Exploring 3 Undervalued Small Caps With Insider Activity In United Kingdom

Over the last 7 days, the United Kingdom market has remained flat, but it is up 5.3% over the past year with earnings expected to grow by 14% per annum over the next few years. In this context, identifying undervalued small caps with notable insider activity can offer promising opportunities for investors seeking to capitalize on potential growth and market resilience.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Bytes Technology Group | 24.4x | 5.5x | 13.33% | ★★★★★☆ |

C&C Group | NA | 0.4x | 46.77% | ★★★★★☆ |

Genus | 154.5x | 1.8x | 5.44% | ★★★★★☆ |

GB Group | NA | 2.8x | 37.92% | ★★★★★☆ |

CVS Group | 23.8x | 1.3x | 37.90% | ★★★★☆☆ |

Essentra | 685.6x | 1.3x | 42.16% | ★★★★☆☆ |

NWF Group | 8.8x | 0.1x | 34.75% | ★★★☆☆☆ |

Franchise Brands | 43.0x | 2.2x | 39.03% | ★★★☆☆☆ |

Alpha Group International | 9.9x | 4.6x | -22.84% | ★★★☆☆☆ |

Watkin Jones | NA | 0.2x | -1454.39% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Bytes Technology Group

Simply Wall St Value Rating: ★★★★★☆

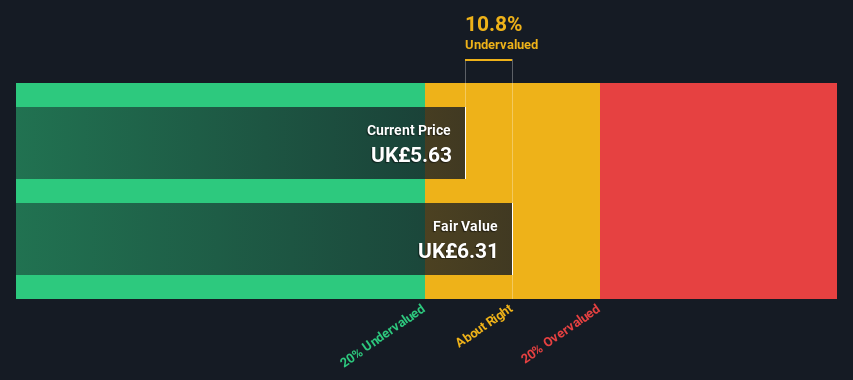

Overview: Bytes Technology Group is an IT solutions provider with a market cap of approximately £1.13 billion.

Operations: The company generates revenue primarily from IT Solutions, with a recent figure of £207.02 million. Its net income margin has shown variability, reaching 22.63% as of the latest period. Operating expenses have been significant, amounting to £89.07 million in the most recent data set provided.

PE: 24.4x

Bytes Technology Group, a small cap in the UK, recently approved a final dividend of 6.0 pence per share and a special dividend of 8.7 pence per share at its AGM on July 11, 2024. These dividends will be payable on August 2, 2024. Insider confidence is evident with significant share purchases over the past year. Earnings are projected to grow by approximately 9.57% annually despite relying entirely on external borrowing for funding, which adds some risk to their financial structure.

Take a closer look at Bytes Technology Group's potential here in our valuation report.

Learn about Bytes Technology Group's historical performance.

Hays

Simply Wall St Value Rating: ★★★★★☆

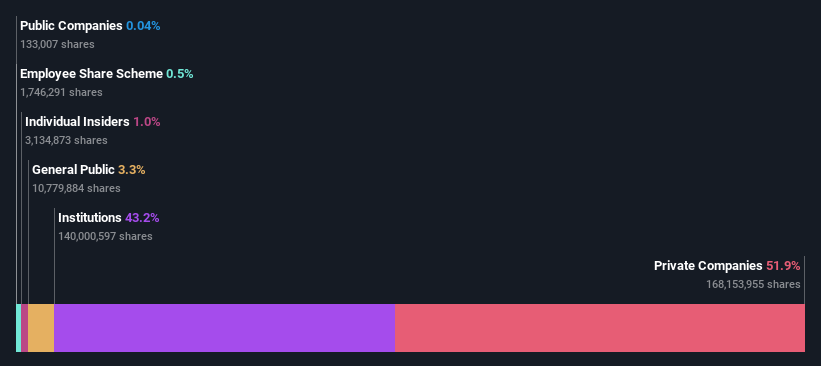

Overview: Hays is a global recruitment company specializing in qualified, professional, and skilled recruitment with a market cap of £1.95 billion.

Operations: The company generates revenue primarily from qualified, professional, and skilled recruitment services. Over the observed periods, net income margin has varied significantly, peaking at 2.90% and dropping to -0.07%. Gross profit margin also fluctuated between 4.21% and 14.34%, reflecting changes in cost structures and operating expenses.

PE: -299.9x

Hays, a UK-based recruitment firm, recently reported a net loss of £4.9 million for the year ending June 30, 2024, compared to a net income of £138.3 million the previous year. Despite this downturn, earnings are forecasted to grow by 62.57% annually. The company’s funding relies entirely on external borrowing, which carries higher risk but no customer deposits are involved. Notably, insider confidence is evident with recent share purchases in August 2024 by key executives.

Get an in-depth perspective on Hays' performance by reading our valuation report here.

Examine Hays' past performance report to understand how it has performed in the past.

Harworth Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Harworth Group is a property regeneration company focused on the development and management of industrial, commercial, and residential properties with a market cap of approximately £0.40 billion.

Operations: Harworth Group's revenue streams include Income Generation (£19.73m), Capital Growth from Other Property Activities (£9.05m), and the Sale of Development Properties (£66.71m). The company has seen fluctuations in its gross profit margin, with a recent high of 54.39% and a low of 11.43%.

PE: 11.8x

Harworth Group, recently added to the FTSE 250 and FTSE 350 indices on September 17, reported significant growth in its H1 2024 earnings. Sales surged to £41.31 million from £18.24 million year-on-year, with net income rising from £2.85 million to £14.78 million. Insider confidence is evident as Independent Non-Executive Chairman Alastair Lyons purchased 50,000 shares for approximately £80,000 in June 2024, increasing their shareholding by over 14%. This reflects a positive outlook amidst growing earnings and strategic index inclusions.

Delve into the full analysis valuation report here for a deeper understanding of Harworth Group.

Assess Harworth Group's past performance with our detailed historical performance reports.

Where To Now?

Access the full spectrum of 25 Undervalued UK Small Caps With Insider Buying by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BYIT LSE:HAS and LSE:HWG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]