Former Trump official: 'Markets would prefer a Joe Biden' over other Democrats

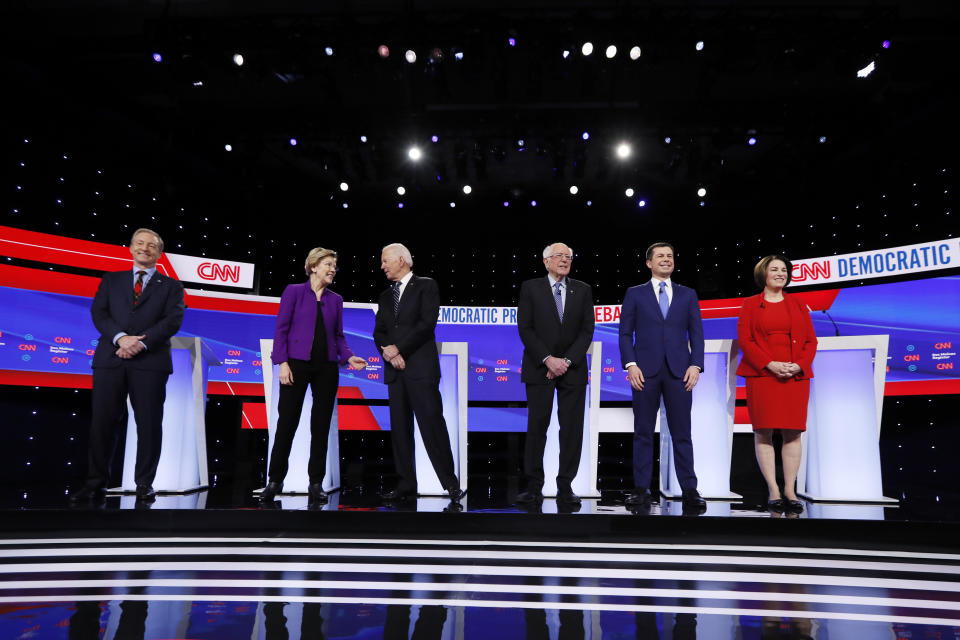

Democratic presidential candidates Bernie Sanders and Elizabeth Warren argue in favor of repealing some of the Trump-era tax breaks and raise taxes on wealthy Americans, but a former administration official said that investors prefer a “status quo” candidate like former Vice President Joe Biden.

Since Donald Trump was elected president, all three indexes, the Dow (DJI), the S&P 500 (GSPC) and NASDAQ (IXIC) have all set record highs. Those stock gains are a milestone Trump often boasts about on Twitter, but prominent Democrats have frequently argued that gains on Wall Street aren’t being felt on Main Street.

STOCK MARKET AT ALL-TIME HIGH! HOW ARE YOUR 401K’S DOING? 70%, 80%, 90% up? Only 50% up! What are you doing wrong?

— Donald J. Trump (@realDonaldTrump) January 9, 2020

As the Iowa Caucus vote looms, former Deputy Assistant Treasury Secretary Stephen Pavlick told Yahoo Finance’s On the Move that “markets would prefer a Joe Biden than an Elizabeth Warren or a Bernie Sanders in terms of the administration.” Pavlick was at Treasury in 2017, when the Trump administration successfully steered tax reform through Congress.

With the former VP narrowly leading the Democratic field, Pavlick said Biden offers a return to the Obama era investor consensus as someone “the markets are familiar with, comfortable with.”

He added: “Biden’s been a fixture in D.C. for a very long time. A lot of people know him, a lot of industries are familiar with where he is, and I think he would be less likely to disrupt the status quo.”

Let the good times roll

Recently, J.P. Morgan Asset Management sent a note to its clients warning about an overhaul of the U.S. economy if Sander’s or Warren’s policies are enacted.

Michael Cembalest, chairman of market and investment strategy wrote that “Warren’s tax increase proposals are roughly 2.5 times the level of [Franklin D. Roosevelt’s] tax increases that took place during the Great Depression, a time when U.S. unemployment reached 22%.”

Other market veterans have also warned that Warren’s policies would be a drag on asset prices. Pavlick echoed those sentiments, arguing that a change at the top could impact markets negatively.

“So we’ve had veteran strategists on our programming for weeks and weeks saying that we need to maintain the status quo in order for the markets to continue seeing these kinds of record highs,” Pavlick told Yahoo Finance.

Wealth inequality is an election issue

55% of Americans own stock, according to a recent Gallup poll — and that includes equities held in 401(k) plans and other retirement accounts. But that percentage is down from the 62% who said they owned stock prior to the financial collapse and subsequent recession.

Warren has seized on the concentration of wealth in fewer hands, and proposed a wealth tax on assets greater than $50 million in an effort to shift the balance.

We need structural change. That’s why I’m proposing something brand new – an annual tax on the wealth of the richest Americans. I’m calling it the “Ultra-Millionaire Tax" & it applies to that tippy top 0.1% – those with a net worth of over $50M.

— Elizabeth Warren (@ewarren) January 24, 2019

Although a new Reuters/Ipsos poll found 64% of Americans support the idea, Pavlick pointed out Democrats will have to win the Senate — not just the White House — to raise taxes or drastically change policy.

“We were able to pass tax reform when I was at Treasury through budget reconciliation which only requires 51 votes in the Senate,” he said. “I think a lot of the other policies they’ve been proposing would require 60 votes,” which at the moment is a scenario that’s considered unlikely for Democrats.

It’s why Pavlick thinks investors and analysts may be overreacting to some of the Democratic proposals for change.

Adam Shapiro is co-anchor of Yahoo Finance’s ‘On the Move.’

As shares fall below $1, it 'might be too late' for JC Penney to turn around

Delta CEO to Boeing: 'Don't lose sight of the future' following 737 Max problems

Why this investor believes Tesla will become a trillion dollar company

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.