Exploring 3 Undervalued Small Caps With Insider Buying In United Kingdom

The United Kingdom's markets have recently faced headwinds, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China. This broader market sentiment has created opportunities for discerning investors to explore undervalued small-cap stocks that may offer potential upside. In this context, identifying small-cap companies with insider buying can be a promising strategy, as it often signals confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Bytes Technology Group | 24.8x | 5.6x | 12.05% | ★★★★★☆ |

Domino's Pizza Group | 15.3x | 1.8x | 35.17% | ★★★★★☆ |

Essentra | 842.2x | 1.6x | 47.73% | ★★★★★☆ |

GB Group | NA | 3.1x | 32.69% | ★★★★★☆ |

Norcros | 7.4x | 0.5x | 4.45% | ★★★★☆☆ |

NWF Group | 9.1x | 0.1x | 32.54% | ★★★★☆☆ |

CVS Group | 22.5x | 1.2x | 40.68% | ★★★★☆☆ |

Foxtons Group | 27.3x | 1.3x | 46.39% | ★★★☆☆☆ |

Franchise Brands | 115.2x | 2.9x | 49.58% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.9x | 36.64% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

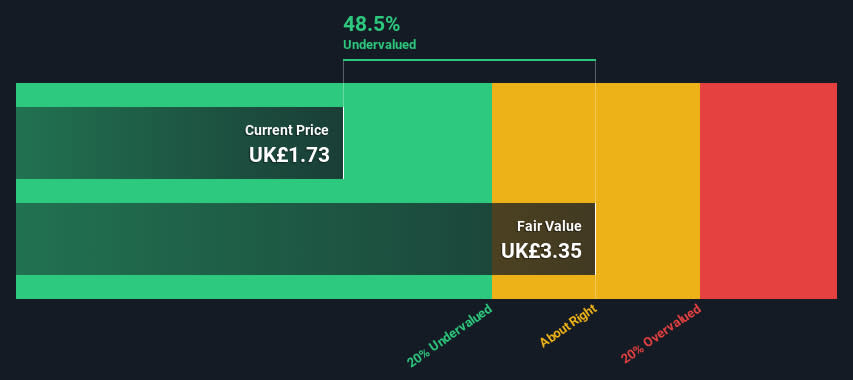

Essentra

Simply Wall St Value Rating: ★★★★★☆

Overview: Essentra is a global provider of essential components and solutions, specializing in packaging, filters, and various precision components, with a market cap of approximately £0.91 billion.

Operations: Essentra's revenue streams are primarily derived from its sales, with notable fluctuations in net income and gross profit margins over the years. The company experienced a significant decline in net income margin to -0.05739% by March 2017, followed by gradual improvements, reaching 0.01834% by December 2023. Gross profit margins have shown variability, peaking at 46.14% in June 2024 after hitting lows of around 10-12% during challenging periods between late 2016 and early 2017.

PE: 842.2x

Essentra, a small cap in the UK market, recently declared an interim dividend of 1.25 pence per share, reflecting their commitment to a progressive dividend policy. Despite reporting lower sales of £159.7 million for H1 2024 and a net income drop to £1.3 million from £6.9 million last year, insider confidence remains high with recent purchases by executives this quarter. The appointment of Steve Good as chair signals potential strategic shifts leveraging his extensive industrial experience.

Click here and access our complete valuation analysis report to understand the dynamics of Essentra.

Explore historical data to track Essentra's performance over time in our Past section.

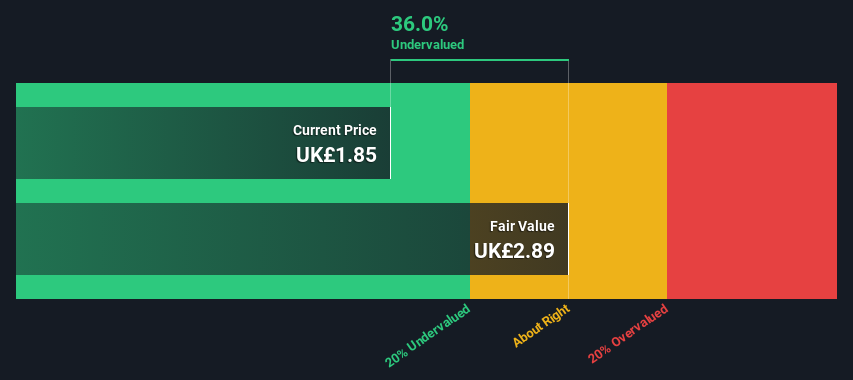

Hochschild Mining

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hochschild Mining is a precious metals company primarily engaged in the exploration, mining, processing, and sale of silver and gold from its operations in Peru and Argentina, with a market cap of approximately £0.55 billion.

Operations: Hochschild Mining generates revenue primarily from its Inmaculada, San Jose, and Pallancata operations, with Inmaculada contributing the largest share. The company's gross profit margin has shown fluctuations, peaking at 42.85% and dipping to as low as 8.08%. Operating expenses have varied but generally include significant allocations towards general and administrative costs.

PE: -23.6x

Hochschild Mining, a notable player in the mining sector, has shown promising production figures for 2024. In Q2 2024, they reported a total gold equivalent of 97.56 koz and silver production of 2,589 koz. For the first half of the year, gold output reached 120.16 koz while silver hit 5,016 koz. Insider confidence is evident with Eduardo Navarro purchasing £235K worth of shares in July, increasing their holdings by over half. Future earnings are projected to grow at an annual rate of nearly 54%.

Get an in-depth perspective on Hochschild Mining's performance by reading our valuation report here.

Examine Hochschild Mining's past performance report to understand how it has performed in the past.

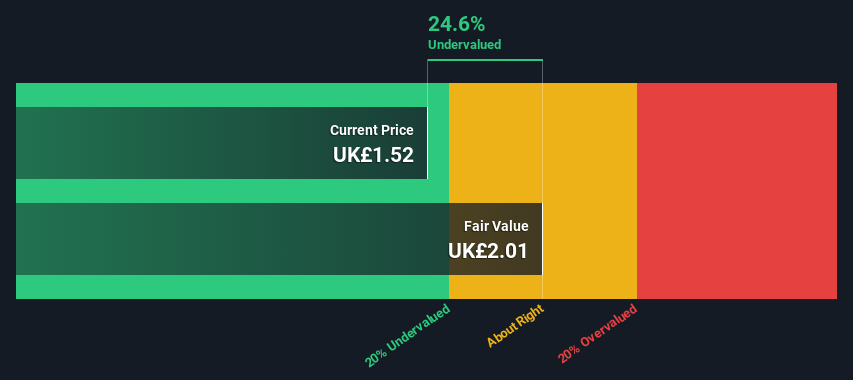

SSP Group

Simply Wall St Value Rating: ★★★★☆☆

Overview: SSP Group operates food and beverage outlets primarily in the travel sector, including airports and railway stations, with a market cap of approximately £2.63 billion.

Operations: The company generates revenue primarily from the food and beverage travel sector, mainly at airports and railway stations, with a gross profit margin of 28.84%. The cost of goods sold (COGS) for the latest period is £2.28 billion, while operating expenses are £717.6 million.

PE: 181.5x

SSP Group, a UK-based company in the travel food and beverage sector, reported a 16% sales increase in Q3 2024 compared to last year. For the nine months ending June 30, 2024, revenues rose by 18%, driven by like-for-like sales growth of 10%. Despite profit margins shrinking from 0.5% to 0.2%, insider confidence is evident with significant share purchases over the past six months. The company's earnings are forecasted to grow annually by over 50%.

Delve into the full analysis valuation report here for a deeper understanding of SSP Group.

Understand SSP Group's track record by examining our Past report.

Turning Ideas Into Actions

Unlock our comprehensive list of 28 Undervalued UK Small Caps With Insider Buying by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:ESNT LSE:HOC and LSE:SSPG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]