Exploring Dividend Stocks On Euronext Paris May 2024

As of May 2024, the French stock market has shown a cautious trend with the CAC 40 Index experiencing a slight decline. This reflects broader European market sentiments where monetary policy adjustments and economic indicators are closely monitored by investors. In this context, dividend stocks on Euronext Paris present an intriguing avenue for those looking to potentially enhance their portfolio stability amidst fluctuating markets. A good dividend stock typically combines reliable payouts with strong business fundamentals, making it an appealing choice during uncertain economic times like these.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 8.42% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 6.15% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.43% | ★★★★★★ |

Métropole Télévision (ENXTPA:MMT) | 9.25% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.70% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.17% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.09% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.72% | ★★★★★☆ |

Carrefour (ENXTPA:CA) | 5.35% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.35% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

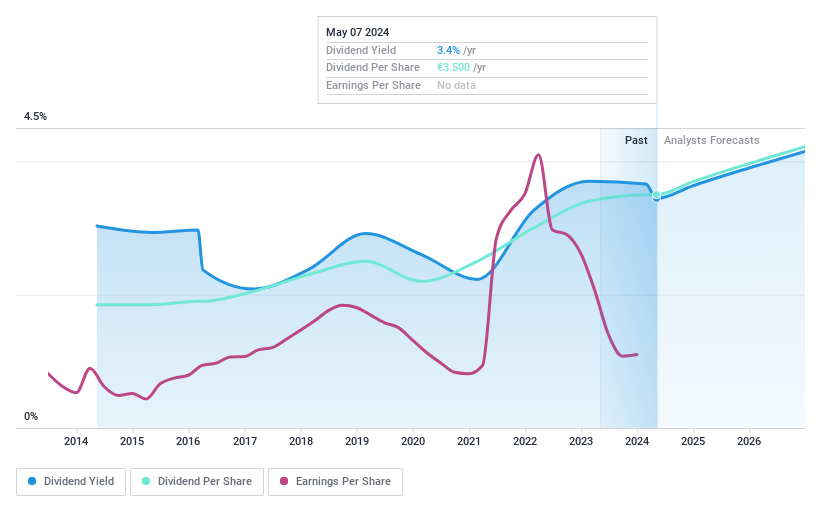

Arkema

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arkema S.A. is a global manufacturer and seller of specialty chemicals and advanced materials, with a market capitalization of approximately €7.03 billion.

Operations: Arkema S.A. generates its revenue primarily from three key segments: Adhesive Solutions (€2.70 billion), Advanced Materials (€3.50 billion), and Coating Solutions (€2.36 billion), along with a smaller contribution from Intermediates (€0.74 billion).

Dividend Yield: 3.7%

Arkema offers a stable dividend yield of 3.72%, supported by a payout ratio of 74.9% and a cash payout ratio of 45.9%, indicating dividends are well-covered by both earnings and cash flows. Despite trading at 45.4% below estimated fair value, its dividend yield remains lower than the top quartile in the French market at 5.16%. Recent financials show a decline with Q1 sales dropping to €2,341 million from €2,524 million year-over-year and net income falling to €79 million from €132 million, reflecting decreased profitability with current profit margins at 3.7% compared to last year's 6.7%.

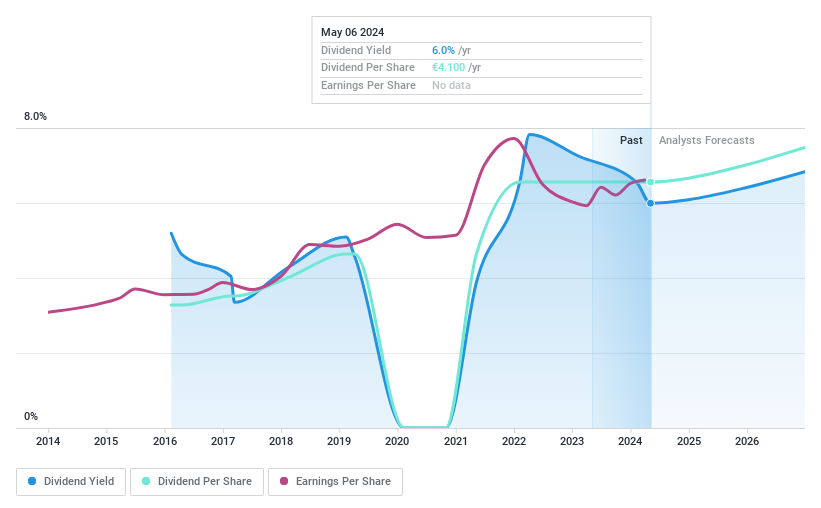

Amundi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market capitalization of approximately €14.40 billion, operating primarily in the asset management sector.

Operations: Amundi generates its revenue primarily through asset management, contributing approximately €6.03 billion.

Dividend Yield: 5.8%

Amundi's recent financial performance shows a positive trend with Q1 2024 revenue reaching €824 million and net income at €318 million, both improvements from the previous year. The appointment of Barry Glavin as head of equity investments could enhance strategic direction. However, despite an attractive dividend yield of 5.79%, which is above the French market average, Amundi's dividend history over the past 8 years reveals instability and volatility in payments. Trading at a 5.6% discount to its estimated fair value suggests potential undervaluation relative to peers.

Get an in-depth perspective on Amundi's performance by reading our dividend report here.

Our valuation report unveils the possibility Amundi's shares may be trading at a discount.

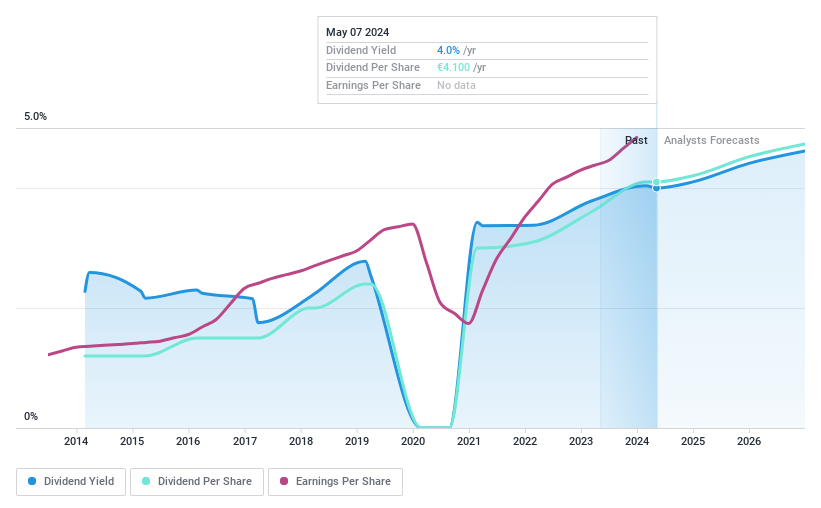

Eiffage

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in various sectors including construction, property and urban development, civil engineering, metallic construction, road infrastructure, energy systems, and concessions both in France and globally, with a market capitalization of approximately €9.51 billion.

Operations: Eiffage SA generates revenue from several key segments: Concessions at €3.90 billion, Construction at €4.29 billion, Energy Systems at €5.99 billion, and Infrastructures at €8.43 billion.

Dividend Yield: 4.1%

Eiffage SA reported a robust financial year in 2023, with sales rising to €22.37 billion and net income increasing to €1.01 billion. Despite this growth, its dividend yield of 4.06% remains below the French market's top quartile average of 5.16%. The company maintains a low cash payout ratio at 15.6%, indicating strong coverage of dividends by cash flows, yet its dividend history has shown volatility over the past decade. Recent board discussions on remuneration and strategic appointments suggest ongoing governance enhancements.

Where To Now?

Take a closer look at our Top Euronext Paris Dividend Stocks list of 31 companies by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AKE ENXTPA:AMUN and ENXTPA:FGR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]