Exploring Investment Opportunities in Three Stocks on Euronext Paris That May Be Trading Below Their Estimated Fair Values

Amid a backdrop of fluctuating global markets, France's CAC 40 Index recently experienced a notable decline, shedding 2.46% as broader European indices grappled with escalating trade tensions and economic uncertainties. This shifting landscape presents an intriguing opportunity to explore potentially undervalued stocks within the Euronext Paris that might be poised for recovery or growth, given the current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Cogelec (ENXTPA:ALLEC) | €11.20 | €20.46 | 45.2% |

NSE (ENXTPA:ALNSE) | €25.50 | €50.92 | 49.9% |

Wavestone (ENXTPA:WAVE) | €57.00 | €93.32 | 38.9% |

Thales (ENXTPA:HO) | €152.50 | €267.31 | 43% |

Lectra (ENXTPA:LSS) | €28.25 | €43.91 | 35.7% |

Tikehau Capital (ENXTPA:TKO) | €23.15 | €32.50 | 28.8% |

ENENSYS Technologies (ENXTPA:ALNN6) | €0.624 | €1.09 | 42.5% |

Vivendi (ENXTPA:VIV) | €10.865 | €16.36 | 33.6% |

Figeac Aero Société Anonyme (ENXTPA:FGA) | €5.70 | €9.99 | 42.9% |

OVH Groupe (ENXTPA:OVH) | €5.56 | €7.51 | 25.9% |

Let's review some notable picks from our screened stocks.

Antin Infrastructure Partners SAS

Overview: Antin Infrastructure Partners SAS is a private equity firm focused on infrastructure investments, with a market capitalization of approximately €2.25 billion.

Operations: The firm generates revenue primarily through its asset management segment, amounting to €282.87 million.

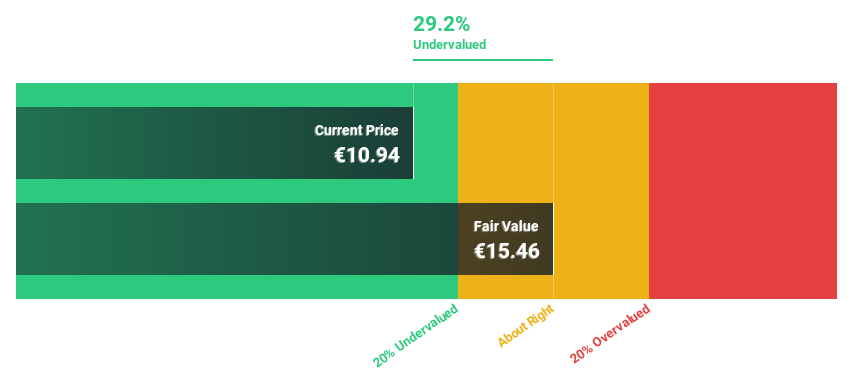

Estimated Discount To Fair Value: 17.7%

Antin Infrastructure Partners SAS, priced at €12.56, trades 17.7% below our estimated fair value of €15.25, reflecting a modest undervaluation based on cash flows. Despite recent dividend increases to €0.71 per share, the payout is not well supported by earnings or free cash flows, indicating potential sustainability issues. Earnings growth is robust, projected at 25.2% annually over the next three years—outpacing the French market's average—though shareholder dilution has occurred within the last year.

Edenred

Overview: Edenred SE operates a global digital platform offering services and payments solutions for companies, employees, and merchants, with a market capitalization of approximately €10.28 billion.

Operations: The company generates its revenue primarily from Business Services, which accounted for €2.31 billion.

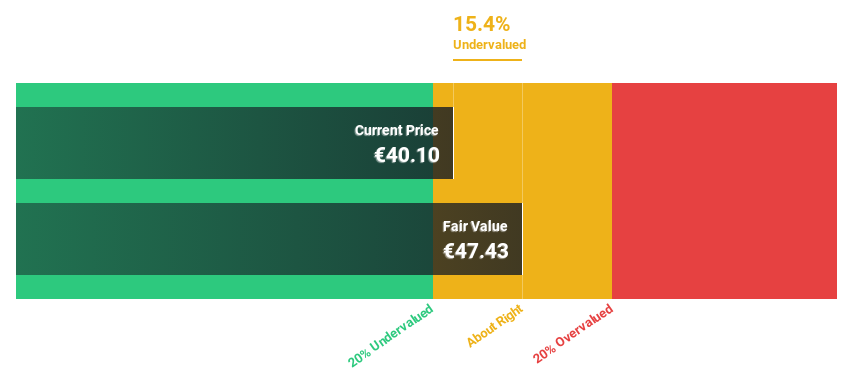

Estimated Discount To Fair Value: 13.5%

Edenred, valued at €41.29, is considered undervalued with a fair value estimate of €47.71, reflecting a modest potential for price appreciation. The company is expected to see significant earnings growth at 20.15% annually over the next three years, surpassing the French market's forecast of 10.9%. However, it carries a high level of debt and its dividend coverage by earnings is weak. Additionally, while revenue growth projections are strong relative to the market, they do not exceed 20% annually.

The growth report we've compiled suggests that Edenred's future prospects could be on the up.

Click to explore a detailed breakdown of our findings in Edenred's balance sheet health report.

Tikehau Capital

Overview: Tikehau Capital is a private equity and venture capital firm that offers a variety of financing products such as senior secured loans, equity, and mezzanine; it has a market capitalization of approximately €4.00 billion.

Operations: The company generates revenue through two main segments: Investment Activities, which brought in €179.19 million, and Asset Management Activities, contributing €322.32 million.

Estimated Discount To Fair Value: 28.8%

Tikehau Capital, priced at €23.15, trades below its calculated fair value of €32.5, indicating a potential undervaluation. Despite a decline in net profit margins from 53.2% to 35.2%, the company's revenue and earnings are expected to grow by 20.1% and 31.3% annually, respectively—both rates exceeding market averages significantly. However, its dividends are poorly covered by free cash flows, and forecasted Return on Equity is low at 12.6%. Recent strategic partnership with Nikko Asset Management could bolster its investment capabilities in Asia.

Summing It All Up

Discover the full array of 15 Undervalued Euronext Paris Stocks Based On Cash Flows right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ANTIN ENXTPA:EDEN and ENXTPA:TKO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance