Exploring Three Top Value Stocks With Intrinsic Discounts Ranging From 12.3% To 36.7%

As global markets exhibit mixed performances with a notable pivot towards value and small-cap stocks, investors are keenly observing shifts caused by geopolitical tensions and economic policies. In this context, identifying stocks that appear undervalued relative to their intrinsic value could be particularly compelling, offering potential opportunities for discerning investors in the current market environment.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Vente-Unique.com (ENXTPA:ALVU) | €15.50 | €30.95 | 49.9% |

Marriott Vacations Worldwide (NYSE:VAC) | US$85.37 | US$169.56 | 49.7% |

Duckhorn Portfolio (NYSE:NAPA) | US$7.22 | US$14.40 | 49.9% |

Calnex Solutions (AIM:CLX) | £0.49 | £0.98 | 49.8% |

IPH (ASX:IPH) | A$5.91 | A$11.73 | 49.6% |

Power and Water Utility Company for Jubail and Yanbu (SASE:2083) | SAR62.20 | SAR124.34 | 50% |

Auction Technology Group (LSE:ATG) | £4.855 | £9.69 | 49.9% |

INKON Life Technology (SZSE:300143) | CN¥7.37 | CN¥14.64 | 49.7% |

Pan American Silver (TSX:PAAS) | CA$29.61 | CA$59.06 | 49.9% |

Vitesco Technologies Group (XTRA:VTSC) | €56.55 | €112.38 | 49.7% |

We'll examine a selection from our screener results.

Prysmian

Overview: Prysmian S.p.A. operates globally, manufacturing and distributing power and telecom cables and systems, along with related accessories under the Prysmian, Draka, and General Cable brands, with a market capitalization of approximately €17.75 billion.

Operations: The company generates revenue primarily from two segments: Digital Solutions, which brought in €1.34 billion, and Electrification - Other, contributing €0.37 billion.

Estimated Discount To Fair Value: 12.3%

Prysmian's financial performance shows resilience with a steady net income increase to €185 million and sales of €3.69 billion, despite a slight decrease from the previous year. The company is actively managing its capital through a significant share repurchase program, enhancing shareholder value. Additionally, Prysmian's investment in advanced conductor technology with a recent expansion funded by the DOE underscores its commitment to innovation and efficiency in energy transmission. Trading at €63.46, below the estimated fair value of €72.33, Prysmian appears undervalued based on cash flows, offering potential for investors looking at fundamental value metrics.

According our earnings growth report, there's an indication that Prysmian might be ready to expand.

Delve into the full analysis health report here for a deeper understanding of Prysmian.

América Móvil. de

Overview: América Móvil, S.A.B. de C.V., a major provider of telecommunications services across Latin America and other global markets, has a market capitalization of approximately MX$969.22 billion.

Operations: The company generates MX$813.38 billion from cellular services.

Estimated Discount To Fair Value: 36.7%

América Móvil, despite a challenging quarter with a net loss of MXN 1,093 million, remains attractive for its future growth prospects. Its earnings are expected to grow by 22.84% annually, outpacing the Mexican market's forecast of 11.4%. Currently trading at MXN 15.82—significantly below its fair value estimate of MXN 25.01—the stock appears undervalued based on discounted cash flows and analyst targets suggesting a potential price increase of 22.1%. However, its high debt levels and lower-than-last-year profit margins at 4% warrant caution.

XPO

Overview: XPO, Inc. operates as a global provider of freight transportation services across the United States, North America, France, the United Kingdom, and other parts of Europe, with a market capitalization of approximately $12.80 billion.

Operations: The company's revenue is generated primarily from its North American Less-Than-Truckload and European Transportation segments, totaling approximately $4.77 billion and $3.08 billion respectively.

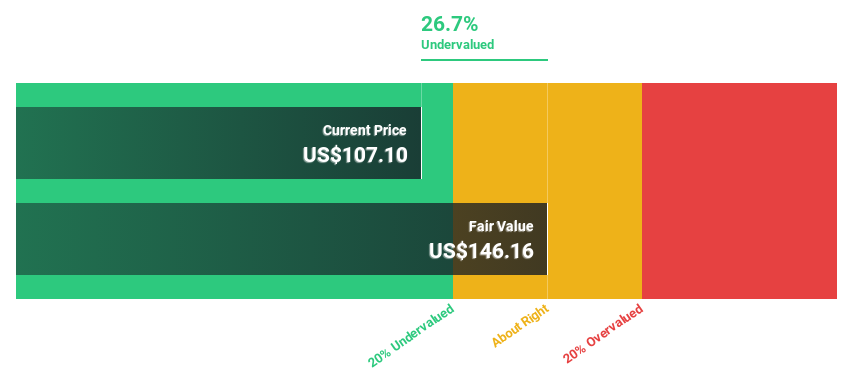

Estimated Discount To Fair Value: 21.9%

XPO Inc., despite recent index reclassifications, shows potential as an undervalued stock based on cash flows. Currently trading at US$114.9, which is 21.9% below its estimated fair value of US$147.21, XPO appears attractively priced. The company's earnings are forecasted to grow by 23.65% annually over the next three years, outstripping the US market's expected growth rate of 15%. However, its revenue growth projection of 6.3% per year lags behind the broader market forecast of 8.7%, and a high level of debt could pose financial constraints.

The analysis detailed in our XPO growth report hints at robust future financial performance.

Take a closer look at XPO's balance sheet health here in our report.

Taking Advantage

Gain an insight into the universe of 981 Undervalued Stocks Based On Cash Flows by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BIT:PRY BMV:AMX B and NYSE:XPO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]