Exploring Three Indian Exchange Growth Companies With High Insider Ownership

The Indian market has experienced a notable fluctuation recently, declining by 5.3% over the last week, yet showing an impressive annual growth of 34%. In this context, companies with high insider ownership can be particularly compelling as they often indicate a strong alignment between company management and shareholder interests, which might be especially valuable in navigating through such volatile conditions.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 28.6% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Aether Industries (NSEI:AETHER) | 31.1% | 32% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Let's review some notable picks from our screened stocks.

Five-Star Business Finance

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Five-Star Business Finance Limited, a non-banking financial company in India, has a market capitalization of approximately ?216.59 billion.

Operations: The company generates revenue primarily from MSME loans, housing loans, and property loans, totaling approximately ?16.59 billion.

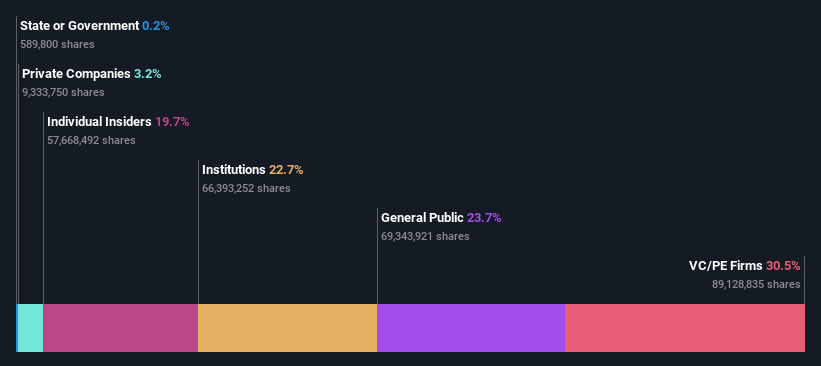

Insider Ownership: 19.7%

Earnings Growth Forecast: 19.5% p.a.

Five-Star Business Finance, despite recent board resignations and auditor changes, reported a substantial increase in annual revenue to INR 21.95 billion and net income to INR 8.36 billion for FY2024. Although its Price-to-Earnings ratio is attractively below the Indian market average, concerns about debt coverage by operating cash flow persist. Analysts predict a price target implying a 21.4% increase, supported by expected high revenue growth of 21.8% per year and earnings growth forecast at 19.5% per year, both surpassing market averages.

Heritage Foods

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Heritage Foods Limited, operating in India, focuses on the procurement and processing of milk and milk products with a market capitalization of approximately ?42.26 billion.

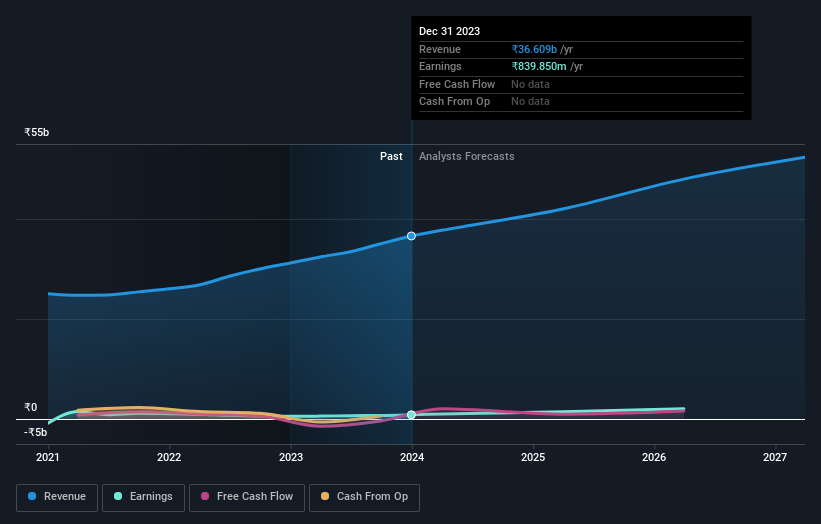

Operations: The company's revenue is primarily generated from its Dairy segment, which brought in ?36.06 billion, and smaller contributions from Feed and Renewable Energy segments at ?1.48 billion and ?0.09 billion respectively.

Insider Ownership: 37.2%

Earnings Growth Forecast: 38.9% p.a.

Heritage Foods, a company with significant insider ownership, has demonstrated robust growth with earnings increasing by 59.9% over the past year. Despite a low dividend coverage of 0.55%, its revenue and earnings are expected to outpace the Indian market, growing at 11.1% and 38.9% per year respectively. Recent strategic expansions include launching a new UHT Milk plant, enhancing product diversity and manufacturing capabilities, although it faces challenges from executive changes and potential shareholder concerns at its upcoming AGM.

Delve into the full analysis future growth report here for a deeper understanding of Heritage Foods.

One97 Communications

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited, operating under the brand Paytm, offers payment, commerce and cloud, and financial services in India with a market capitalization of approximately ?227.23 billion.

Operations: The company generates revenue primarily through its data processing services, amounting to ?99.78 billion.

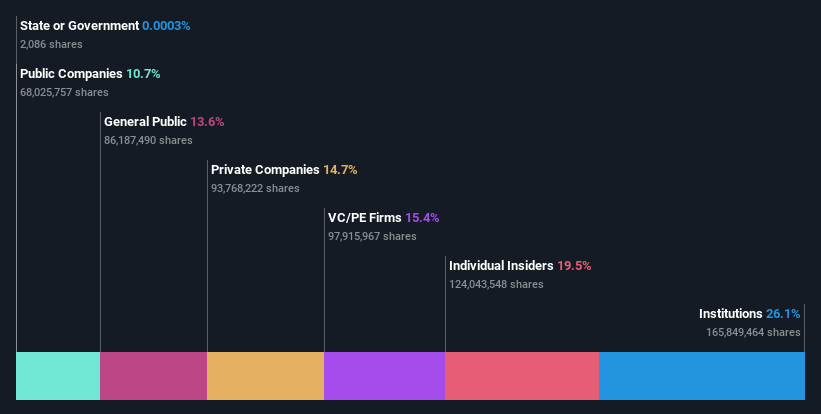

Insider Ownership: 19.5%

Earnings Growth Forecast: 60.3% p.a.

One97 Communications, the parent of Paytm, is navigating a complex growth trajectory. Despite recent quarterly losses increasing significantly to INR 5,496 million from INR 1,684 million year-over-year and annual losses shrinking slightly to INR 14,170 million from INR 17,759 million, the company's revenue growth forecasts remain modest at 9.4% per year. Insider ownership remains substantial with CEO Vijay Shekhar Sharma holding about 19%, valued at approximately INR 42.18 billion. Recent speculations about Adani Group acquiring a stake add potential strategic shifts but are officially unconfirmed by both parties involved.

Seize The Opportunity

Click through to start exploring the rest of the 80 Fast Growing Indian Companies With High Insider Ownership now.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:FIVESTAR NSEI:HERITGFOOD and NSEI:PAYTM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]