Fed 'prepared to adjust' balance sheet to prevent repo market flare-up

The Federal Reserve hopes that a larger balance sheet and a temporary repo facility in New York will help it steer clear of another spike in interest rates later this year. But Fed Chairman Jerome Powell said Wednesday that if those measures are not enough, the central bank could “adjust the details of our operations” — which could include mixing up the securities it buys.

In his last press conference of 2019, Powell said he is watching developments in the overnight lending market (or repo market), which saw borrowing costs rise to as high as 10% in mid-September.

Powell said he feels the Fed has controlled repo markets since that episode, but said the central bank would do whatever it takes to keep interest rates within its target range.

“We’re prepared to adjust our tactics,” Powell told reporters on Dec. 11, after announcing no change to interest rates. “We’re focused on year-end as well and we’re prepared to adjust our operations as appropriate.”

At issue: Firms will face year-end checks and will need to show regulators that they have enough cash on hand to fund options, derivatives, or debt instruments held on their balance sheets. But with less cash floating around in the system, banks may opt to hoard their cash instead of lending it in the money market.

As a result, some are worried that a lack of liquidity in the money market could bid interest rates far higher than where the Fed would like them to be.

And some Wall Street firms are now betting that the Fed will have to either extend its pace of asset growth or pursue serious quantitative easing to handle future demand for cash.

“The Fed’s liquidity operations have not been sufficient to relax the constraints banks will face in the upcoming year-end turn,” Credit Suisse’s Zoltan Pozsar wrote Dec. 10.

Two factors are among those cited for a possible year-end crunch: a scramble by the biggest banks to duck under high regulatory requirements, and a foreign exchange swap market hungry for liquidity.

Big banks hunker down on cash

The Bank for International Settlements, the organization run by 60 central banks from around the world, wrote in a report Dec. 8 that the repo crunch on Sept. 17 was caused by a reluctance among the four largest U.S. banks (JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo) to lend in the money market.

The reason: those four banks have favored U.S. Treasuries over cash as a source of liquidity.

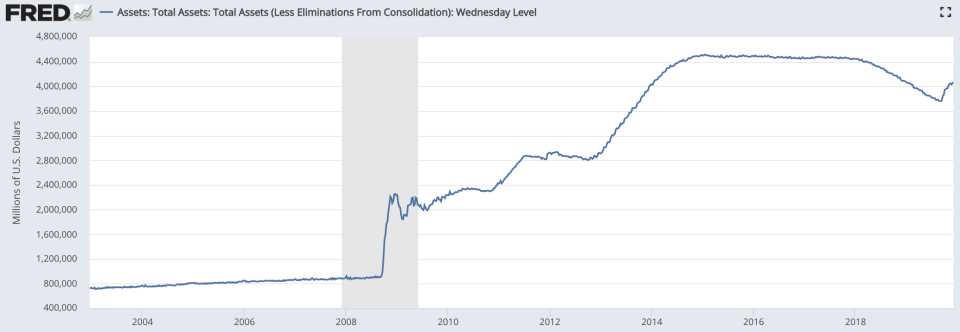

The Fed is partly to blame; during quantitative easing, banks had to turn to cash since the Fed was eating up most of the long-dated U.S. Treasuries available to the market.

When the Fed began winding down its balance sheet in Oct. 2017, banks were able to take on more Treasuries as bank reserves declined. In September, the due date for U.S. corporate taxes coincided with a large settlement of U.S. Treasuries to lead to a cash crunch.

“The resulting drain and swings in reserves are likely to have reduced the cash buffers of the big four banks and their willingness to lend into the repo market,” the BIS wrote.

In October, the Fed announced it would begin re-expanding its balance sheet by buying short-term Treasury bills at a $60-billion-a-month pace, at least through the second quarter of next year.

Powell reiterated Dec. 11 that the asset purchases are not quantitative easing because it is “operational” by design and has little bearing on macroeconomic factors.

Another crunch?

Another repo crunch could be coming because the banks, already with reduced cash holdings, are expected to hunker down on cash to show regulators they have ample funding.

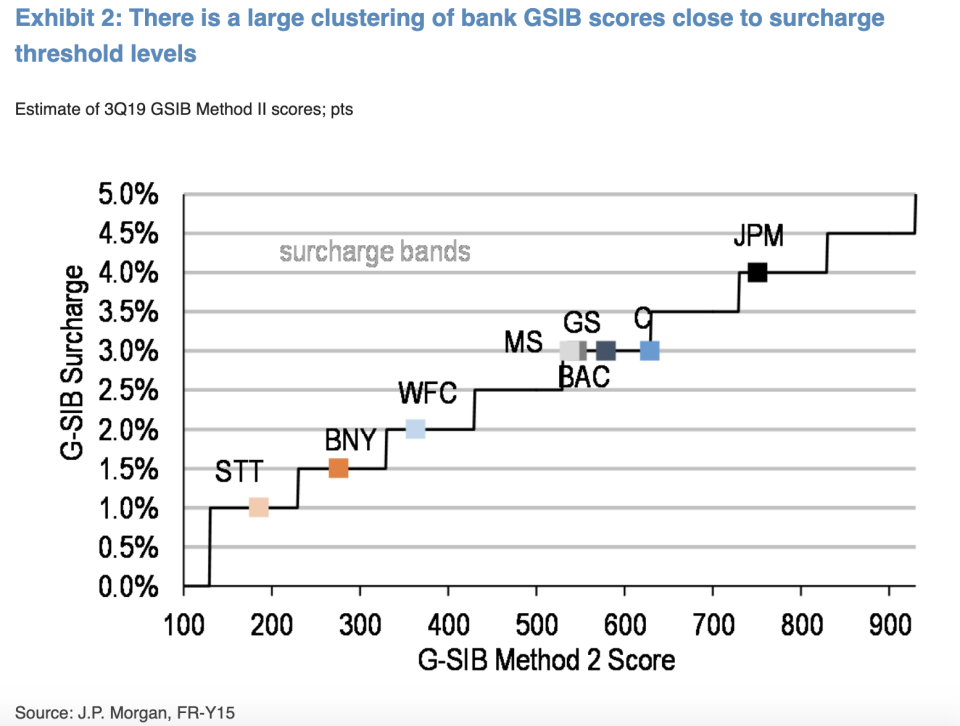

The largest U.S. banks identified as “global systemically important banks” face a regulation called the “GSIB surcharge.” Under the rule, banks are required to hold more capital relative to smaller banks since the massive scale of these firms presents larger risk to financial stability.

Not all banks face the same surcharge. JPMorgan Chase plays by a higher GSIB surcharge than any other bank, for example. The amount of the surcharge is assessed based on five factors: size, complexity, cross-jurisdictional activity, interconnectedness, and substitutability.

The Fed makes these assessments based on a snapshot of each bank’s financials as of Dec. 31, meaning the banks are likely to pare back on some activities to get their houses in order in the days leading up to the new year.

The Bank Policy Institute, which represents the largest banks, wrote Nov. 26 that banks will likely opt to hold onto cash at year-end because engaging actively in repo lending with other borrowers could make the bank appear more interconnected and cross-jurisdictional.

Holding back on repo could mean getting a smaller GSIB surcharge, which would free up more capital for the bank to work with in the following year.

QE4?

Credit Suisse’s Zoltan Pozsar wrote that FX swap markets could present the biggest risk this month. Pointing to the GSIB surcharge, Pozsar worries that banks will not play in the repo market, meaning hedge funds looking to fund FX swaps through bond trades may find harsh interest rates at year-end.

Pozsar goes further, arguing that since the FX swap market is large enough to weigh on Treasury yields, a spike in borrowing costs would send Treasury yields higher. His prediction: the Fed would have to shift from buying short-term Treasury bills to buying longer-term Treasuries with the goal of depressing longer-term interest rates.

“If we’re right about funding stresses, the Fed will be doing ‘QE4’ by year-end,” Pozsar wrote.

UBS, meanwhile, wrote Nov. 11 that the Fed balance sheet will likely continue to grow, predicting that the balance sheet will exceed its previous peak in mid-2022.

Powell said Wednesday that the Fed could purchase “other short-term coupon securities” if stresses got to that point.

“We would be prepared to do that if the need arises, but we’re not at that place,” Powell said.

The Fed’s next meeting will take place Jan. 28 and 29.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Charles Schwab-TD Ameritrade deal would be the latest in a long series of broker mergers

Fed officials split over October cut but now see interest rates as 'well calibrated'

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.