Forget Amazon: These Unstoppable Stocks Are Better Buys

If you've been investing long enough, you've almost certainly considered a stake in Amazon (NASDAQ: AMZN). It's one of Wall Street's favorite recommendations, after all. And to be fair, Amazon stock has been a solid performer and is still a respectable pick.

From a risk-reward perspective, however, Amazon isn't quite the opportunity it was in its early days. Its massive size makes it difficult to continue growing at a meaningful pace. E-commerce competitors are finally stepping up their games, too. And shares are arguably near their full potential valuation. It might be time to put other names ahead of Amazon on your watch list.

Here are three better options to think about buying now.

DraftKings

It's been a tough few months for shareholders of sports betting technology company DraftKings (NASDAQ: DKNG). Mostly in response to revenue shortfalls and a proposed surcharge on its customers' wagering, the stock is down more than 30% from March's high, and still within sight of the multiweek low hit earlier this month. Investors are simply responding to headlines.

But these worries obscure the fact that DraftKings is still growing in a big way, and continuing to make progress toward sustained profitability.

Take its second-quarter numbers as an example. While its top line of just over $1.1 billion fell slightly short of estimates of a little more than $1.11 billion, sales were still up 26% year over year. Adjusted per-share earnings of $0.22 not only topped expectations for a loss of $0.01, but nearly doubled the Q2 year-earlier comparison of $0.14. The second quarter's revenue and earnings also extended long-established trends that are expected to persist well into the future.

And these lofty expectations are hardly out of line. Although the federal ban on sports betting was lifted in 2018, states have staggered their legalization of it. As of the latest look only about two-thirds of U.S. states now permit sports betting in any form. But many of the others are at least considering passing legislation that would make it legal, opening the door to DraftKings' presence in that market. Market research outfit Technavio believes the worldwide sports betting market is set to grow at an annualized pace of 12% through 2030, largely led by the U.S.

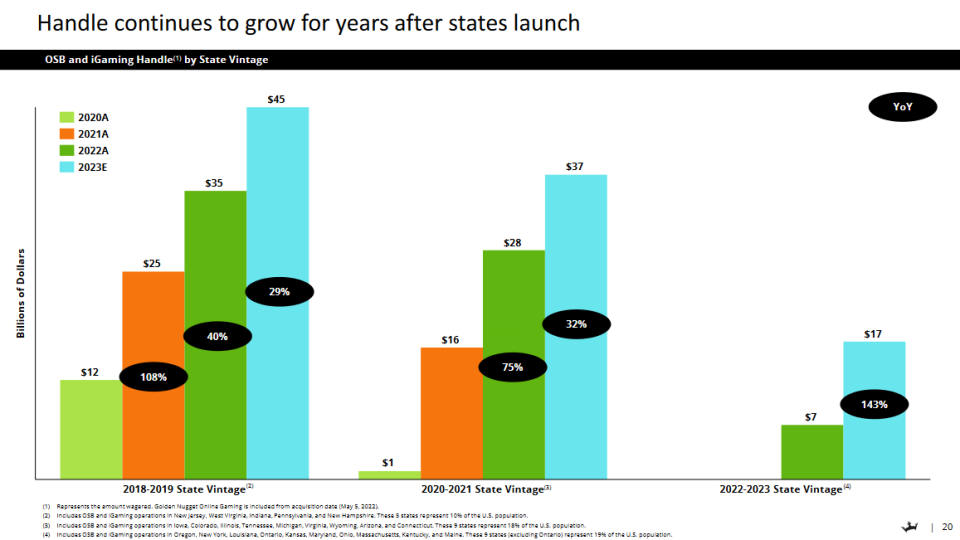

Fueling at least some of this expansion is the way the business grows. A paying customer base swells for a long time once DraftKings establishes its presence in a particular market, as people learn more about its offerings and finally respond to marketing efforts. As the graphic below shows, betting handles are still growing even in the fourth year DraftKings is operating in any given state. This ongoing progress is likely to show similar growth in the years beyond the fourth one, too, once DraftKings has that data to offer.

Translation: There's room and reason to expect continued growth here. So why isn't the stock reflecting any of this? Because sometimes stocks just temporarily stumble. For great companies like DraftKings though, these short-term stumbles are long-term buying opportunities.

Shopify

Much like DraftKings, Shopify (NYSE: SHOP) stock has been a tough name to stick with of late. Shares are down nearly 20% from their February peak despite a solid earnings-prompted bounce this month. Its recent profit guidance has been less than the market was hoping for. Also like DraftKings though, it's arguable that the market is only been looking for bad news from this name, ignoring the bigger bullish picture.

Shopify helps companies build and manage an e-commerce presence. Millions of small (and not-so-small) businesses rely on this company's tech to sell their goods and services. In many ways it could be considered the anti-Amazon in that it empowers a merchant with an option other than a massive online shopping mall that pits these sellers against one another.

Sure, the e-commerce market may be crowded and mature. That doesn't mean there's not lots of opportunity here, however. The Census Bureau reports that only about 16% of the United States' retail sales are done online. Although some of the other 84% can never be done online, a big chunk of that business is up for grabs to the e-commerce industry.

Mordor Intelligence believes the United States' e-commerce market is set to grow by an average of 14.7% per year through 2029. A similar dynamic applies overseas, where this company is starting to grow its presence.

And forecasts jibe with this industrywide outlook. Shopify's 2024 top line is expected to improve on last year's revenue by over 23%, with the next several years likely to mirror that pace. Earnings are apt to keep growing at an even faster clip.

Yes, the company has got a profit margin challenge right now that probably will persist for at least a few more quarters. It's not a fatal problem, though. There's simply too much in direct-to-consumer shopping to hold Shopify back.

Microsoft

Finally, add Microsoft (NASDAQ: MSFT) to your list of unstoppable stocks to buy instead of Amazon. You, of course, know the company. Microsoft has been at the heart of the personal computer business since its rapid proliferation in the '90s although it's become so much more in the meantime. Cloud computing, business services, artificial intelligence, and even video gaming are all in its wheelhouse now.

Diversification isn't the crux of the reason you might want to own a piece of this software giant, however. Rather, it's the way the business increasingly works.

Fewer and fewer people are outright buying software anymore. They're renting cloud-based versions of their productivity platforms like Word or Excel, translating into predictable and recurring high-margin revenue for the provider. The company's cloud computing offerings are available via a similar arrangement. This model allows Microsoft to focus on attracting new paying customers.

And it's doing this very, very well. Last quarter's revenue of $64.7 billion was up 16% year over year, extending long-standing growth trends that are expected to continue into the distant future. Ditto for earnings. The world's simply too dependent on this company -- and its popular Windows operating system in particular -- to truly consider alternative platforms.

This stock's persistent gains could be intimidating to would-be buyers. Don't sweat it so much that you end up unwilling to make a purchase though. The forward-looking price-to-earnings ratio of just over 31 is actually relatively cheap given a revenue growth pace that's persistently in the mid-teens. Analysts' current consensus price target of nearly $500 is also 19% above the stock's present price.

This might help: Of the 60 analysts following Microsoft stock, 49 of them rate it not just a buy, but a strong buy.

Should you invest $1,000 in DraftKings right now?

Before you buy stock in DraftKings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and DraftKings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $796,586!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Microsoft, and Shopify. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget Amazon: These Unstoppable Stocks Are Better Buys was originally published by The Motley Fool