Goldman Sachs cuts its forecast for S&P 500 earnings

Goldman Sachs analysts have cut their outlook for S&P 500 (^GSPC) earnings through 2018.

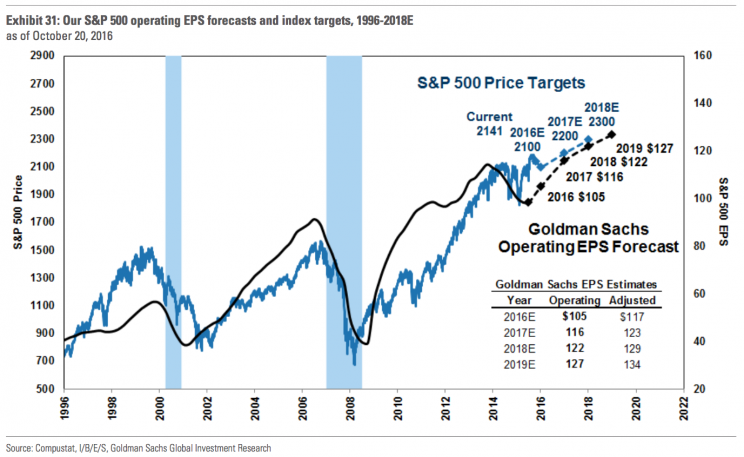

They now see earnings per share climbing 5% to $105 (from $110) in 2016, 10% to $116 in 2017 (from $123), and 5% to $122 (from $130) in 2018.

The analysts blame disappointing earnings growth from the financials and information technology sectors. Furthermore, they blame the impact of low interest rates on telecom sector pension liabilities.

This comes amid expectations for an ongoing earnings and revenue recession to end by year-end. Should Q3 earnings growth be negative for the S&P, it will have marked the sixth consecutive quarter of year-over-year earnings declines for the index.

It’s worth noting that Goldman’s outlook on the beleaguered energy sector is improving. From its client note: “A rebound in crude oil prices means that energy write-downs, which have plagued S&P 500 EPS for more than a year, should fade in the second half of 2016. Earnings for the energy sector will be less negative this year than in 2015.”

With this earnings backdrop, the analysts expect the S&P 500 to end the year at 2,100. By the end of 2017 and 2018, they expect the index to reach 2,200 and 2,300, respectively.

This is not surprising

The analysts’ language for next year was a bit more unsettling.

“Key issues for investors in 2017: (1) secular stagnation and (2) peaking margins,” Goldman Sachs’ David Kostin said on Monday.

“Our economists forecast that real GDP growth in the US will persist at a roughly 2% annual pace through 2019,” he said of the secular stagnation issue. “Increased infrastructure spending represents a source of potential upside to our estimate. However, the benefit from increased government spending is unlikely to kick in until 2018, when new budget deals would go into effect.”

Meanwhile, profit margins are expected to be pressured by limited pricing power, rising labor costs, and falling margins in the IT sector.

For months, experts have warned that cuts to profit forecasts were likely as fundamentals have been persistently unfavorable. Since July, Wall Street’s top strategists began to grumble about what appeared to be overly optimistic oulooks for S&P 500 earnings. And in recent weeks, a growing chorus of strategists have warned that the expectation for 12%-13% earnings growth in 2017 is somewhere between “irrationally exuberant” and “grossly enthusiastic.”

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Why a tax holiday for the $2.4 trillion held overseas would flop

The most controversial use of corporate cash could hit $1 trillion this year

A growing chorus of strategists are sounding the same warning about 2017

The next selloff could be triggered by something we’re not discussing right now