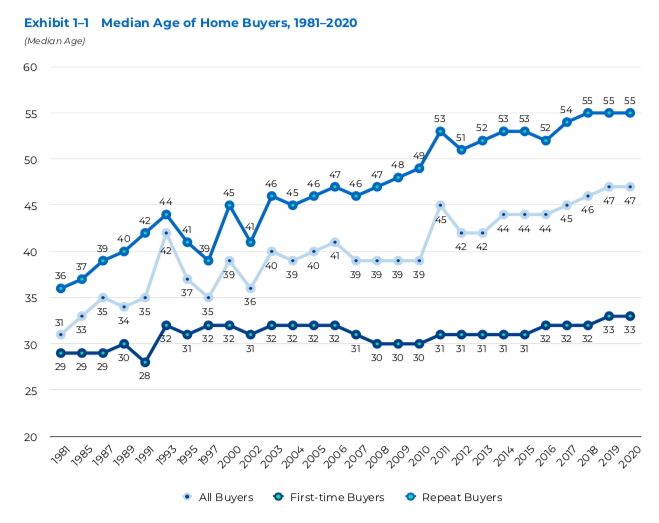

First-time homebuyers hit lowest level since 1987

Economists predicted that 2020 would be the year of the millennial homebuyer. But with record-high home prices, first-time homebuyers actually comprised less of the market in 2020 than they did last year.

Only 31% of homes bought this year were purchased by first-time buyers, compared to 33% last year. It’s the lowest share since 1987, according to a new study by the National Association of Realtors (NAR).

“Affordability is a massive constraint, and the lack of inventory makes it hard for first-time homebuyers to enter the market,” said Jessica Lautz, vice president of demographics and behavioral insights at the NAR. Lautz said that predictions of first-time homebuyer booms were overblown regardless of the coronavirus pandemic, due to the ongoing affordable inventory shortage.

The housing market was hot this summer and fall, in part due to low interest rates and pent-up demand which delayed the typically busy spring homebuying activity . Demand outpaced supply, and bidding wars drove home prices to a record median price of $350,000, according to Realtor.com, making homeownership unattainable for many first-time buyers looking for an entry-level ($200,000 or less) home.

“The people who have been able to jump into the market in recent months are those who have a higher income and are able to purchase a more expensive home. That has been very strong, but those who would be purchasing their first home at an affordable price point are those that have been really left out this year,” said Lautz.

Notably, first-time homebuyers represented 36% of home purchases in April, before home prices started rising. Politicians have proposed an array of tax credits and financial incentives to boost first-time homeownership in 2021: In July, Congressman Sean Maloney (D-NY) proposed First Time Homebuyer Pandemic Savings Act, which would allow first-time homebuyers to use retirement funds in their home purchase. The proposed act was endorsed by the National Association of Realtors but has not passed the U.S. House of Representatives.

Pandemic impact on homebuying

The pandemic created dual economic effects: Some first-time homebuyers benefitted, with work uninterrupted, access to lower interest rates, and more opportunities to save money. Of first-time buyers who managed to buy a home in 2020, they reported a median income of $80,000, up from $79,400 last year, according to NAR.

“Shelter-in-place orders helped many who were fortunate enough to keep their jobs save for a down payment — one of the largest hurdles of buying a home. The combination of low rates and the opportunity to save is enabling many millennials to move up their home buying timeline,” said Realtor.com chief economist Danielle Hale in a statement.

But on average, Americans of typical first-time homebuying age (millennials) were among the hardest-hit during the pandemic, with 65% saying their household income was impacted, compared to 57% on average, according to a recent Transunion survey.

Sarah Paynter is a reporter at Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

More from Sarah:

Is the Democratic or Republican Party better for homeowners?

American dream of owning a home less attainable as home values rise $2 trillion

Barbara Corcoran: Housing market is hot, election results won’t matter