Exploring UK Stocks With Intrinsic Value Discounts Ranging From 36.9% To 49.8%

Recent performance of the UK stock market has been subdued, influenced by disappointing trade data from China and its ripple effects on global markets. The FTSE 100 and FTSE 250 indices both closed lower, reflecting concerns about international economic recovery. In this context, identifying stocks that appear undervalued relative to their intrinsic value could offer investors potential opportunities for long-term growth amidst current market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

Begbies Traynor Group (AIM:BEG) | £1.04 | £1.98 | 47.5% |

Gaming Realms (AIM:GMR) | £0.369 | £0.69 | 46.3% |

WPP (LSE:WPP) | £7.44 | £14.16 | 47.5% |

LSL Property Services (LSE:LSL) | £3.39 | £6.39 | 46.9% |

Loungers (AIM:LGRS) | £2.81 | £5.50 | 48.9% |

Accsys Technologies (AIM:AXS) | £0.55 | £1.05 | 47.8% |

Entain (LSE:ENT) | £6.442 | £12.28 | 47.5% |

Ricardo (LSE:RCDO) | £4.96 | £9.43 | 47.4% |

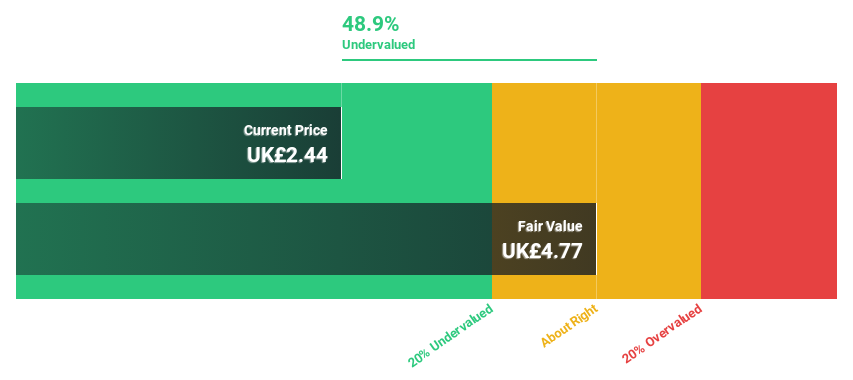

Nexxen International (AIM:NEXN) | £2.38 | £4.74 | 49.8% |

M&C Saatchi (AIM:SAA) | £2.07 | £4.00 | 48.2% |

Underneath we present a selection of stocks filtered out by our screen.

Nexxen International

Overview: Nexxen International Ltd. is a company based in Israel that offers a comprehensive software platform connecting advertisers with publishers, with a market capitalization of approximately £328.23 million.

Operations: The company generates $334.69 million from its marketing services segment.

Estimated Discount To Fair Value: 49.8%

Nexxen International Ltd., with a current trading price of £2.38, is significantly undervalued based on discounted cash flow analysis, suggesting a fair value of £4.74. Despite recent losses—£6.87 million in Q1 2024—the company's revenue is expected to grow by 7.8% annually, outpacing the UK market average of 3.5%. This growth is supported by strategic initiatives like the Nexxen Data Platform and partnerships aimed at enhancing data-driven consumer engagement, positioning Nexxen for profitability within three years amidst aggressive share buybacks totaling £19.99 million recently.

Energean

Overview: Energean plc is an oil and gas company focused on the exploration, production, and development of energy resources, with a market capitalization of approximately £1.94 billion.

Operations: The company's revenue primarily stems from its exploration and production activities in the oil and gas sector, totaling approximately $1.42 billion.

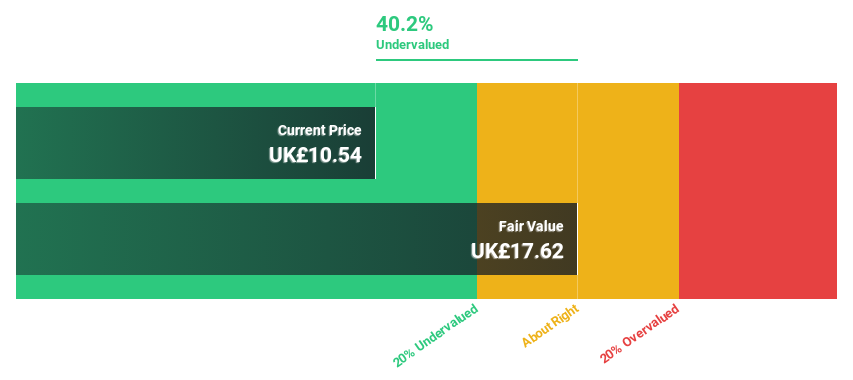

Estimated Discount To Fair Value: 44.6%

Energean, priced at £10.60, is considerably below its estimated fair value of £19.13, reflecting a potential undervaluation based on discounted cash flow analysis. Despite a robust dividend of 30 US cents per share and a significant increase in production to 142 kboed as of Q1 2024—a 49% year-over-year rise—the sustainability of this dividend is questionable due to inadequate coverage by earnings or free cash flows. With expected revenue growth outpacing the UK market average and forecasts suggesting substantial future returns on equity, Energean's financial outlook appears promising although constrained by high debt levels and recent shareholder dilution.

Our growth report here indicates Energean may be poised for an improving outlook.

Click to explore a detailed breakdown of our findings in Energean's balance sheet health report.

Foxtons Group

Overview: Foxtons Group plc is a UK-based estate agency specializing in residential property services, with a market capitalization of approximately £200.28 million.

Operations: The company generates revenue through three primary segments: sales (£37.16 million), lettings (£101.19 million), and financial services (£8.78 million).

Estimated Discount To Fair Value: 36.9%

Foxtons Group, trading at £0.66, is valued at 36.9% below its fair value of £1.05, suggesting potential undervaluation based on discounted cash flow metrics. While the company's revenue growth forecast of 5.9% per year surpasses the UK market average of 3.5%, its profit margins have declined from last year's 6.8% to 3.7%. Despite this, Foxtons' earnings are expected to grow significantly at a rate of 32.4% annually, outpacing the broader UK market projection of 12.6%.

Next Steps

Get an in-depth perspective on all 62 Undervalued UK Stocks Based On Cash Flows by using our screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:NEXN LSE:ENOG and LSE:FOXT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]