Genscript Biotech Leads Trio Of Value Stocks On SEHK Estimated Below Market Valuations

As global markets navigate through mixed economic signals and varied regional performances, the Hong Kong market has shown resilience amidst broader Asian market challenges. This context sets a compelling stage for investors to consider undervalued stocks, such as Genscript Biotech, which may present opportunities in an environment where discerning value is key.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

Giant Biogene Holding (SEHK:2367) | HK$39.45 | HK$75.78 | 47.9% |

COSCO SHIPPING Energy Transportation (SEHK:1138) | HK$9.00 | HK$16.23 | 44.5% |

Bairong (SEHK:6608) | HK$8.74 | HK$15.59 | 43.9% |

West China Cement (SEHK:2233) | HK$1.08 | HK$2.16 | 49.9% |

Shanghai INT Medical Instruments (SEHK:1501) | HK$27.85 | HK$48.85 | 43% |

Mobvista (SEHK:1860) | HK$1.89 | HK$3.69 | 48.8% |

AK Medical Holdings (SEHK:1789) | HK$4.38 | HK$8.05 | 45.6% |

Q Technology (Group) (SEHK:1478) | HK$4.28 | HK$8.30 | 48.4% |

MicroPort Scientific (SEHK:853) | HK$5.08 | HK$9.55 | 46.8% |

Vobile Group (SEHK:3738) | HK$1.26 | HK$2.32 | 45.6% |

Let's dive into some prime choices out of the screener.

Genscript Biotech

Overview: Genscript Biotech Corporation is an investment holding company that manufactures and sells life science research products and services across the United States, Europe, China, Japan, other Asia Pacific regions, and globally, with a market capitalization of approximately HK$26.26 billion.

Operations: The company's revenue is generated from several segments, including Cell Therapy (HK$285.14 million), Operation Unit (HK$53.15 million), Biologics Development Services (HK$109.49 million), Life Science Services and Products (HK$412.91 million), and Industrial Synthetic Biology Products (HK$43.05 million).

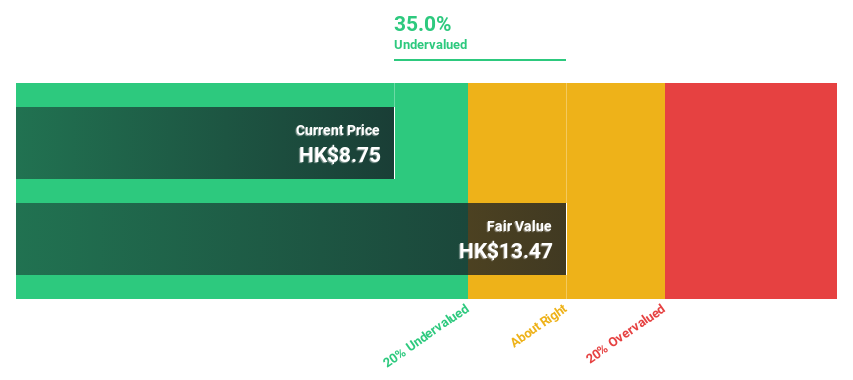

Estimated Discount To Fair Value: 26.9%

Genscript Biotech, trading at HK$12.34, significantly below its estimated fair value of HK$16.88, appears undervalued based on cash flows. Despite a highly volatile share price in recent months, the company's revenue is expected to grow by 37.2% annually, outpacing the Hong Kong market's 7.4%. While forecasted to become profitable within three years with an anticipated earnings growth of 97.94% per year, its Return on Equity is expected to remain low at 16.3%.

Bosideng International Holdings

Overview: Bosideng International Holdings Limited operates in the People's Republic of China, focusing on the design, manufacture, and sale of down and non-down apparel, with a market capitalization of approximately HK$41.50 billion.

Operations: Bosideng International Holdings generates revenue primarily from three segments: down apparels at CN¥19.54 billion, original equipment manufacturing (OEM) management at CN¥2.70 billion, and ladieswear apparels at CN¥0.82 billion.

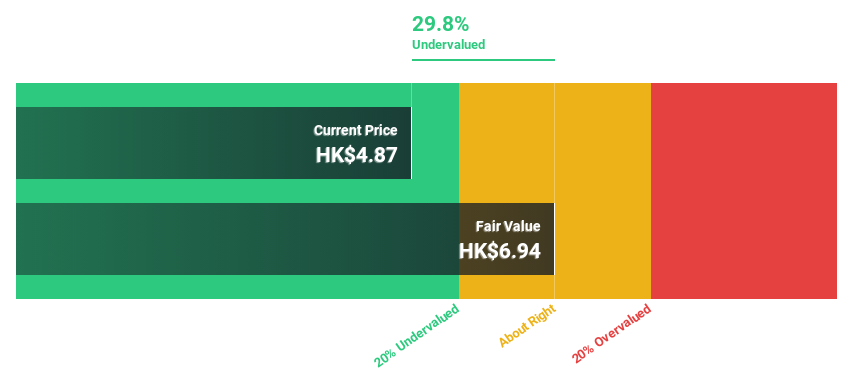

Estimated Discount To Fair Value: 36.5%

Bosideng International Holdings, priced at HK$3.78, is valued below its fair value of HK$5.95, suggesting undervaluation based on cash flows. Its revenue and earnings are growing at 11.2% and 12.8% per year respectively, surpassing the Hong Kong market averages. Despite a non-stable dividend history and significant insider selling recently, analysts predict a potential stock price increase of 47.5%. Recent financial results showed substantial growth with sales reaching CNY 23.21 billion and net income at CNY 3.07 billion.

FIT Hon Teng

Overview: FIT Hon Teng Limited operates in the manufacturing and sale of mobile and wireless devices and connectors across Taiwan and globally, with a market capitalization of approximately HK$18.63 billion.

Operations: The company's revenue is derived primarily from consumer products, generating $708.26 million, and intermediate products, contributing $3.63 billion.

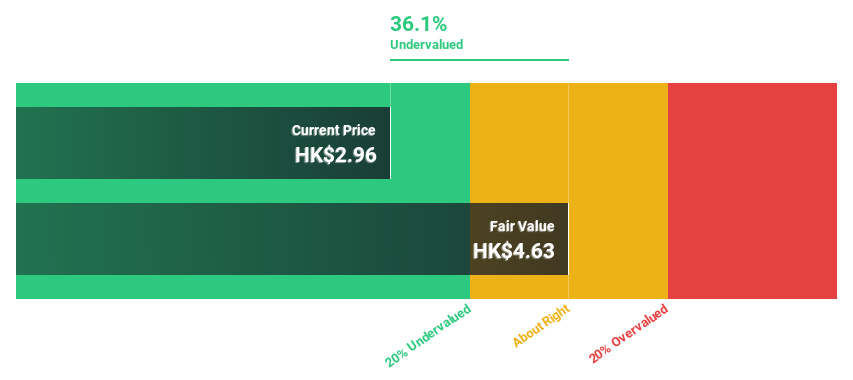

Estimated Discount To Fair Value: 40.1%

FIT Hon Teng Limited's recent financial guidance forecasts a net profit of US$28 million to US$33 million for the first half of 2024, marking a significant recovery from a net loss the previous year. This turnaround is credited to enhanced management and increasing demand in computing and networking markets. Despite trading at HK$2.63, below the estimated fair value of HK$4.39, indicating potential undervaluation based on cash flows, concerns include substantial insider selling and highly volatile share prices recently.

Where To Now?

Embark on your investment journey to our 36 Undervalued SEHK Stocks Based On Cash Flows selection here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1548 SEHK:3998 and SEHK:6088.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]