Former CFTC chair says Ripple's cryptocurrency XRP is not a security—but Ripple is his client

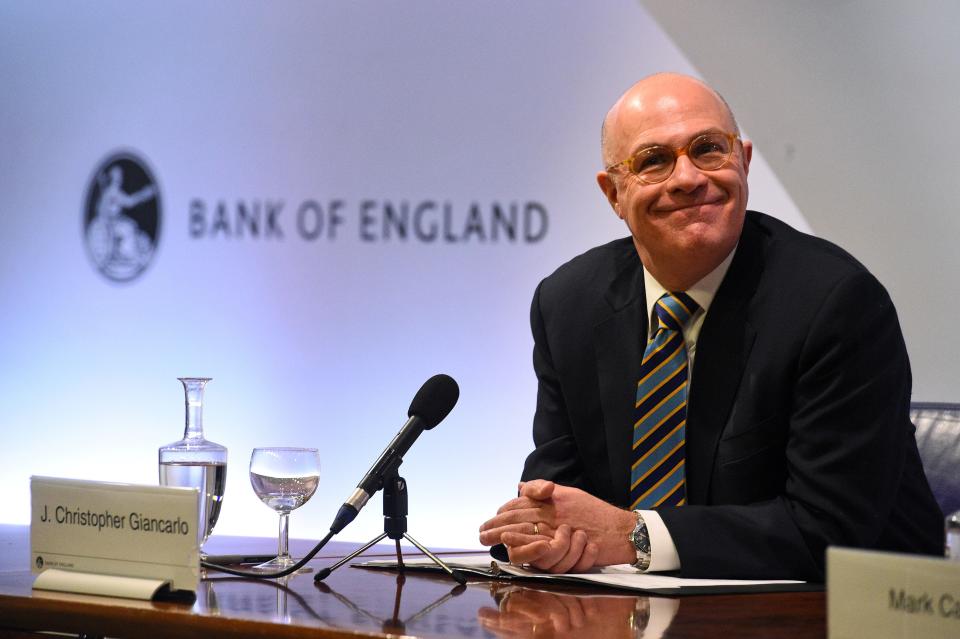

Christopher Giancarlo, the former chairman of the Commodity Futures Trading Commission, made waves last week when he co-authored a paper in the International Financial Law Review arguing that the cryptocurrency XRP does not qualify as a security, and thus “should not be regulated as a security, but instead considered a currency or a medium of exchange.”

If federal regulators agree, this would be a major win for holders of XRP, the No. 3 cryptocurrency by market cap. In the past two years, federal officials from both the SEC and the CFTC have declared that bitcoin (the original and largest cryptocurrency) and ether (the token of the Ethereum network) are not securities. That keeps them out of the jurisdiction of the SEC, which has cracked down hard on other cryptocurrencies formed through initial coin offerings (ICOs).

But Giancarlo’s conclusion comes with a heavy grain of salt.

Not only is Giancarlo no longer a regulator, and thus “not speaking in an official capacity,” as he acknowledged on Yahoo Finance Live last week, but he is now an attorney at the Washington, D.C. firm Willkie Farr & Gallagher, which he joined six months ago. Ripple Labs, the fintech company that developed and uses XRP in its software product for banks, is a client of the firm. A footnote to the law review paper discloses: “Willkie is counsel to Ripple on certain matters and relied on certain factual information provided by Ripple in the preparation of this article.”

The law review paper, Giancarlo tells Yahoo Finance, is “a legal piece, it’s not an advocacy piece, it’s not a policy piece. It’s a straight legal analysis.”

Some might counter that a legal paper with conclusions that benefit a company, written by attorneys for a firm that represents the company, relying on facts provided by the company, sure looks like an advocacy piece.

The logic that SEC and CFTC officials have used to classify whether a digital currency behaves like a security comes from the “Howey Test,” a 1946 case involving the selling of shares in a Florida citrus grove.

Under the Howey Test, digital tokens, like the shares in the citrus grove, are akin to securities when they are invested in by a third party with the expectation of profit, and marketed and promoted as an investment that will bring profit. Using the Howey Test, officials have made clear that they see most of the tokens created through ICOs as securities, but not bitcoin or ether.

SEC director of corporate finance William Hinman cited the Howey Test when he said at Yahoo Finance’s All Markets Summit: Crypto in June 2018 that the newly created tokens in ICOs are securities because they are marketed with “the promise that the assets will be cultivated in a way that will cause them to grow in value, to be sold later at a profit,” and “typically are sold to a wide audience rather than to persons who are likely to use them on the network.”

Hinman sees bitcoin and ether, on the other hand, as sufficiently decentralized, and not controlled by a “central third party whose efforts are a key determining factor in the enterprise.”

Therein lies the potential problem for Ripple Labs: the company developed XRP (originally called “ripples”) and owns nearly 50% of all existing XRP tokens. That does not sound very decentralized.

Ripple CEO Brad Garlinghouse, who would very much like for the SEC to clear XRP as not a security, makes the case this way: “If Ripple the company shut down tomorrow, the XRP ledger would continue to operate. It’s open-source, decentralized technology that exists independent of Ripple... I don’t think that our ownership of XRP gives us control… just because we own a lot of an asset.”

Giancarlo, in his new paper, echoes that argument: “Both the network (XRP Ledger) and the platform [Ripple’s liquidity product for banks that uses XRP] are currently fully functional and developed such that Ripple does not need to use the sale of XRP for further development,” and, “the tokens (XRP) are immediately useable at the time of acquisition.”

Of course, just because Giancarlo’s analysis benefits Ripple, his client, doesn’t mean it’s wrong. But what matters is what the SEC says—and it still hasn’t said what it thinks about XRP.

—

Daniel Roberts is an editor-at-large at Yahoo Finance and closely covers bitcoin and blockchain. Follow him on Twitter at @readDanwrite.

Read more:

Ripple CEO: 3 reasons XRP is not a security

What the third bitcoin halving means for crypto investors

Fed Chair Jay Powell grilled on China's cryptocurrency plans, US response

Facebook-led Libra Association has lost 8 'founding members'

Cryptocurrency CEO who paid $4.6M for lunch with Buffett: 'It might be unrealistic'

Exclusive: SEC quietly widens its crackdown on ICOs

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.