German Exchange Dividend Stocks With Yields Ranging From 3% To 6.5%

Amidst a backdrop of political stability and modest economic gains, the German market has shown resilience with the DAX index climbing by 1.32% recently. In such an environment, dividend stocks can be appealing for investors seeking steady income streams from their investments.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.23% | ★★★★★★ |

Südzucker (XTRA:SZU) | 6.87% | ★★★★★☆ |

OVB Holding (XTRA:O4B) | 4.66% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.28% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.94% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.20% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.76% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.24% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.23% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.12% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

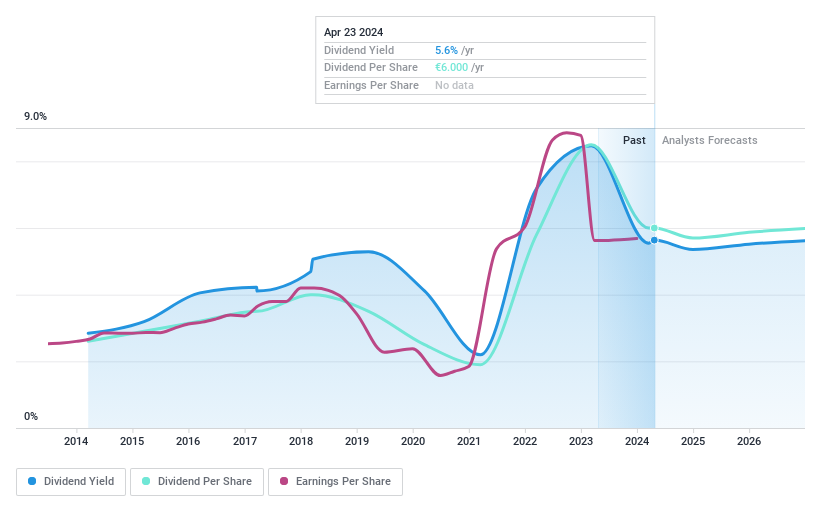

Bayerische Motoren Werke

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft (BMW) operates globally, focusing on the development, manufacture, and sale of automobiles and motorcycles, along with spare parts and accessories, with a market capitalization of approximately €57.21 billion.

Operations: Bayerische Motoren Werke Aktiengesellschaft (BMW) generates revenue primarily through its Automotive segment at €131.95 billion, Motorcycles at €3.15 billion, and Financial Services at €36.93 billion.

Dividend Yield: 6.6%

Bayerische Motoren Werke (BMW) offers a dividend yield of 6.59%, ranking in the top 25% of German dividend payers. Despite this, the sustainability of its dividends is questionable, with payments not well-covered by earnings or cash flows, indicated by a high cash payout ratio of 168.2%. Although BMW's dividends have increased over the past decade, they've also been volatile and unreliable. The stock trades at 17.8% below estimated fair value and analysts expect a potential price rise of 24.5%.

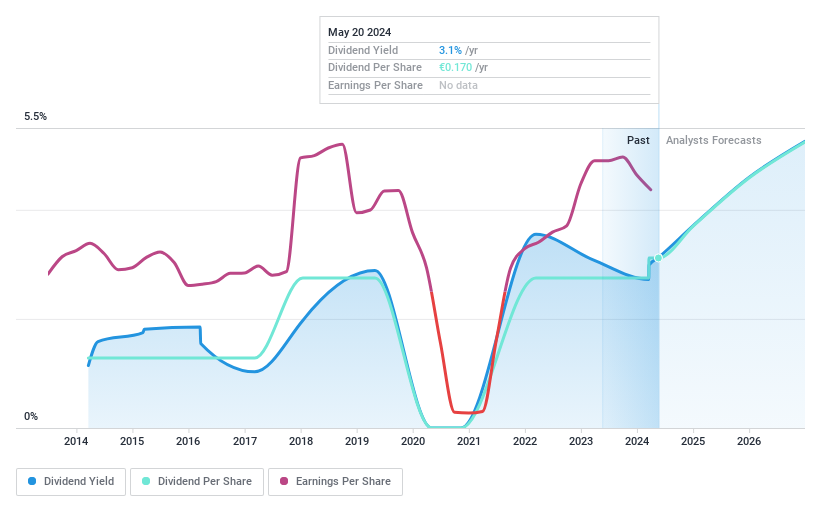

DEUTZ

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DEUTZ Aktiengesellschaft is a company that develops, manufactures, and sells diesel and gas engines across various regions including Europe, the Middle East, Africa, the Asia Pacific, and the Americas, with a market capitalization of approximately €0.77 billion.

Operations: DEUTZ Aktiengesellschaft generates €5.30 million from its Green segment and €2.01 billion from its Classic segment in revenues.

Dividend Yield: 3.1%

DEUTZ's recent strategic alliance with TAFE Motors aims to enhance its engine production capabilities in India, potentially bolstering its position in the APAC region. Despite a challenging Q1 2024, where sales dropped to €454.7 million and net income fell to €8.8 million, DEUTZ maintains a low payout ratio of 22.7%, indicating that dividends are well-covered by earnings and cash flows (38% cash payout ratio). However, DEUTZ's dividend yield stands at 3.08%, which is lower than the top quartile of German dividend stocks at 4.64%. Additionally, while dividends have increased over the past decade, their track record shows volatility and unreliability.

Get an in-depth perspective on DEUTZ's performance by reading our dividend report here.

Our valuation report here indicates DEUTZ may be undervalued.

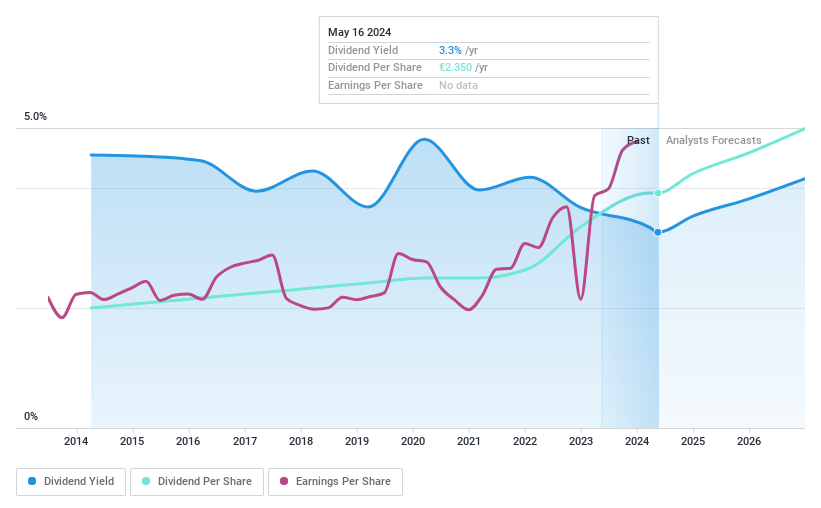

Talanx

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Talanx AG operates globally, offering a range of insurance and reinsurance products and services, with a market capitalization of approximately €18.46 billion.

Operations: Talanx AG delivers a diverse array of insurance and reinsurance solutions across the globe.

Dividend Yield: 3.3%

Talanx has demonstrated a stable dividend history over the past decade, with dividends consistently covered by earnings and cash flows, evidenced by a payout ratio of 34.7% and a cash payout ratio of 7.5%. Despite its reliable dividend yield of 3.28%, it is below the top quartile in the German market at 4.64%. The company's recent financial performance shows strength, with first-quarter net income rising to €572 million from €423 million year-over-year, supporting ongoing dividend sustainability.

Taking Advantage

Explore the 31 names from our Top German Dividend Stocks screener here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BMWXTRA:DEZ and XTRA:TLX

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]