Fed Chair Powell: Congress should use 'great fiscal power' to provide direct support

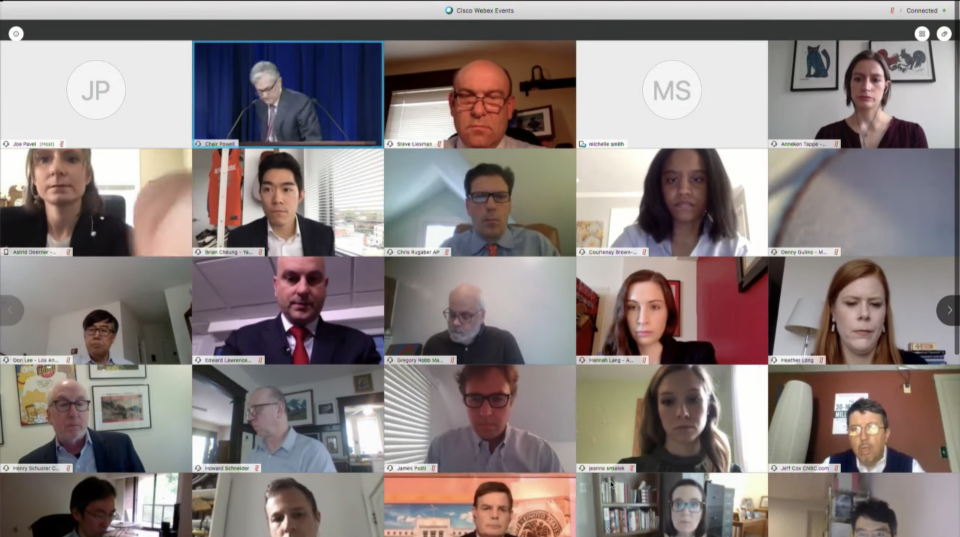

Federal Reserve Chairman Jerome Powell called on Congress to provide further support to households and businesses as the COVID-19 shutdown continues to grip the U.S. economy.

“This is the time to use the great fiscal power of the United States to do what we can do to support the economy and try to get through this with as little damage to the longer-run productive capacity of the economy as possible,” Powell said in a press conference on Wednesday.

Powell said Congress could specifically do more on direct support to businesses that the Fed can’t reach under its statutory authority. Although the Fed is serving as a lender of last resort to financial market participants like banks and money market funds, the central bank cannot directly send checks to families and small businesses.

“This direct support can make a critical difference, not just in helping families and businesses in a time of need but also in limiting long lasting damage to our economy,” Powell said.

The Fed announced Wednesday that it was holding rates at near zero, in a target range of between 0% and 0.25%. The central bank also maintained its open-ended asset purchases under quantitative easing, preferring not to commit itself to a specific pace of buying Treasury and asset mortgage-backed securities.

The Fed’s $6.6 trillion balance sheet continues to grow at a breakneck speed, and the central bank’s capacity to absorb government debt - combined with near-zero interest rates - is leaving the door open for fiscal policymakers to finance relief packages.

“Powell is clearly ready to do more to leverage spending by Congress if needed,” Grant Thornton Chief Economist Diane Swonk wrote April 29.

‘Not the time’ for deficit hawks

With the federal government already having spent trillions on the Coronavirus Aid, Relief, and Economic Security (CARES) Act and other measures, the United States is set to see a federal deficit of $3.8 trillion this year, according to the Committee for a Responsible Federal Budget.

But Powell emphasized that fiscal discipline is not more important than saving the households and businesses imperiled by a crisis that they did not create.

“But this is not the time, in my personal view, to let that concern, which is a very serious concern, get in the way of us winning this battle,” Powell said.

For the Fed’s part, Powell said the central bank is moving “forcefully, proactively, and aggressively” to help bridge the economy through the coronavirus-induced business stoppages across the country.

Powell said the Fed is “close to announcing” the start of its Main Street Lending Program, which will provide four-year loans to businesses larger than those covered by the small business-aimed Paycheck Protection Program.

The PPP offers loans to businesses with less than 500 employees and converts the loan to a grant if the business keeps employees employed for eight weeks. But borrowers under the Main Street Lending Program will have to pay the loan back, which Powell said may result in weaker demand.

The $349 billion appropriated for the PPP quickly ran dry and a second round of $310 billion is expected to generate high demand as well.

The Main Street Lending Program will allow for up to $600 billion in loans, but Powell said it has room to expand the program if needed.

“We won’t run out of money,” Powell said.

The Fed has launched nine liquidity facilities to backstop markets ranging from U.S. dollars to risky corporate debt. To support the facilities, Congress appropriated $454 billion that the U.S. Treasury can use as credit protection or equity against the Fed’s lending or purchasing programs.

Less than half of that money has been used through the facilities opened so far.

“We are clearly moving into areas where there is more risk than there has been in the past and I think that’s okay, that’s what we’re supposed to do,” Powell said.

The Fed’s next scheduled FOMC meeting will take place June 9 and 10.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

Fed commits to near-zero rates as US economy sees 'sharp declines'

Cafe chain Cosi sues SBA for excluding bankrupt companies from emergency loans

FOMC Preview: Powell to face 'status check' on Fed's emergency actions

Fed extends municipal liquidity facility beyond largest cities

A glossary of the Federal Reserve's full arsenal of 'bazookas'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance