancor Foundation raised $153 million worth of ether (the digital token of the blockchain network Ethereum) in exchange for its own token, BNT. The company’s plans are vague, but it says its tokens will facilitate smart contracts.

Bancor’s ICO was the largest yet (based on the price of ether at the time) but not the fastest: that title goes to Brave, a new web browser from the former CEO of Mozilla (maker of Firefox) that seeks to use digital tokens as a method of micro-payment for online content. Brave raised $35 million worth of ether last month in exchange for its own “Basic Attention Tokens,” and it sold out of the tokens in 30 seconds. And SONM (Supercomputer Organized by Network Mining), an Ethereum-based cloud computing network, raised $42 million in its ICO last week.

Forget venture capital, forget the IPO, the hottest new way to raise money is the ICO.

How does an ICO work?

It started with Ethereum, a blockchain network designed for smart contracts.

Blockchain technology originated with the digital currency bitcoin in 2009—a decentralized, permissionless ledger that permanently records all bitcoin transactions. But now there are applications of blockchain cropping up that have nothing to do with bitcoin. Ethereum is one of them: it runs on its own blockchain and is meant for smart contracts, which are coded agreements that live in a permanent spot on the Ethereum chain. These agreements can interact with other contracts to automatically enact functions. (For example, I could sell you the deed to my car over Ethereum.) Ether is the digital token of Ethereum.

TechCrunch writes that Ethereum is “poised to overhaul open-source development.” And there are even implications very relevant to global politics at the moment: 23-year-old Ethereum founder Vitalik Buterin met with Vladimir Putin this week. Putin reportedly had big praise for Ethereum.

Ethereum launched in July 2014 through its own ICO, though that term wasn’t widely used yet: it sold about 60 million ether tokens and brought in $18.5 million worth of bitcoin. To be clear: participants bought ether and paid for it in bitcoin.

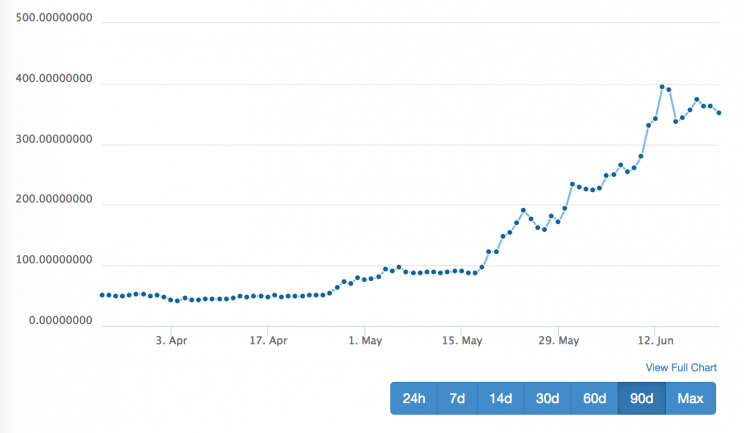

Now scores of blockchain-based startups are using an ICO to create and distribute their own digital tokens. Many of them are choosing to do their ICO via Ethereum—either because of the excitement over smart contract applications on Ethereum, or because the price of ether is up 130% in the past month, to $350.

For yet another example: DAO Casino, which aims to launch an online betting protocol atop Ethereum that would keep online casinos, game-makers, and sports bet-takers honest, plans an ICO for June 29 in which it will sell BET, its own digital token for use only on sites that build using its protocol.

Much like how Kickstarter, Indiegogo, and other crowdfunding sites allow a startup to forego the traditional path of pitching venture capitalists, an ICO is a way for a crypto startup to raise capital by selling its own token to investors.

The tokens created are typically not all offered to investors in the ICO: a portion is put aside for the company itself, and for potential developers. In Bancor’s ICO, for example, half of its BNT tokens were sold to participants in the fundraiser, 20% was saved for potential partnerships and other good-conscience efforts, 20% went to Bancor to operate its business, and 10% went to the Bancor founders and early employees with equity.

ICOs are exploding: calendars like ICO Timeline track upcoming token offerings, and there are sales coming every week. And it’s not just companies that originated in cryptocurrency that are doing them: Kik, an early SMS messaging app a la WhatsApp that launched in 2013 and amassed 300 million users, recently announced an upcoming ICO for its own Kin coin, with big plans to use the coin to incentivize developers and users, and monetize its app without relying on intrusive advertising.

What are the risks of participating in an ICO?

The ICO explosion has many people warning caution.

In part, that’s because last year, a decentralized, leaderless network that launched atop Ethereum, The Dao, raised $150 million in its ICO and was promptly hacked: $50 million worth of ether was stolen.

Buterin enacted a “hard fork” of Ethereum (basically a split into two) as an emergency measure to seal off the stolen coins and restore investors who lost their funds, but many criticized him for the hasty fix. (A rival cryptocurrency, litecoin, also recently did a fork, and in the much larger bitcoin world there is raging debate over whether the bitcoin blockchain should fork.)

The damage was done: there are those who warn that every ICO is vulnerable and risky and that the rate at which crypto investors are throwing their money at these events is dangerous.

In the simplest terms, the explosion of the ICO market is also troublesome because companies that are only at the idea stage, that haven’t done anything yet, are raising enormous sums in an instant.

An ICO lets you exit before you start

— Adam Ludwin (@adamludwin) June 21, 2017

The biggest and most obvious risk of participating in an ICO is that the token you’re purchasing is only as valuable as the technology or company offering it. That is, if you buy up BET tokens in the forthcoming ICO of DAO Casino, and the protocol fails, or doesn’t catch on, or gets beaten to market by someone faster and better, your tokens are worthless. (Or they could get stolen.)

If you get antsy, you can convert most major cryptocurrencies back into US dollars (or into other cryptocurrencies, like ether, bitcoin, or ripple) but your rate is dependent on the ever-fluctuating price of these digital assets.

Of course, an ICO lover may counter that traditional venture capital, in which deep-pocketed Silicon Valley prognosticators throw money into nascent ideas with promise and potential, is just as risky. And so is crowdfunding. Startups, even those that attain $1 billion paper valuations (“unicorn” status) bust all the time. Investing in a token sale isn’t really any riskier, one might argue—just newer and less understood.

Disclosure: The author owns less than 1 bitcoin, purchased in 2015 for reporting purposes.

—

Daniel Roberts closely covers bitcoin and blockchain at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

Why Ethereum is the hottest new thing in digital currency

More than 75 banks are now on Ripple’s blockchain network

Expect more blockchain hype in 2017

Here’s why 21 Inc. is the most exciting bitcoin company right now

How bitcoin company Coinbase is staying relevant amid the blockchain craze