Fed remains unchanged on rates, pledges to 'sustain the expansion'

The Federal Reserve did not move on rates at the conclusion of its policysetting meeting June 19, but committed itself to acting “as appropriate to sustain the expansion.”

The Fed elected to keep the benchmark interest rate within its target range of 2.25% to 2.5%, but new economic projections show more Fed officials seeing the case for a rate cut — or two — by the end of 2020.

The Federal Open Market Committee made a number of changes to its policy statement, removing the word “patient” in favor of language promising to “closely monitor the implications of incoming information for the economic outlook.” Some market participants had viewed the word “patient” as having a bias toward rate hikes, since the central bank had previously messaged that it was on pause, and not full stop, on efforts to normalize interest rates.

The Fed said it still sees a “sustained expansion of economic activity, strong labor market conditions, and inflation near” the committee’s 2% target, but added that “uncertainties about this outlook have increased.”

Fed Chairman Jerome Powell also saw his first dissent since becoming head of the central bank; St. Louis Fed President James Bullard voted against the decision to hold rates steady, instead preferring a 25-basis point cut in today’s decision.

More members see rate cuts by 2020

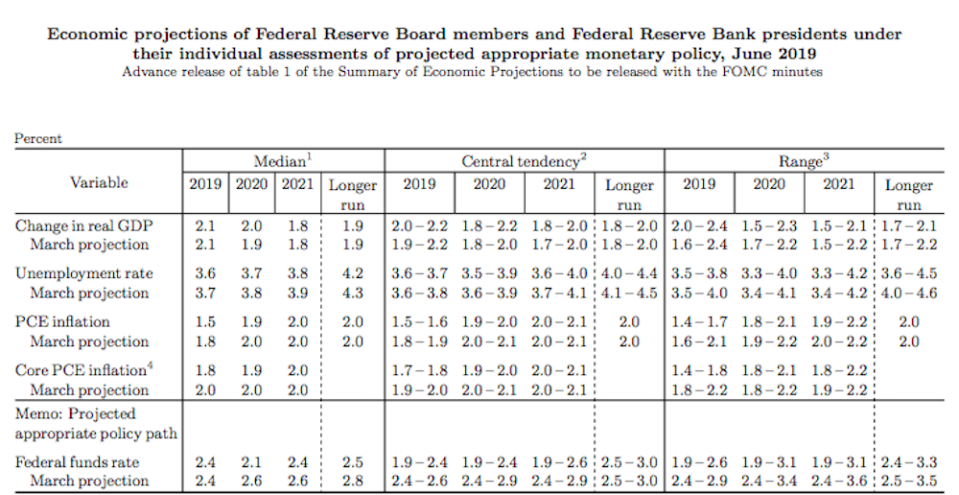

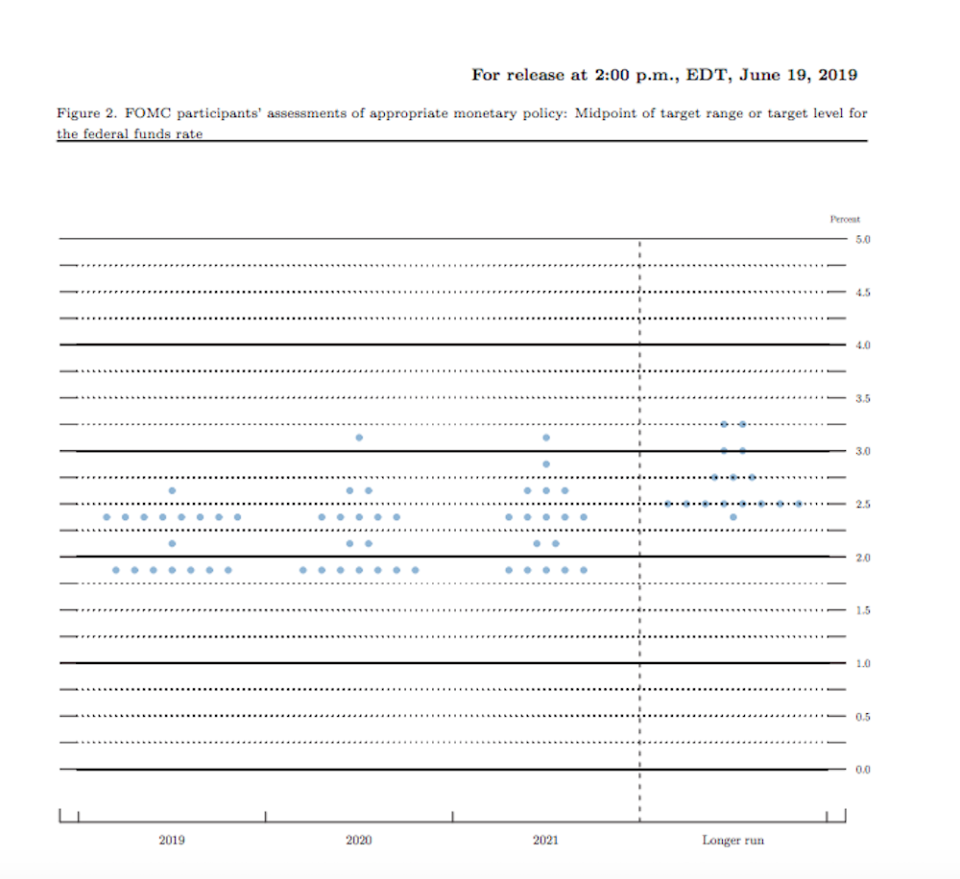

The Fed also released a fresh print of economic projections, which included new “dot plots” that map out policysetting members’ preferred rate paths through the next three years.

The median dot reflected no rate changes through the rest of 2019, and one 25-basis point rate cut in 2020. The previous dot plots in March (before trade tensions escalated and economic data softened) also had the median dot calling for no rate changes by the end of 2019, but projected a rate hike in 2020.

The new dot plots show Fed officials tilting closer toward a rate cut by the end of 2020. Nine members now see a case for up to two rate cuts in that same window of time. For comparison, the March dot plot reflected only seven members seeing a case for a rate cut by the end of 2020 — and none projected more than a single 25-basis point cut.

The June update shows some members still taking a hawkish stance. Three Fed officials see a case for at least one rate hike by the end of 2020, with one of those three officials predicting three rate hikes.

The economic projections also saw a tick down in future expectations for inflation. In March, the median Fed official projected the economy touching 2% on core personal consumption expenditures (the central bank’s preferred measure of inflation) by the end of 2019 and hitting that target again in 2020 and 2021.

The median Fed official now expects the Fed to miss its target for core PCE in 2019 and 2020, hitting 1.8% and 1.9% by the end of those years, respectively.

Inflation has been a conundrum for the Fed ever since it set its 2% symmetric inflation target in 2012. Since the Fed adopted that target, the central bank’s preferred measure for inflation - core personal consumption expenditures - have only touched or breached 2% once, raising the question of how the Fed can stimulate persistent undershooting of its target.

Labor market remains strong?

On the labor market front, the Fed said the labor market “remains strong,” despite a disappointing jobs report since the last policysetting meeting in May.

That jobs report showed a sharp miss on expectations for added payrolls in addition to tepid wage growth pointing to a labor market that may be running below full employment.

Still, the Fed continues to bring down its expectations for the unemployment rate, suggesting that policy members continue to see room for more tightening in the labor market.

In the updated economic projections, the median Fed official projected a 3.6% unemployment rate by the end of 2019, a tick down from the March prediction of 3.7%. Fed officials appear to find this trend structural, as the median member also brought down the longer-run expectation for unemployment from 4.3% in March to 4.2% in the projections released today.

But as the Fed statement noted, the “strong” labor market conditions are part of the “uncertainties” that have increased in recent weeks.

The Fed’s next policysetting meeting will be July 30-31.

—

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Lael Brainard: Regulators may be 'whittling away' at financial stability

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance onTwitter,Facebook,Instagram,Flipboard,SmartNews,LinkedIn, YouTube, and reddit.