Expedia shakes up C-suite, Barry Diller says management and board ‘disagreed on strategy’

Online travel agency Expedia (EXPE) announced the exit of two of its top executives Wednesday in the latest high-profile C-suite reorganization of 2019.

Expedia CEO Mark Okerstrom and CFO Alan Pickerill will each be resigning, effective immediately, the company said in a statement.

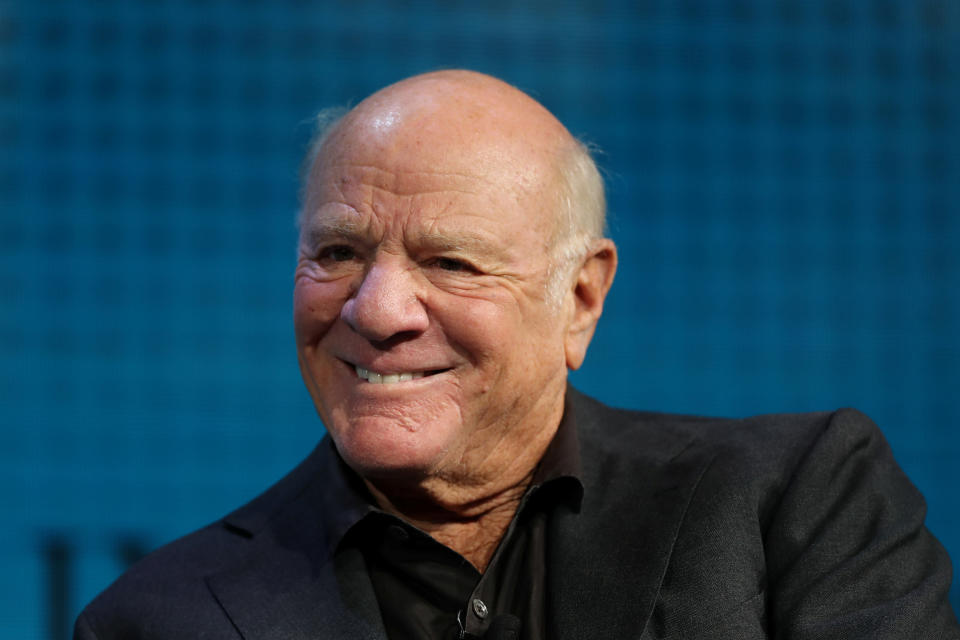

Barry Diller, chairman of Expedia, and Vice Chairman Peter Kern will oversee the executive leadership team and manage daily operations in the interim. Eric Hart, current chief strategy officer, will serve as acting CFO.

"Ultimately, senior management and the Board disagreed on strategy. Earlier this year, Expedia embarked on an ambitious reorganization plan with the goal of bringing our brands and technology together in a more efficient way,” Diller said in a statement.

“This reorganization, while sound in concept, resulted in a material loss of focus on our current operations, leading to disappointing third quarter results and a lackluster near-term outlook,” he added. “The Board disagreed with that outlook, as well as the departing leadership's vision for growth, strongly believing the Company can accelerate growth in 2020. That divergence necessitated a change in management.”

Okerstrom had been president and CEO of Expedia since 2017, succeeding Dara Khosrowshahi, now CEO of Uber (UBER). During Okerstrom’s more than two-year tenure as head of the digital travel booking company, the stock lost nearly a third of its value.

The company’s revenue growth has slowed this year amid increasing competition from other services like AirBnb and Booking.com (BKNG), and higher marketing costs have cut into margins. Expedia has also struggled to fully capitalize on its acquisition of vacation rental business Vrbo four years ago, and lowered profit expectations for the business segment in its most recent quarterly report. And analysts have increasingly called out the rising threat of changes to Google’s (GOOGL, GOOG) search tools for steering business away from companies like Expedia in favor of its own travel search platforms and paid links.

“A wholesale removal and replacement of both CEO & CFO is something that will likely result in an ongoing multi-quarter transition period for the company,” Piper Jaffray analyst Michael Olson wrote in a note after Expedia’s announcement. He reiterated his Neutral rating on the stock.

“Expedia continues to invest heavily in technology, marketing and alternative accommodations (Vrbo), which we believe is prudent,” he added. “Some of the issues presented in the Q3 results were new, while some were simply amplified; in each case we believe these issues will likely not be remedied immediately.”

In its statement Wednesday, Expedia also announced a new share repurchase authorization for up to an additional 20 million shares, on top of an existing 9 million shares available under a previous authorization. Diller said he will be purchasing additional shares in Expedia “as a tangible sign of my faith in and commitment to Expedia’s long-term future.”

Shares of Expedia jumped 5.88% to $1045.20 each as of 9:39 a.m. ET, after closing lower by more than 1% Tuesday. The stock was down 11.8% for the year to date through Tuesday’s close, underperforming against the S&P 500’s more than 23% gain.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Stock Market 2020: BMO’s bull is reminded of Notorious B.I.G., Tupac and Snoop

How this CBD company created a buzz by ‘kind of making fun of millennial culture’

FedEx CEO: ‘Whistling past the graveyard’ on the U.S. consumer belies a broader slowdown

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news