Exploring Nissin Foods And Two More Undervalued Small Caps With Insider Action In Hong Kong

Amidst a broader global landscape marked by fluctuating economic indicators and market sentiments, the Hong Kong small-cap sector presents a unique area of interest for investors looking to explore potential undervalued opportunities. This article will focus on three such stocks, including Nissin Foods, which have shown notable insider actions—a key indicator that can sometimes highlight underlying value not immediately apparent to the broader market.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

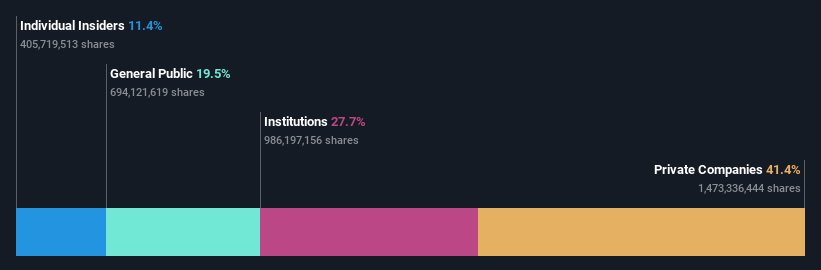

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Tian Lun Gas Holdings | 8.1x | 0.5x | 11.45% | ★★★★☆☆ |

Zhongzhi Pharmaceutical Holdings | 5.1x | 0.4x | 21.62% | ★★★★☆☆ |

Far East Consortium International | NA | 0.3x | 34.90% | ★★★★☆☆ |

Abbisko Cayman | NA | 100.5x | 32.08% | ★★★★☆☆ |

Xtep International Holdings | 12.3x | 0.9x | 35.06% | ★★★☆☆☆ |

Giordano International | 8.9x | 0.8x | 33.28% | ★★★☆☆☆ |

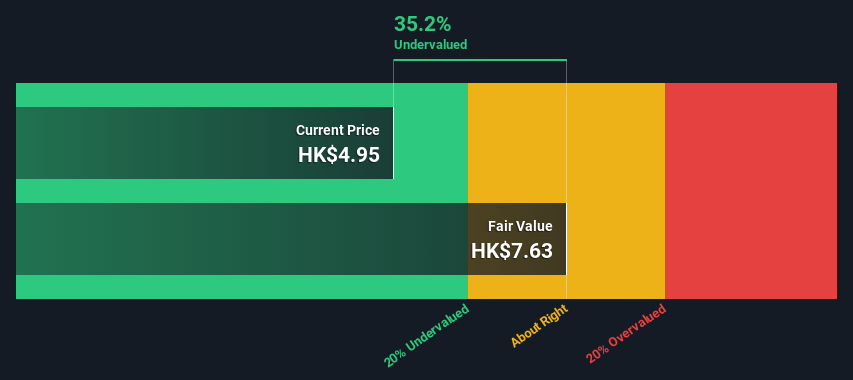

Nissin Foods | 15.3x | 1.4x | 35.15% | ★★★☆☆☆ |

China Lesso Group Holdings | 4.5x | 0.3x | -2.04% | ★★★☆☆☆ |

China Overseas Grand Oceans Group | 3.2x | 0.1x | -14.50% | ★★★☆☆☆ |

Pizu Group Holdings | 10.8x | 1.0x | 46.51% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Nissin Foods (1475)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nissin Foods is primarily engaged in the production and sale of instant noodles across Mainland China, Hong Kong, and other parts of Asia.

Operations: Mainland China and Hong Kong, along with other Asian regions, form the primary markets for Nissin Foods, contributing HK$2.47 billion and HK$1.68 billion to its revenue respectively. The company has demonstrated a gross profit margin of 34.16% as of the latest fiscal period in 2024, reflecting its cost management in production processes while navigating varying market demands across these key geographic segments.

PE: 15.3x

Recently, Nissin Foods showcased a promising financial trajectory with first-quarter sales reaching HK$963 million and net income climbing to HK$118 million. This performance, coupled with a modest annual earnings growth forecast of 7.33%, reflects solid fundamentals. Notably, Kiyotaka Ando's recent purchase of 155,430 shares for approximately HK$770,000 underscores insider confidence in the company’s prospects. Despite relying solely on external borrowing—a riskier funding strategy—the firm's consistent dividend payouts, including a proposed HK$0.1582 per share for last year, signal its commitment to shareholder returns amidst challenges.

Click here to discover the nuances of Nissin Foods with our detailed analytical valuation report.

Understand Nissin Foods' track record by examining our Past report.

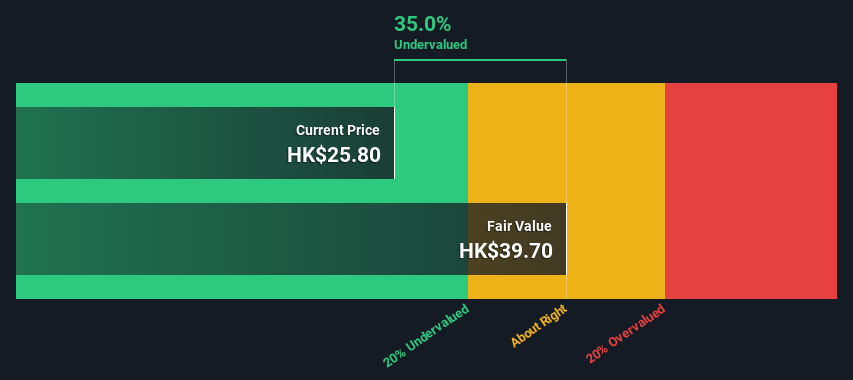

China Overseas Grand Oceans Group (81)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Overseas Grand Oceans Group Ltd. primarily engages in property investment and development, with additional operations in property leasing and other segments, boasting a market capitalization of approximately CN¥13.24 billion.

Operations: The company primarily engages in property investment and development, generating CN¥56.08 billion, complemented by smaller revenue streams from property leasing at CN¥242.46 million and other business activities totaling CN¥85.96 million. The gross profit margin has shown variability over recent periods, with a notable figure of 25.72% as of the last reporting period in September 2023.

PE: 3.2x

China Overseas Grand Oceans Group Ltd. has shown a notable insider confidence, with Hancheng Zhou acquiring 350,000 shares recently for HK$708,295. This move suggests a strong belief in the firm's prospects despite its challenging financial landscape marked by high debt levels and reliance on riskier funding sources. The company's recent performance highlights a downturn, with property sales and GFA experiencing significant year-on-year declines as of April 2024. However, these market challenges could mask potential growth opportunities for discerning investors looking at longer-term horizons.

Dive into the specifics of China Overseas Grand Oceans Group here with our thorough valuation report.

Explore historical data to track China Overseas Grand Oceans Group's performance over time in our Past section.

Ferretti (9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti specializes in the design, construction, and marketing of yachts and recreational boats, with a market capitalization of €1.23 billion.

Operations: The company specializes in the design, construction, and marketing of yachts and recreational boats, generating €1.23 billion in revenue as of the latest reporting period. It has a gross profit margin of 37.08%, reflecting the cost efficiency in its production processes relative to its sales.

PE: 12.4x

Ferretti, a Hong Kong-listed entity, recently confirmed 2024 earnings projections with anticipated revenue between €1.22 billion and €1.24 billion, reflecting up to 11.6% growth. Notably, insiders have demonstrated their confidence through recent share acquisitions, underscoring a positive outlook on the firm's prospects amid its strategic adjustments at the April AGM. With earnings climbing by an estimated 12.46% annually and a solid dividend increase to €0.097 per share approved in April, Ferretti presents as an appealing prospect for those eyeing underappreciated market opportunities.

Unlock comprehensive insights into our analysis of Ferretti stock in this valuation report.

Examine Ferretti's past performance report to understand how it has performed in the past.

Taking Advantage

Dive into all 15 of the Undervalued Small Caps With Insider Buying we have identified here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]