Exploring Undervalued Small Caps With Insider Buying In Hong Kong July 2024

Amid a holiday-shortened week, the Hong Kong market displayed resilience with the Hang Seng Index gaining 0.46%, contrasting with broader Asian markets where concerns about economic slowdowns persisted. This backdrop sets an intriguing stage for investors to explore undervalued small-cap stocks in Hong Kong, particularly those with recent insider buying which may signal unrecognized potential in these enterprises.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Wasion Holdings | 11.4x | 0.8x | 32.51% | ★★★★☆☆ |

Xtep International Holdings | 10.6x | 0.8x | 45.22% | ★★★★☆☆ |

Sany Heavy Equipment International Holdings | 7.9x | 0.7x | -21.82% | ★★★★☆☆ |

Ever Sunshine Services Group | 6.0x | 0.4x | 14.21% | ★★★★☆☆ |

China Overseas Grand Oceans Group | 2.9x | 0.1x | -2.95% | ★★★★☆☆ |

China Leon Inspection Holding | 9.5x | 0.7x | 29.65% | ★★★★☆☆ |

Nissin Foods | 15.0x | 1.4x | 38.77% | ★★★★☆☆ |

Transport International Holdings | 11.5x | 0.6x | 44.84% | ★★★★☆☆ |

Giordano International | 8.5x | 0.8x | 37.02% | ★★★☆☆☆ |

Kinetic Development Group | 4.0x | 1.8x | 19.45% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Nissin Foods

Simply Wall St Value Rating: ★★★★☆☆

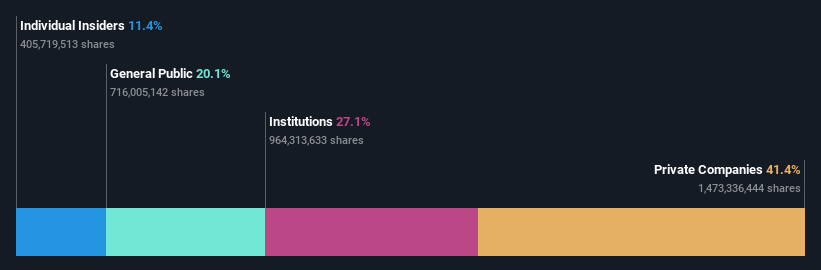

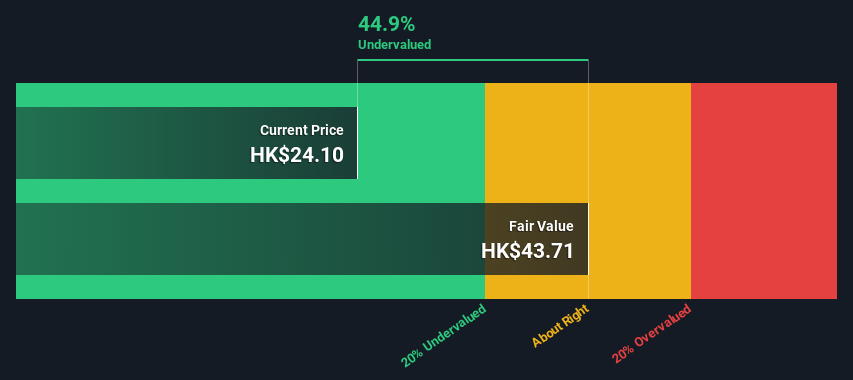

Overview: Nissin Foods is a leading producer of instant noodles and other food products, primarily serving markets in Mainland China, Hong Kong, and other parts of Asia.

Operations: Mainland China and Hong Kong, along with other Asian regions, contribute significantly to the company's revenue, totaling HK$4.15 billion. The company's gross profit margin has shown an upward trend over recent periods, reaching 0.34% by the latest date provided.

PE: 15.0x

Nissin Foods, a lesser-known entity in Hong Kong's market, recently bolstered its executive team, signaling strategic enhancements that could steer future growth. Notably, insider Kiyotaka Ando demonstrated confidence by acquiring 155,430 shares for HK$770,000 in June 2024—a move reflecting optimism about the company's prospects. With earnings showing a steady increase from HK$109.92 million to HK$117.95 million in the first quarter of 2024 and dividends rising to 15.82 HK cents per share, financial health appears robust despite relying solely on external borrowing for funding—a factor worth monitoring closely by potential investors looking for emerging opportunities in the region.

Get an in-depth perspective on Nissin Foods' performance by reading our valuation report here.

Evaluate Nissin Foods' historical performance by accessing our past performance report.

China Overseas Grand Oceans Group

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Overseas Grand Oceans Group Ltd operates primarily in property investment and development, with additional interests in property leasing and other sectors, boasting a market capitalization of approximately CN¥11.96 billion.

Operations: The entity generates significant revenue from property investment and development, contributing CN¥56.08 billion, alongside smaller streams from property leasing at CN¥242.46 million. Over the observed periods, the gross profit margin has shown variability but notable peaks, such as 33.82% in June 2019, reflecting changes in cost of goods sold and operational efficiency.

PE: 2.9x

Recently, China Overseas Grand Oceans Group Limited has shown signs of being undervalued, with insider confidence underscored by recent share purchases. Despite a challenging year with property sales down significantly, the firm's resilience is evident in its strategic adjustments and leadership changes, including appointing a new auditor and board members. These moves suggest a proactive approach to governance and financial management that could signal potential for future stabilization and growth in an ever-competitive market.

Ferretti

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti specializes in the design, construction, and marketing of yachts and recreational boats.

Operations: The company's revenue grew from €544.16 million in 2016 to €1.23 billion by the end of 2023, with a corresponding increase in net income from €14.13 million to €83.05 million over the same period. Gross profit margin saw an upward trend, increasing significantly from 23.23% in 2016 to approximately 37.08% by 2023, reflecting improved operational efficiency and cost management strategies.

PE: 11.6x

Ferretti, with its recent confirmation of a revenue forecast between €1.22 billion and €1.24 billion for 2024, reflects a solid growth trajectory of up to 11.6%. This growth is underpinned by high-quality earnings predominantly from non-cash sources, indicating robust underlying financial health despite its reliance on external borrowing—a riskier funding strategy. Insight into the company's strategic direction was further revealed at their May conference, enhancing investor familiarity with leadership's vision. Additionally, insider confidence is evident as they recently purchased shares, signaling belief in the company’s future prospects amidst an anticipated 12.46% annual earnings increase.

Click to explore a detailed breakdown of our findings in Ferretti's valuation report.

Explore historical data to track Ferretti's performance over time in our Past section.

Make It Happen

Unlock our comprehensive list of 18 Undervalued Small Caps With Insider Buying by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1475 SEHK:81 and SEHK:9638.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]