Former FDIC chair: Fed needs to hit pause on hikes

Yahoo Finance’s Brian Cheung contributed data to this article.

Since I was a child, I’ve always been a bit of a contrarian. Knowing this, my mother would routinely bend me to her will by asking me to do the opposite of what she wanted. If she wanted me to go outside to play, she would say it was too cold. When she wanted me to start taking piano lessons, she told me I wasn’t old enough to learn. She even got me to start mowing the grass by slyly commenting to my father that I wasn’t strong enough to push the mower.

I grew up thinking I was defiantly independent of my mother’s influence, when, of course, I was doing exactly what she wanted. Fortunately, my contrariness led me (unwittingly) to do the right thing. (Mom always knew best.) In contrast, I fear that Federal Reserve officials will do precisely the wrong thing at the next Federal Open Markets Committee (FOMC) meeting by raising rates to show their independence from the president, who is publicly bullying them against such a move. Instead, they should heed the market which is flashing warnings, and listen to a growing chorus of experts encouraging them to hit pause on interest rate hikes. Fortunately, recent comments by the Fed’s new vice chair, Rich Clarida, and its chair, Jay Powell, suggest they may just be independent enough of the president to rethink interest rate policy, despite his hectoring.

I say this as an interest rate hawk and long-time critic of the Fed’s zero interest rate policy (ZIRP). Intended to stimulate economic growth through the “wealth effect” of inflating financial assets, ZIRP certainly helped the upper echelons recover quickly from the 2008 crisis, but working families are only now getting back on their feet. In fact there is no persuasive empirical evidence that low interest rates stimulate broad-based economic growth — just ask Japan whose economy has remained in the doldrums notwithstanding decades of hyper-low interest rates. With the advent of the “Greenspan put,” in the late 1980s, we proved that we could protect investors from financial losses by lowering rates to inflate asset values. However, that technique did little to spur real wage gains and its corollary, sustainable economic growth. Instead we entered an endless cycle of credit-driven asset bubbles — first the tech bubble, then the housing bubble, and now the everything bubble.

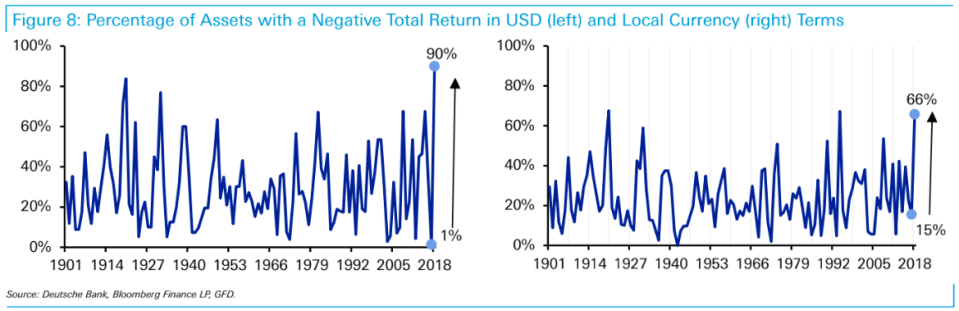

While lowering interest rates has a questionable impact on economic growth, raising them more often than not leads to recession. This is because interest rate hikes deflate assets and collateral held by financial institutions, causing distress in the financial sector which in turn causes disruptive credit contractions. With October’s volatility, we are now seeing downward trends in stock, bond and commodity prices, as well as slowing global growth and a flattening yield curve. All point to a potentially significant downturn in the months ahead. To be sure, there are headwinds outside the Fed’s control — Brexit, a looming trade war — but the biggest controllable risk to economic growth at present is the Fed raising rates too fast.

The Fed is worried about inflation. Conventional wisdom suggests this long period of loose monetary policy should have been inflationary. It has been — for asset prices — but for consumer prices, not so much. The Fed’s preferred measure of consumer prices, which excludes food and energy, has increased at an annualized rate of only 1.6% in the second half of this year, compared to a tame 2.3% annual rate over the preceding 12 months.

The Fed is worried that wage gains from a competitive labor market will fuel consumer demand and lead to more rapid consumer price increases. (Someday someone will explain to me why the Fed celebrates the wealth effect on consumer demand from a rising stock market but sounds the alarm bells when consumer demand is stimulated by real wage growth.) Yes, this long-in-the-tooth recovery has finally trickled down to the little guy, particularly the lowest paid workers. We should be celebrating — not hitting the brakes on further economic growth. In any event, median wage gains still lag their pace in previous recoveries and will continue to be constrained by technology and globalization, Mr. Trump’s America First trade initiatives notwithstanding.

The Fed is also worried about financial excesses and speculation typically caused by low interest rates. Fed officials say they want maneuvering room to lower rates during the next downturn. But with corporate, consumer, and government debt high by historic standards, the “financial excess” train left the station awhile back. In its financial stability report, while sanguine about the stability of the financial sector (unwisely in my view), the Fed acknowledged elevated valuations as a systemic vulnerability. The challenge is to manage monetary policy so that they adjust downward gradually. We want these bubbles to leak slowly, not pop. The corporate sector is particularly problematic, as the Fed report also noted. Indeed, non-financial corporate debt has exploded, with a record number of corporates rated just above investment grade. Even a mild downturn could take them into junk territory, sending bond prices tumbling with rising defaults as these over-leveraged companies struggle to refinance their debt with dramatically higher funding costs.

As for flexibility to respond to a downturn, it makes no sense to increase the risk of recession so that you have better tools to respond to one. Let’s try to avoid the recession to begin with. Moreover, if the Fed wants more tools to ease credit conditions in a downturn, it can and should use its supervisory tools. Many have argued, as have I, that the Fed should require large banks to raise their capital buffers now, in the good times, so that they have the flexibility to expand their balance sheets when the economy goes south. But while the Fed fiercely protects its independence on monetary policy, it seems all too willing to be influenced by the Trump Administration’s deregulatory agenda. It has proposed weakening stress test requirements, and substantially lowering capital requirements for the nation’s largest FDIC-insured banks. Last summer, it even approved shareholder payouts that exceeded big banks’ earnings, thus eroding instead of building the banks’ capital base.

Last week, the Fed’s new vice chair, Rich Clarida, had some sensible things to say about improving labor markets as a positive for the economy. Fed Chairman Jay Powell followed the next day by back-tracking on previous comments that interest rates were still a “long way” from the Fed’s desired neutral target. As testament to the outside influence of monetary policy on markets, they soared.

At long last, the benefits of economic recovery are being more broadly realized at all income levels. It would be a cruel irony to Main Street families to risk a recession now. As is so often the case, even when the president is right on policy, he undermines his own position by putting people’s backs against the wall. The best way for the Fed to prove its independence from the president is to leave rates where they are next month and reconsider those three increases it has pencilled in for next year. Let’s give the little guy more time to finally share in the fruits of economic growth.

Sheila Bair is the former Chair of the FDIC and has held senior appointments in both Republican and Democrat Administrations. She currently serves as a board member or advisor to a several companies and is a founding board member of the Volcker Alliance, a nonprofit established to rebuild trust in government.

Read more:

America has left the door wide open for bailouts

Vulnerability in America’s lower income brackets poses a risk to the economy

China thinks long-term on financial stability — so should we

Former FDIC chair: Why we shouldn’t ban bitcoin

Sheila Bair: Trump is going after the Bill of Rights

Former FDIC chair: The Fed needs to get serious about its own digital currency