Exploring Value Opportunities With 3 ASX Stocks In June 2024

Amidst a turbulent trading day where the ASX200 dipped after an initial rise, and following a downturn in US markets, investors are keenly watching for opportunities. In such a market environment, identifying undervalued stocks can be particularly compelling as they may represent potential for growth despite broader market volatility. In assessing what makes a good stock under current conditions, factors like resilience in fluctuating markets and sectors showing relative strength become crucial considerations.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

Name | Current Price | Fair Value (Est) | Discount (Est) |

LaserBond (ASX:LBL) | A$0.705 | A$1.21 | 41.7% |

MaxiPARTS (ASX:MXI) | A$1.855 | A$3.12 | 40.6% |

Charter Hall Group (ASX:CHC) | A$12.24 | A$22.43 | 45.4% |

ReadyTech Holdings (ASX:RDY) | A$3.18 | A$5.96 | 46.6% |

hipages Group Holdings (ASX:HPG) | A$1.02 | A$1.94 | 47.5% |

Regal Partners (ASX:RPL) | A$3.24 | A$6.17 | 47.5% |

IPH (ASX:IPH) | A$6.32 | A$11.37 | 44.4% |

Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

South32 (ASX:S32) | A$3.72 | A$6.11 | 39.1% |

Treasury Wine Estates (ASX:TWE) | A$12.63 | A$21.36 | 40.9% |

Let's review some notable picks from our screened stocks

Infomedia

Overview: Infomedia Ltd is a technology company that provides electronic parts catalogues, service quoting software, and e-commerce solutions to the automotive industry globally, with a market capitalization of approximately A$624.62 million.

Operations: The company generates revenue primarily from its publishing of periodicals, contributing A$136.58 million.

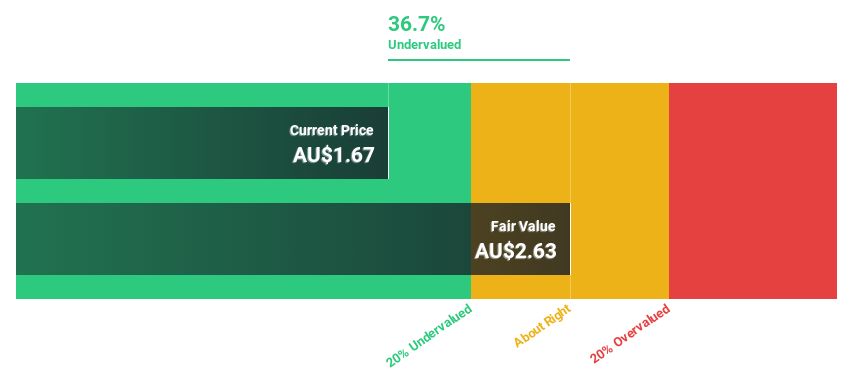

Estimated Discount To Fair Value: 36.7%

Infomedia, priced at A$1.67, is considered undervalued with a fair value estimate of A$2.63, reflecting a 36.7% discount. This valuation comes despite expectations of significant earnings growth at 27.83% annually, outpacing the Australian market's forecast of 13.7%. However, revenue growth projections are modest at 7.9% annually compared to some higher-growth peers. Recent activities include presentations at the Bell Potter Emerging Leaders Conference and upcoming discussions on its Americas operations which could influence future financial performance.

SiteMinder

Overview: SiteMinder Limited is a company that develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers both in Australia and internationally, with a market capitalization of approximately A$1.42 billion.

Operations: SiteMinder's revenue primarily comes from its software and programming segment, generating A$171.70 million.

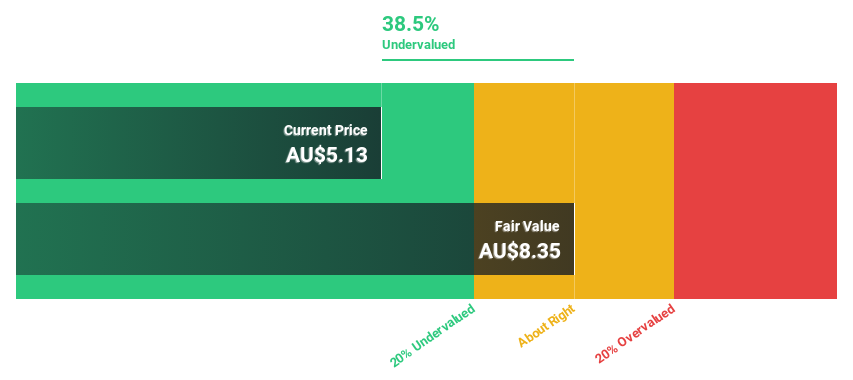

Estimated Discount To Fair Value: 38.5%

SiteMinder, currently priced at A$5.13, trades below its estimated fair value of A$8.35, indicating a substantial undervaluation. The company's revenue growth is robust at 19.7% annually, surpassing the Australian market average of 5.5%. Expected to turn profitable within three years, earnings are projected to surge by 72.7% annually. Recently, SiteMinder formed a strategic partnership with Cloudbeds to enhance distribution and operational capabilities for hoteliers, potentially boosting future revenues and market position.

Worley

Overview: Worley Limited operates globally, offering professional project and asset services to the energy, chemicals, and resources sectors, with a market capitalization of approximately A$7.52 billion.

Operations: The company's revenue segments total approximately A$11.34 billion, primarily derived from professional project and asset services in the energy, chemicals, and resources sectors.

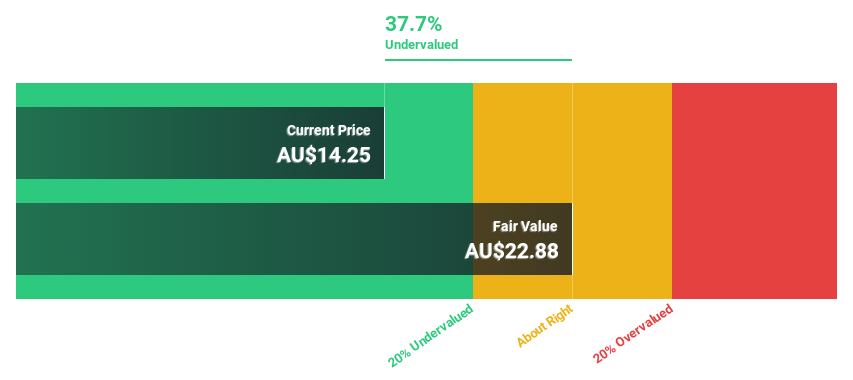

Estimated Discount To Fair Value: 37.7%

Worley, priced at A$14.25, is significantly undervalued with an estimated fair value of A$22.88, trading 37.7% below this level. Its earnings are expected to grow by 22.6% annually, outpacing the Australian market forecast of 13.8%. Although its revenue growth is projected at 6.3% per year, slightly above the market average of 5.5%, its future Return on Equity is considered low at 9.8%. Recently, Worley partnered with Nano One to advance clean energy technology in battery production.

Insights from our recent growth report point to a promising forecast for Worley's business outlook.

Navigate through the intricacies of Worley with our comprehensive financial health report here.

Where To Now?

Investigate our full lineup of 47 Undervalued ASX Stocks Based On Cash Flows right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:IFMASX:SDRASX:WOR and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance