Fed raises rates, sees three rate hikes in 2018

WASHINGTON — For the third time this year the Federal Reserve raised rates, a widely-expected move following signals from Fed officials.

After its two-day policy meeting, the Federal Open Market Committee voted to lift its benchmark federal funds rate between 1.25% and 1.50% and to continue the process of balance sheet normalization, which began in October. Two members of the committee, Neel Kashkari and Charles Evans, voted against the decision, preferring not to raise rates.

Economic outlook

The Fed’s cautious, yet generally positive, economic statement follows a slew of mixed data, including better-than-expected third quarter GDP and soft inflation numbers.

Unemployment has held solidly below 5% for over a year, a level many economists consider to be near full employment. The unemployment rate sank to 4.1% in November, its lowest level in over a decade.

“Averaging through hurricane-related fluctuations, job gains have been solid, and the unemployment rate declined further,” the Fed wrote in its statement.

Meanwhile, the Fed’s preferred inflation reading has continued to run below its 2% target. The core Personal Consumption Expenditures index increased to 1.4% year-over-year in October. Another measure of inflation, the core Consumer Price Index, dropped to 1.7% for November.

“Hurricane-related disruptions and rebuilding have affected economic activity, employment, and inflation in recent months but have not materially altered the outlook for the national economy,” the central bank noted.

Within the past few months, Fed chair Janet Yellen has expressed concern about persistently low inflation. Other Fed officials have joined her, including Robert Kaplan of the Dallas Fed and Charles Evans of the Chicago Fed.

The Fed also confirmed the timeline for winding down its $4.5 trillion balance sheet. At the June meeting, the Fed revealed plans to gradually reduce assets by decreasing its reinvestment of principal payments. Consistent with its previously announced schedule, the Fed will increase the monthly caps of its balance sheet shrinkage by $10 billion per month beginning in January.

Fed projections and dot plots

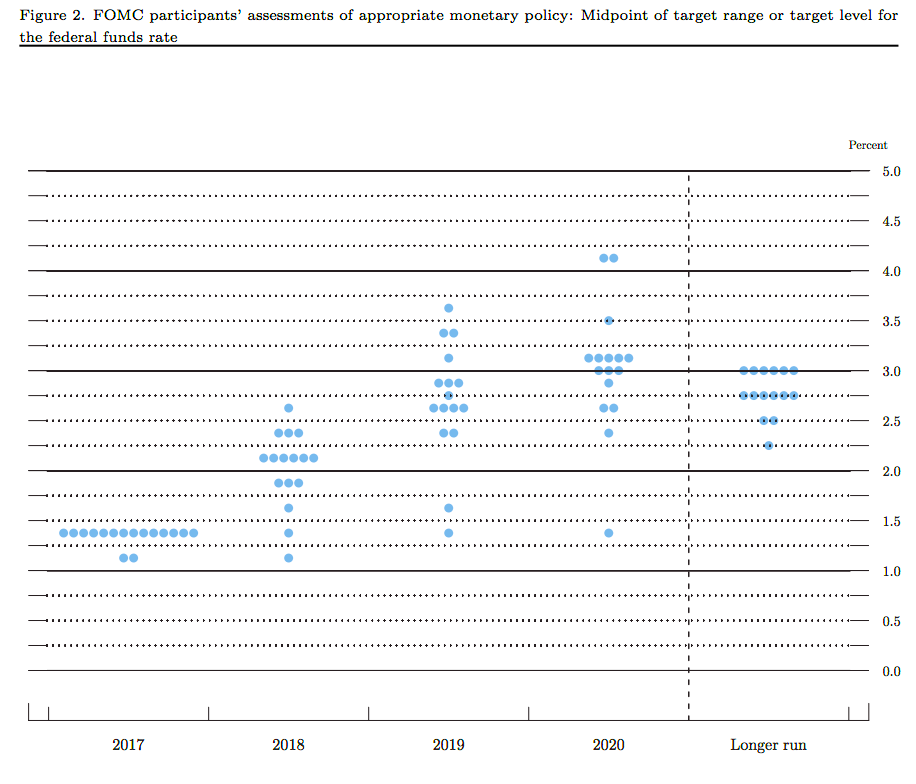

Projections for the total number of expected rate hikes in 2018 remained unchanged with three quarter-point raises next year. Officials also forecast the fed funds rate will reach 3.1% in 2020, just above its long-run goal of 2.8%.

The Fed’s expectations for GDP growth increased slightly to 2.5% in 2018. Meanwhile forecasts for core PCE inflation remained unchanged, while officials predict unemployment will hit 4% in 2020, below the long-run goal of 4.6%.