Exploring 3 Undervalued Small Caps In United Kingdom With Insider Action

Over the last 7 days, the United Kingdom market has remained flat, yet it has experienced a 6.5% increase over the past year with earnings forecasted to grow by 14% annually. In this context, identifying stocks that are potentially undervalued and exhibit insider activity can be an intriguing opportunity for investors seeking to capitalize on growth prospects within the small-cap segment.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Senior | 18.1x | 0.6x | 37.25% | ★★★★★★ |

Bytes Technology Group | 22.0x | 5.6x | 12.84% | ★★★★★☆ |

Genus | 170.5x | 2.0x | 8.80% | ★★★★★☆ |

Headlam Group | NA | 0.2x | 27.81% | ★★★★★☆ |

Essentra | 730.7x | 1.4x | 26.01% | ★★★★☆☆ |

Marlowe | NA | 0.7x | 40.87% | ★★★★☆☆ |

Optima Health | NA | 1.3x | 37.17% | ★★★★☆☆ |

Robert Walters | 40.3x | 0.2x | 43.26% | ★★★☆☆☆ |

Oxford Instruments | 22.2x | 2.4x | -24.73% | ★★★☆☆☆ |

Petra Diamonds | NA | 0.2x | -32.82% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Mears Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mears Group is a UK-based company specializing in management and maintenance services, with a market cap of £0.32 billion.

Operations: The company generates revenue primarily from Management (£591.63 million) and Maintenance (£551.73 million) services. Its cost of goods sold (COGS) has been rising, impacting the gross profit margin, which most recently stood at 21.68%. Operating expenses have also increased over time, with general and administrative expenses being a significant component. The net income margin has shown improvement in recent periods, reaching 3.67% as of the latest data point available in October 2024.

PE: 8.5x

Mears Group, a UK-based company, recently reported half-year sales of £580.04 million and net income of £22.73 million, showing growth from the previous year. They increased their interim dividend to 4.75 pence per share, reflecting confidence in their financial health despite relying entirely on external borrowing for funding. Insider confidence is evident with recent share purchases by executives over the past few months. However, earnings are expected to decline by an average of 14% annually over the next three years due to market conditions and operational challenges.

Unlock comprehensive insights into our analysis of Mears Group stock in this valuation report.

Gain insights into Mears Group's historical performance by reviewing our past performance report.

Robert Walters

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Robert Walters is a global recruitment consultancy firm specializing in professional recruitment and recruitment process outsourcing, with a market capitalization of approximately £0.37 billion.

Operations: Robert Walters generates revenue primarily from its core business and Resource Solutions, contributing £765.40 million and £209.70 million respectively. The company's gross profit margin has shown fluctuations over time, reaching 38.62% in June 2023 before declining to 35.96% by October 2024. Operating expenses form a significant portion of costs, with general and administrative expenses consistently being a major component within this category.

PE: 40.3x

Robert Walters, a UK-based recruitment firm, displays characteristics of an undervalued stock within its category. Despite recent financial challenges, including a net loss of £2.4 million for H1 2024 and declining sales to £459.3 million from the previous year's £548.3 million, insider confidence is evident with share purchases throughout 2024. The company maintains its interim dividend at 6.5 pence per share, reflecting stability in shareholder returns amidst fluctuating profit margins and reliance on external borrowing for funding needs.

Dive into the specifics of Robert Walters here with our thorough valuation report.

Assess Robert Walters' past performance with our detailed historical performance reports.

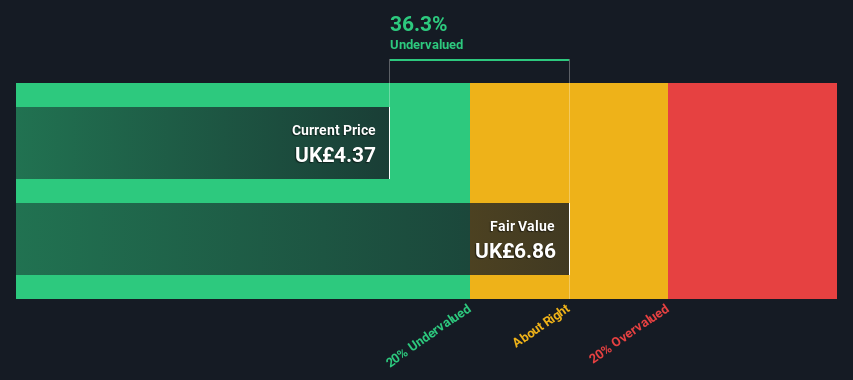

Senior

Simply Wall St Value Rating: ★★★★★★

Overview: Senior is a company engaged in the design and manufacture of high-technology components and systems for the aerospace and industrial sectors, with a market capitalization of approximately £0.73 billion.

Operations: Senior derives its revenue primarily from two segments: Aerospace (£651.10 million) and Flexonics (£333 million). The company's gross profit margin has shown a trend of fluctuation, reaching 18.06% in the latest period reported. Operating expenses, including general and administrative costs, have been a significant component of the cost structure, impacting overall profitability.

PE: 18.1x

Senior plc, a UK-based company, has been drawing attention in the investment community due to its potential for growth and insider confidence. Recently, they reported sales of £501.4 million for H1 2024, up from £482.3 million last year, despite a slight dip in net income to £10.9 million. The company anticipates mitigating lower 737 MAX production impacts with other business growth and maintains positive earnings guidance for 2024. Notably, Senior was awarded significant contracts with Deutsche Aircraft and Rolls-Royce, enhancing their aerospace portfolio and market position amidst evolving industry dynamics.

Take a closer look at Senior's potential here in our valuation report.

Understand Senior's track record by examining our Past report.

Taking Advantage

Gain an insight into the universe of 27 Undervalued UK Small Caps With Insider Buying by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:MER LSE:RWA and LSE:SNR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]