Forget the Metaverse! 7 Real-World Tech Stocks Poised for Breakout.

The technology sector offers growth that few other sectors can match. Some of that growth is rooted in utilitarian, real-world innovation. Conversely, other niches within the tech sector grow due to the promise inherent to undeveloped, future technology. The metaverse is an excellent recent example of the latter. However, it remains very risky, and I believe that investors should focus on real-world tech stocks instead.

When I say real world, I mean firms currently selling utilitarian technology. That means the things we see and use regularly, not vague promises like those from the metaverse.

Fortunately, there are many options within the highly developed tech sector. The more real-world innovation these companies bring to market, the more valuable their stocks should become. Sure, investing in undeveloped future technology sometimes yields massive returns. That said, the utilitarian route is safer and still offers very strong returns.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Apple (AAPL)

Source: sylv1rob1 / Shutterstock.com

Apple (NASDAQ:AAPL) stock has returned even though iPhone sales remain problematic. By now, investors know the reason: Apple is rolling out its AI, which will be heavily applied to iPhones. The application of AI there, too, has reignited interest in the stock, sending it substantially higher over the past few months.

While Apple’s shares are currently fully priced, I think investors will continue to invest regardless. In 2024, the markets will continue to look for news to substantiate optimism, justified or not.

I believe the rollout of the application of generative AI is a justifiable reason to invest in Apple even now. Apple intends to ship 10% more iPhones in the second half of 2024. The company plans to ship 90 million iPhone 16 devices during the period. The application of AI features in those phones is anticipated to drive a 10% rise in sales above iPhone 15 devices. iPhone sales are the main driver of Apple’s success. They continue to fall, so a rebound, measured by actual numbers and not just hype, should send share prices higher.

Grab Holdings (GRAB)

Source: Twinsterphoto / Shutterstock.com

Grab Holdings (NASDAQ:GRAB) is a real-world tech stock that continues to be poised for a breakout. Several reasons, both internal and external, lead investors to continue to hold that belief.

Internally, investors must spend a few minutes reviewing the company’s financial statements. Those who do will see a company that continues growing rapidly on the top line while approaching net profitability.

The company continues rapidly improving its operating losses, leading management to adjust its guidance upward.

Externally, investors should note that the rideshare super app serves a Southeast Asia region that is growing rapidly. GDP in the region is expected to increase by 4.6% in 2024. The region is characterized by favorable demographics and massive opportunities due to shifting global supply chains. Those factors supercharge the potential of companies, including Grab Holdings.

Grab Holdings is an excellent example of how real-world technology can be applied to create utilitarian innovation and tangible results.

STMicroelectronics (STM)

Source: Michael Vi / Shutterstock.com

Depending upon where you look, STMicroelectronics (NYSE:STM) is expected to break out strongly or very strongly.

The consensus is that the European chip maker is expected to increase value by roughly 20%. However, others, including Morningstar, expect that STMicroelectronics has closer to 50% upside.

The push for safer, greener, smarter vehicles leads to increased electronic content across the automotive sector. STMicroelectronics is a notable competitor in the automotive sector. The company has significant opportunities in the microcontroller and silicon carbide based power product spaces.

Silicon carbide (SiC) has unique properties that are highly utilitarian in power products. SiC components can withstand voltages up to 10 times higher than traditional silicon components. They also conduct heat better than silicon components. The technical advantages go on and on, and if STMicroelectronics competes strongly in that arena, it will thrive.

The three most recent analyst actions related to STMicroelectronics include two upgrades and the reiteration of a buy rating.

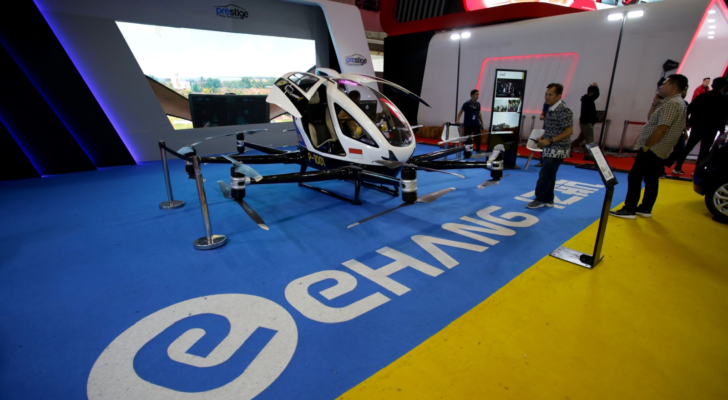

EHang Holdings (EH)

Source: Toto Santiko Budi / Shutterstock.com

EHang Holdings (NYSE:EH) is the world’s most advanced flying car company. The Chinese company commercialized electric vertical takeoff and landing (eVTOL) technology far ahead of its U.S. competitors.

EHang Holdings’ U.S. competitors continue to work through regulatory hurdles and are expected to commercialize sometime in 2025. Meanwhile, EHang Holdings has been delivering vehicles for some time. The company delivered 27 eVTOLs in late June to Wenchang County Transportation Group in Zhejiang Province. The vehicles are being used in tourism, and EHang Holdings is seeing success.

The company delivered 26 eVTOLs during the first quarter, substantially more than the 11 vehicles delivered a year prior. EHang Holdings’s more than year of vehicle delivery experience should give investors some idea of how it compares with U.S. flying car firms and stoke interest due to the real-world results the deliveries exemplify.

Revenues are booming at the company, while net losses continue to narrow. I believe EHang Holdings’s early lead over its U.S. competitors, combined with improving financials, poises the stock for a breakout.

Lam Research (LRCX)

Source: Michael Vi / Shutterstock

Lam Research (NASDAQ:LRCX) is a highly utilitarian tech stock that is poised for a breakout.

The company produces semiconductor fabrication equipment to produce the integrated circuits necessary for artificial intelligence. So, it’s a part of the AI opportunity. The company is also building facilities near its global customers’ research hubs.

While the company is preparing for the continued emergence of AI, its results are also attractive. Earnings increased by 11.4% in the first quarter on better-than-anticipated revenues. Sales have grown by more than 20% over the last three years, while earnings during the same period increased by more than 30%.

The company announced a share buyback roughly two months ago, which is indicative of the company’s commitment to shareholders.

Many investors looking for AI equipment producers will initially land on ASML (NASDAQ:ASML) as the best choice. Lam Research is not to be overlooked in that regard.

Crowdstrike (CRWD)

Source: T. Schneider / Shutterstock.com

Crowdstrike (NASDAQ:CRWD) is a major player in cybersecurity. Its core offerings focus on protecting computer systems from cyberattacks, with a particular emphasis on security solutions designed for the cloud environment, which offer scalability and flexibility. The advent of AI has upped the stakes in the cyber security world, positioning Crowdstrike stock for a breakout.

To be fair, Crowdstrike has already broken out in 2024 increasing in price by more than 47%. Even so, share prices remain slightly below consensus target prices.

Judging the tech sector is particularly difficult concerning AI. Software stocks, including Crowdstrike, recently saw a spike in demand as the markets rotated out of chip stocks and into software. It currently appears that FOMO surrounding chip stocks is suddenly high again.

It remains to be seen whether the two AI subsectors can rise together in the coming weeks. Regardless, Crowdstrike is undergoing substantial earnings growth in 2024. That alone is a strong reason to expect it to break out further.

Cisco Systems (CSCO)

Source: Anucha Cheechang / Shutterstock.com

Cisco Systems (NASDAQ:CSCO) stock represents a combination of stability and broad tech exposure that is highly utilitarian. The company sells networking hardware and includes a dividend that yields 3.5%.

Meanwhile, the company is shifting toward a greater percentage of software sales overall. Software sales are associated with repeat purchases, whereas hardware sales tend to be one-and-done. The result is a much more advantageous sales cycle. Beyond that, software sales are associated with greater margins than hardware sales.

Cisco Systems is positioned to capitalize on the LoRa and Lo RaWAN opportunities. That said, Cisco Systems stock is down by more than 7% in 2024. In my mind it’s poised for a breakout due to all of the factors I just mentioned. EPS is expected to grow by more than 23% this year at the company.

However, Cisco Systems also anticipates that the top line will contract by a few percentage points. I look at it this way: The company will continue to have the earnings to pay a healthy dividend based on EPS projections. So, buy Cisco Systems for that while also remaining optimistic as are many analysts who expect shares could rise as high as $76, well beyond their current price of $46.

On the date of publication, Alex Sirois did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

On the date of publication, the responsible editor held a LONG position in AAPL.

Alex Sirois is a freelance contributor to InvestorPlace whose personal stock investing style is focused on long-term, buy-and-hold, wealth-building stock picks. Having worked in several industries from e-commerce to translation to education and utilizing his MBA from George Washington University, he brings a diverse set of skills through which he filters his writing.

More From InvestorPlace

The post Forget the Metaverse! 7 Real-World Tech Stocks Poised for Breakout. appeared first on InvestorPlace.