Exploring Dividend Stocks: Choosing One Over Hakuhodo DY Holdings

Investing in dividend stocks is a popular strategy for those seeking regular income from their investments. However, it's crucial to examine the sustainability of these dividends. Companies like Hakuhodo DY Holdings, with high payout ratios, may indicate financial pressures that could jeopardize future dividend payments.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.65% | ★★★★★★ |

Globeride (TSE:7990) | 3.89% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.54% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.25% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.06% | ★★★★★★ |

Nichimo (TSE:8091) | 4.03% | ★★★★★★ |

InabataLtd (TSE:8098) | 3.44% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.54% | ★★★★★★ |

Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 390 stocks from our Top Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

Tohokushinsha Film

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tohokushinsha Film Corporation, with a market capitalization of ¥74.43 billion, operates as a media business company in Japan, engaging in various entertainment and communication activities.

Operations: The company engages in diverse entertainment and communication activities across Japan.

Dividend Yield: 4.7%

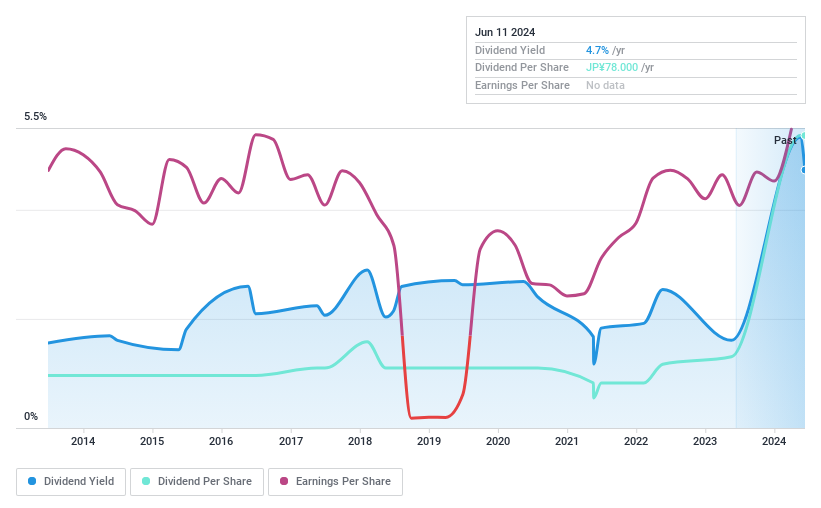

Tohokushinsha Film Corporation, with a dividend yield of 4.71%, ranks in the top 25% of Japanese dividend payers. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 87.2% and 63.4% respectively, indicating a sustainable payment structure compared to firms with excessive payouts. However, its dividend track record has been unstable and volatile over the past decade, showing inconsistency in payments despite recent increases and high earnings growth (28.3% last year).

One To Reconsider

Hakuhodo DY Holdings

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Hakuhodo DY Holdings Inc. operates as a marketing and communications service provider in Japan and globally, with a market capitalization of approximately ¥429.88 billion.

Operations: The firm's revenue is derived from marketing and communications services both domestically and internationally.

Dividend Yield: 2.7%

Hakuhodo DY Holdings, despite planning a steady dividend of ¥32 per share for FY2024, faces significant challenges. The company's high payout ratio of 212.3% indicates that its dividends are not well-covered by earnings, highlighting a risky proposition for dividend stability. Additionally, recent postponements in financial reporting due to overcharging issues at a subsidiary add uncertainty to their financial health. This coupled with a low dividend yield of 2.73%, which falls below the market's top quartile average of 3.4%, makes it less attractive for those seeking reliable dividend stocks in Japan.

Where To Now?

Click this link to deep-dive into the 390 companies within our Top Dividend Stocks screener.

Shareholder in one of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2329 and TSE:2433.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com