Goldman Sachs: S&P 500 could fall to 2,000 as corporate losses mount

Like U.S. GDP growth, corporate earnings face a total collapse as the coronavirus pandemic forces business activity to grind to a halt.

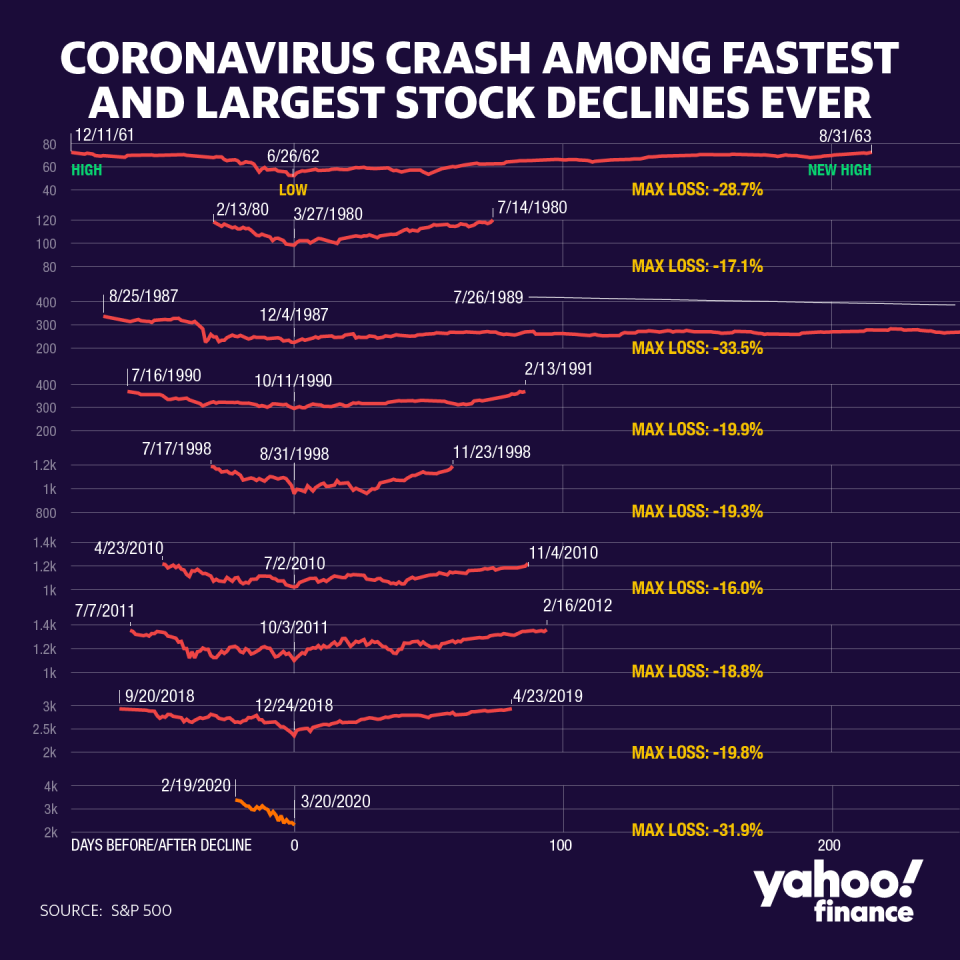

The sudden shutdown of much of the world’s largest economy has sent stocks diving from all-time highs into a bear market at a record pace. Wall Street now thinks a deep recession is a foregone conclusion, and Goldman Sachs expects Corporate America to pay a heavy price as earnings per share (EPS) get hammered.

“We now forecast S&P 500 (^GSPC) EPS of $110 in 2020, a decline of 33% from 2019,” Goldman Sachs equity strategist David Kostin wrote in a note to clients on Friday.

This puts Goldman on the bearish end of the analyst spectrum. According to a recent Factset survey, the average forecaster is looking for about $170 in EPS for the S&P 500.

“On a quarterly basis, this reflects year/year growth of -15%, -123%, -21% and +27%,” Kostin said about the first, second, third and fourth quarters, respectively.

“We have cut our 2020 earnings forecast three times in 30 days (-37% in total) as the magnitude of the economic slowdown has become increasingly apparent,” Kostin added — a reflection of how analysts have barely been able to keep up with COVID-19’s impact on the real economy.

On Friday, Goldman’s U.S. economics team wrote that it expects GDP to fall at a 24% rate in Q2. Kostin estimates when Q2 earnings are all tallied up, S&P 500 companies in aggregate will have reported a $10 net loss per share.

[See Also: What is a recession? Here are the basics]

The expected sudden drop in revenue is translating into crushed profits, as corporations have had very little time to adjust their operations and finances to address what’s happening.

“At the sector level, we expect large declines in energy, consumer discretionary (e.g., cruises, hotels, restaurants), and industrials (e.g., airlines),” Kostin added. “On the other hand, stockpiling may partially insulate consumer staples EPS.”

Another 13% drop in stock prices

The S&P 500 closed at 2,304 on Friday, down 32% from its Feb. 19 high of 3,393.

Kostin thinks the market goes lower before coming back.

“In the near-term, we expect the S&P 500 will fall towards a low of 2000,” he wrote.

“The stock market is a leading indicator of business trends, and corporate activity continues to deteriorate with no signs yet of a bottom,” Kostin added. “The first quarter has not even ended and companies have yet to release 1Q results but equities have already collapsed by 32% in one month. The speed of business erosion is unprecedented.”

A handful of companies have already explicitly warned Q1 financial results would disappoint. What’s arguably worse is that many companies are opting to withdraw or suspend earnings guidance, reflecting the unprecedented uncertainty that persists amid the coronavirus outbreak.

“The question for managers is do they know about future performance substantially more than investors do? My guess is that in most cases managers aren’t now better informed than investors,” said Baruch Lev, the Philip Bardes professor of accounting and finance at NYU’s Stern School of Business.

“We are all in the dark,” Lev said to Yahoo Finance. “In that case, guidance is futile.”

In terms of volatility, investors should prepare for companies to preempt their official earnings announcements — which will mostly come out from mid-April through mid-May — with ugly previews via pre-announcement press releases.

“Understandably, many firms have withdrawn previously issued guidance,” Kostin said. “More will pre-announce in coming days.”

In other words, brace for more volatility.

—

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @SamRo

Read more:

'We are all in the dark': Wall Street's smartest are making guesstimates

Why Warren Buffett’s 2008 message to investors was perfectly timed

Why a big market rally right now is no reason to get excited

Something dangerous is happening beneath the surface of the selloff

The incredibly bullish force investors can’t afford to ignore

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay