Coronavirus stimulus to for-profit colleges spurs fears of another predatory student loan boom

For-profit colleges in total were slated to receive over a billion dollars from the federal government via the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act, which gave U.S. colleges and universities $14 billion overall to fight the pandemic.

After the rush to get the money out the door, questions are now emerging about why some schools — including universities with massive endowments and for-profit entities accused of predatory practices — were receiving millions in taxpayer-backed stimulus money.

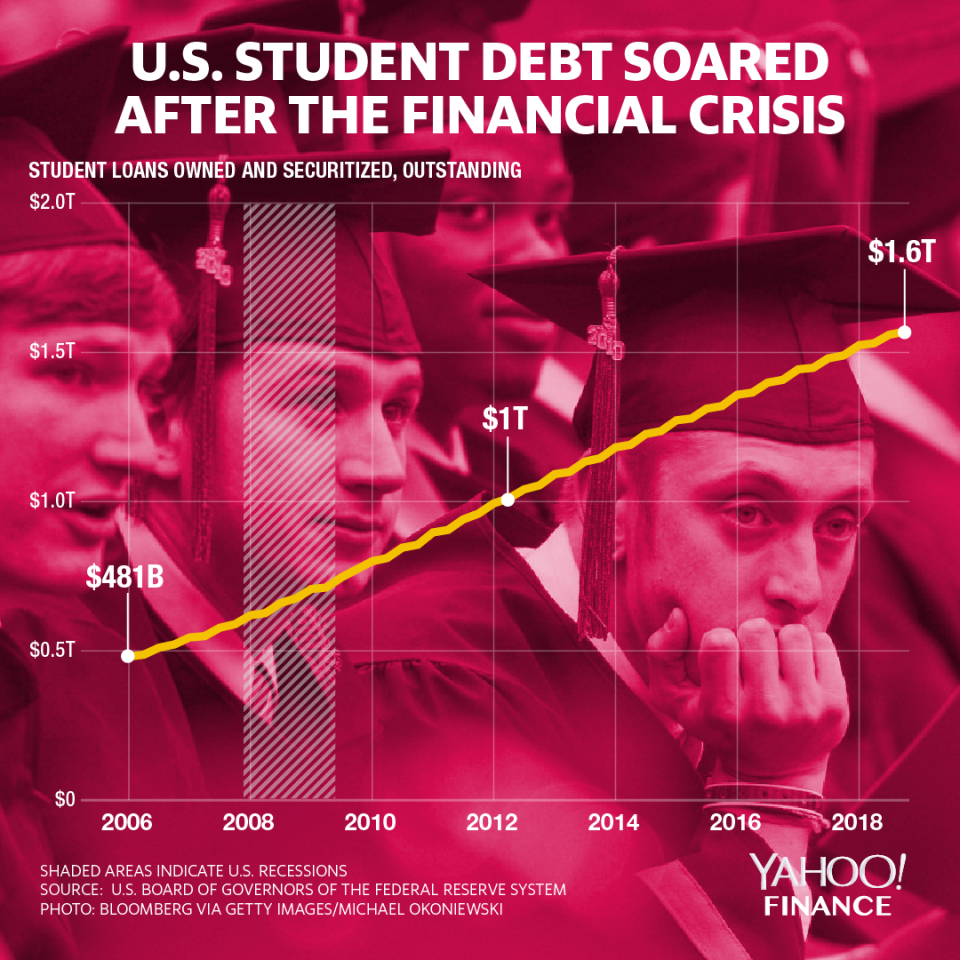

The for-profit higher education sector saw tremendous growth after the 2008 Financial Crisis. In 2016, the New York Fed noted that enrollment at these schools had “skyrocketed” as the country emerged out of the Great Recession. Debt levels rose as well: Students graduating from for-profit institutions generally hold far higher levels of debt than those attending other institutions.

“What happened was that budget cuts by states meant that public colleges were not able to serve as many students, and there was increased demand because more people were out of work,” Bob Shireman, a senior fellow at the Century Foundation and former Education Department official during the Obama administration, told Yahoo Finance.

Shireman explained that Americans “were looking for a degree or training to get a job… And so the for-profits, charging ten times more, we're taking advantage of that situation by promising: ‘We'll help train you for the jobs of the future.’ … It was opportunism combined with budget cutbacks in states that created a big opening for the for-profits.”

A December 2019 report by the Institute for College Access & Success asserted that “the economic return on investment for students of for-profit colleges is low. Students at associate programs at for-profit colleges see lower earnings gains than students in other sectors.”

Furthermore, “for-profit colleges account for a disproportionately large share of student loan defaults.” While for-profit colleges accounted for just 9% of total college students in 2016, students who left those schools and ended up defaulting on their student loans accounted for 33% of the overall number.

Experts are now worried that the CARES Act could abet another for-profit college boom, which could worsen the student loan crisis.

Here are the biggest for-profit college winners from the CARES Act:

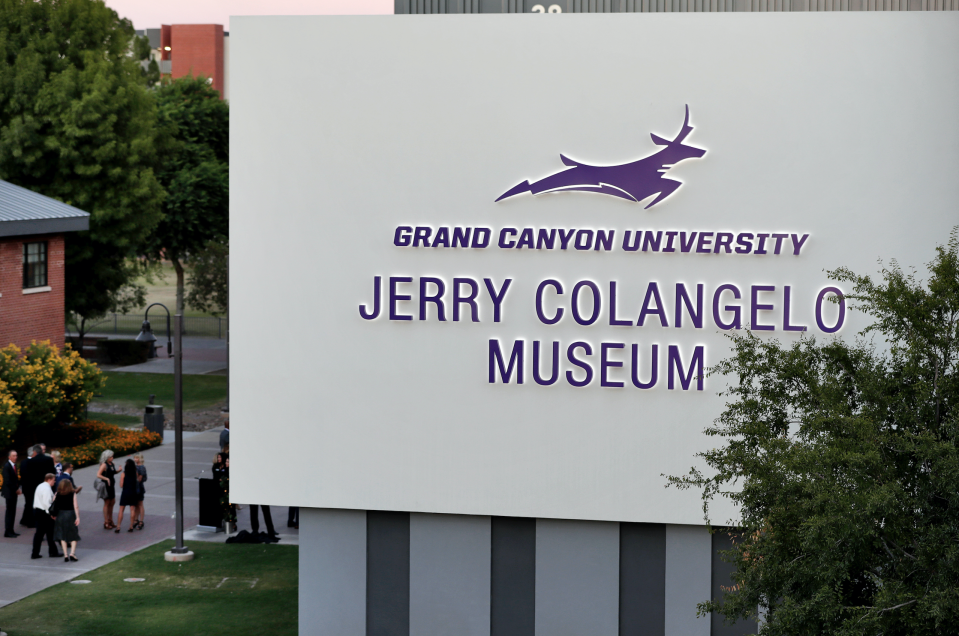

Grand Canyon University, $22.3 million

The Phoenix, Arizona-based university is one of the largest in the country, with over 105,000 students enrolled in online or campus-based programs, and the country’s first for-profit Christian school.

According to ED’s classification, the school is a for-profit institution.

The university’s spokesperson Bob Romantic told Yahoo Finance that the university “has the legal authority to operate as a nonprofit institution” and has been recognized by the state, and the state’s accreditor, and the Internal Revenue Service (IRS).

“It’s confusing and we are working with the Department of Ed to address their concerns and resolve the situation,” he added.

National University College, $21.4 million

The Puerto Rico-based college, part of the EduK Group, has around 10,200 students, according to ED’s College Scorecard, enrolled in part-time and full-time programs.

The EduK Group also owns several other for-profit colleges, such as Florida Technical College and the Instituto de Banca y Comercio.

In January 2018, after legal action was taken against Florida Technical College, the chain paid $600,000 for submitting false claims for federal financial aid on behalf of ineligible students.

“In providing such false documentation, FTC-Cutler Bay’s enrollment numbers were falsely increased, and consequently, the amount of federal dollars the school received also increased at the expense of taxpayers and students, who incurred long-term debt,” the Justice Department stated. “FTC cooperated in the investigation and FTC no longer employs the admissions personnel or their managers involved.”

Jeffrey Leeds, the founder of EduK’s parent company, Leeds Equity Partners, told MarketWatch in a recent interview that he wasn’t going to comment on the federal funds: “We haven’t thought about those issues because that ideological debate continues to rage and we don’t want to be a part of that.”

EduK did not to respond to request for comment.

Pima Medical Institute, $21.3 million

The institute has multiple locations across the U.S., from Arizona to Texas, and the federal dollars refer to how much the campuses in Arizona received. According to the College Scorecard, around 3,446 students are enrolled in its Arizona-based institutes.

The school was singled out recently in a trade publication for offering courses to give California nurses additional training on how to treat coronavirus patients.

Pima’s President and CEO Fred Freedman told Yahoo Finance that while the college has applied for the federal funds, they haven’t been transferred as of Friday morning.

The school asserted that “a minimum of 50%” would “go directly into the hands of students” based on financial need.

“Although most students have made the transition to distance education, this is an incredibly important benefit that the federal government has made available to students’ disrupted education,” Freedman stated.

He added that while the institute is not currently hiring any additional admissions reps, an increase in unemployment could lead to increased demand in health care and skilled training, and push them to re-evaluate that decision.

Florida Career College, $17.3 million

The Florida-based college with campuses across the country — from Florida to Houston, Texas — is part of the International Education Corporation, and has around 6,787 students, according to the College Scorecard.

Its parent company, which is based in Irvine, Calif., also owns UEI College (which received around $5 million), United Education Institute (which received around $15 million), and U.S. Colleges.

The school has announced that it will use the federal funds that it received to provide grants to students to help cover student living expenses, as per a press release.

The school was recently slapped with a class action lawsuit by Harvard’s Project on Predatory Student Lending and two private law firms.

Plaintiffs alleged that Florida Career College had used “high pressure sales tactics to enroll as many students as possible in order to profit from their federal student loans and grants without providing the experience or career opportunities it promises.”

The lawsuit also alleges that the school targeted African-American people through its advertising, which is “clear from its enrollment statistics.”

One of the plaintiffs, Kareem Britt, stated in a court filing that he enrolled at Florida Career College’s Lauderdale Lakes campus in 2018 for the HVAC program after seeing an ad on Facebook. Prior to enrollment, he was working two jobs as a cook and was not making enough to support himself and his family.

He stated that he clicked on the ad, which prompted him to call the school, and a recruiter set up an “interview” with him. The recruiter didn’t provide job placement rates but he decided to enroll, took on student loans (in total, $12,500), and completed the program in 2019.

Britt argued that the program didn’t have enough equipment for students to use and didn’t prepare him for the necessary HVAC or OSHA certification tests. He also alleged that while he completed the program, he fell behind on his student loan payments and the school refused to provide him his diploma. He also noted that “a majority of the students were Black or Latinx.”

Britt ended up back at square one, working as a cook in a hotel. He doesn’t work in the HVAC field.

International Education Corporation did not respond to a request for comment.

ECPI University, $16.8 million

The Virginia-based technical school with campuses in Virginia, North and South Carolina has more than 12,000 undergraduates enrolled in its institutes, according to the College Scorecard.

EPCI has an interesting backstory: Founder Alfred Dreyfus immigrated to New York City in 1947 from Germany amid the upheaval, and later started the university— the Electronic Computer Programming Institute — in Norfolk, Virginia, seeing a need for skilled technician training.

ECPI’s Vice President for Regulatory Affairs Jeff Arthur told the Chronicle of Higher Education that the school will give out seven-eighths of the federal dollars through a formula and set aside the rest as a pool of money that students can apply for.

ECPI did not respond to request for comment.

‘There's always a concern when you're talking about predatory practices’

The CARES Act placed some limitations for for-profit colleges .

Senators Elizabeth Warren (D-MA) and Sherrod Brown (D-OH), for instance, led the charge in demanding that if for-profit colleges were to get access to that pot of money, ED should prevent them from using that funding “for any purposes beyond those which directly support student instruction, emergency financial aid to students, and student support services central to schools’ educational missions.”

The department agreed, and the guidance issued on how to spend that money specifically stated that schools “shall not use funds for payment to contractors for the provision of pre-enrollment recruitment activities, which include marketing and advertising; endowments; or capital outlays associated with facilities related to athletics, sectarian instruction, or religious worship.”

Schools are also told to not use that money for expenditures such as paying executive or senior administrators’ salaries, benefits, bonuses, contracts, incentives, stock buybacks, shareholder dividends payouts, capital restrictions, stock options, “and any other cash or other benefit for a senior administrator or executive.”

However, the longer-term effects of these schools were something to be concerned about, experts warned, as many public higher education institutions are on the brink of closure. According to an estimate by the American Council on Education, the number of students on campus is expected to decline by 15%, amounting to a $23 billion revenue shortfall.

“There's always a concern when you're talking about predatory practices and bad outcomes and promising jobs that don't exist and promising salaries and all these things,” Wesley Whistle, senior adviser on higher education at D.C.-based think tank New America, told Yahoo Finance. “And if you're promising that to the most vulnerable students that's unacceptable.”

When the economy sours, college enrollments soar.

Student numbers will probably drop in the short term due to the pandemic. But in the medium term, enrollments are likely to reach a record high.https://t.co/q5if5oRtd1 pic.twitter.com/swj0XFIsAj— Preston Cooper (@PrestonCooper93) April 24, 2020

For-profit colleges have historically tried to recruit “students of color, and of course, veterans,” Whistle explained. “For-profits have long recruited veterans as a way to get around the 90/10 rule, to get around that accountability and use those federal dollars.”

The Obama administration had addressed some of these issues with graduation outcomes and offered help with students who were saddled with debt after their school collapsed. The ED under Devos overturned the 2014 borrower defense rule, which was designed to allow students of defunct for-profit colleges to claim debt relief. (Both the House and the GOP-controlled Senate voted to block the move.)

“It’s frustrating and it’s depressing,” Shireman said of the oversight reversal under the Trump administration.

—

Aarthi is a writer for Yahoo Finance covering consumer finance. She can be reached at [email protected]. Follow her on Twitter @aarthiswami.

Read more:

Trump's anger toward Harvard highlights dysfunction amid coronavirus response

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.