Exploring Three Premier Dividend Stocks In Germany

Amidst a backdrop of cautious optimism in the European markets, with Germany's DAX index recently marking modest gains, investors continue to seek stable returns in an unpredictable economic climate. In this context, dividend stocks remain a compelling option for those looking to generate steady income from their investments.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.28% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.73% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.68% | ★★★★★★ |

Südzucker (XTRA:SZU) | 6.34% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.41% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.63% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.13% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.90% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.14% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.11% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

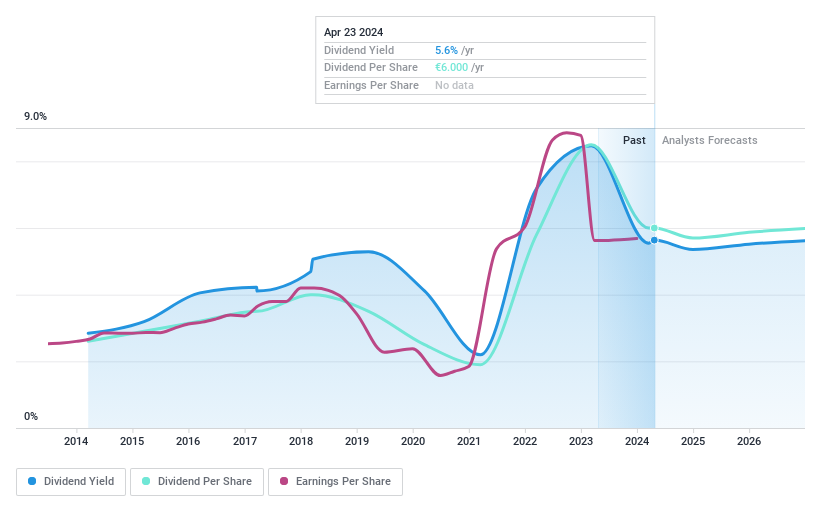

Bayerische Motoren Werke

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft (BMW), along with its subsidiaries, operates globally in the production and sale of automobiles and motorcycles, as well as spare parts and accessories, with a market capitalization of approximately €57.40 billion.

Operations: Bayerische Motoren Werke Aktiengesellschaft (BMW) generates €131.95 billion from its automotive segment, €3.15 billion from motorcycles, and €36.93 billion through financial services.

Dividend Yield: 6.6%

Bayerische Motoren Werke (BMW) recently reported a dip in quarterly earnings, with net income falling to €2.79 billion from €3.42 billion year-over-year amidst sales declines. Despite this, BMW maintains a dividend yield of 6.58%, though it's challenged by a high cash payout ratio of 168.2%, indicating dividends are not well covered by free cash flow. The company also completed significant share repurchases amounting to €2.47 billion under its ongoing buyback program, signaling confidence in its financial health despite the coverage issues and recent executive changes aiming at strategic realignment towards electric mobility and digitalization.

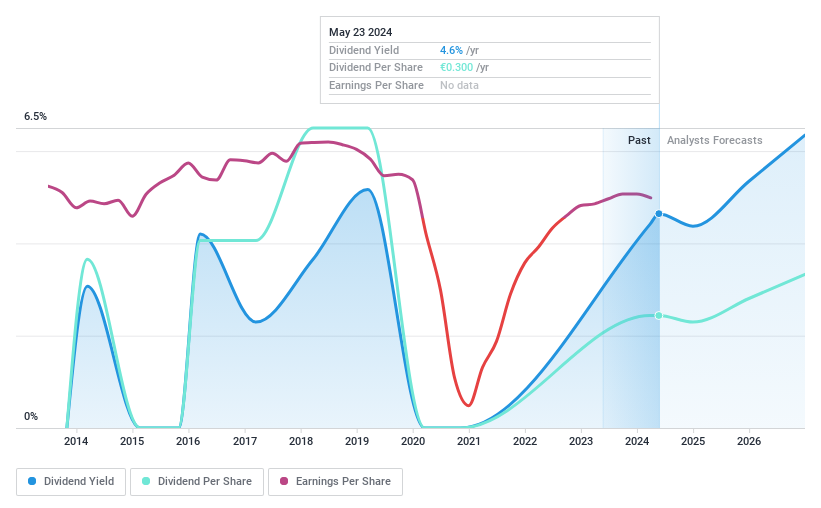

Deutsche Lufthansa

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Deutsche Lufthansa AG is a global aviation company with a market capitalization of approximately €7.53 billion.

Operations: Deutsche Lufthansa AG generates revenue primarily through its Passenger Airlines segment at €28.69 billion, followed by Maintenance, Repair and Overhaul Services at €6.78 billion, Logistics at €2.85 billion, and Additional Businesses and Group Functions contributing €0.97 billion.

Dividend Yield: 4.8%

Deutsche Lufthansa AG has demonstrated a mixed performance in dividend reliability, with a history of volatile dividends over the past decade. Despite this, its current dividend yield of 4.76% stands above the German market average. The dividends are well-supported by a low payout ratio of 22.3% and a reasonable cash payout ratio of 50.3%. Recently, Lufthansa completed several fixed-income offerings totaling €2.24 billion and proposed a modest dividend payment following significant quarterly losses, highlighting challenges in maintaining consistent shareholder returns amidst financial fluctuations.

Novem Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Novem Group S.A., based in Luxembourg, specializes in developing and supplying trim elements and decorative function elements for car interiors globally, with a market capitalization of approximately €251.30 million.

Operations: Novem Group S.A. generates €635.50 million in revenue from its automotive parts and accessories segment.

Dividend Yield: 6.8%

Novem Group S.A. reported a decrease in annual sales to €635.5 million and net income to €34.8 million for the year ending March 2024, reflecting a downturn from previous figures. Despite this, NVM's dividend yield of 6.85% ranks well above the German market average of 4.58%. The dividends are sustainably covered by both earnings and cash flows with payout ratios of 37.7% and 36.1%, respectively, although the company has only started paying dividends recently with no increases in payments over two years, indicating potential concerns about future growth and stability in its dividend policy.

Click to explore a detailed breakdown of our findings in Novem Group's dividend report.

Upon reviewing our latest valuation report, Novem Group's share price might be too pessimistic.

Turning Ideas Into Actions

Unlock our comprehensive list of 32 Top Dividend Stocks by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BMW XTRA:LHA and XTRA:NVM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]