Google beats Q3 expectations, advertising and cloud revenue soar

Google parent Alphabet (GOOG, GOOGL) reported its Q3 2020 earnings after the closing bell on Thursday, beating analysts’ expectations and providing a better look at the effect of the coronavirus pandemic on digital advertising.

Importantly, the report follows the Justice Department’s long-awaited antitrust lawsuit alleging Google engages in anticompetitive behavior to maintain its dominance of the search and search advertising industries.

Here are the most important numbers from the quarter compared to what analysts were expecting from the company, as compiled by Bloomberg.

Revenue ex-TAC: $38.01 billion versus $35.35 billion expected

Earnings per share: $16.40 versus $11.42 expected

The company’s stock was up 4% immediately following the announcement.

“Total revenues of $46.2 billion in the third quarter reflect broad based growth led by an increase in advertiser spend in Search and YouTube as well as continued strength in Google Cloud and Play,” Ruth Porat, Alphabet’s chief financial officer, said in a release.

Google’s Cloud Platform brought in $3.44 billion in the quarter compared to $2.38 billion in the same quarter last year. The company is jockeying for position in the cloud wars behind Amazon, the market leader, and Microsoft, which is in second place. YouTube, meanwhile, saw revenue of $5.04 billion compared to $3.80 billion in Q3 2019.

Other tech giants also reported earnings on Thursday, including Amazon, Apple, and Facebook.

An antitrust battle that could last years

The larger narrative for Google, though, has to do with what is expected to be its years-long antitrust lawsuit. So far, investors have been unfazed by the Oct. 20 announcement. That’s likely because, according to legal experts, Google won’t be forced to split up. Instead, there’s a good chance the firm will reach a settlement with the DOJ requiring it to alter its business practices.

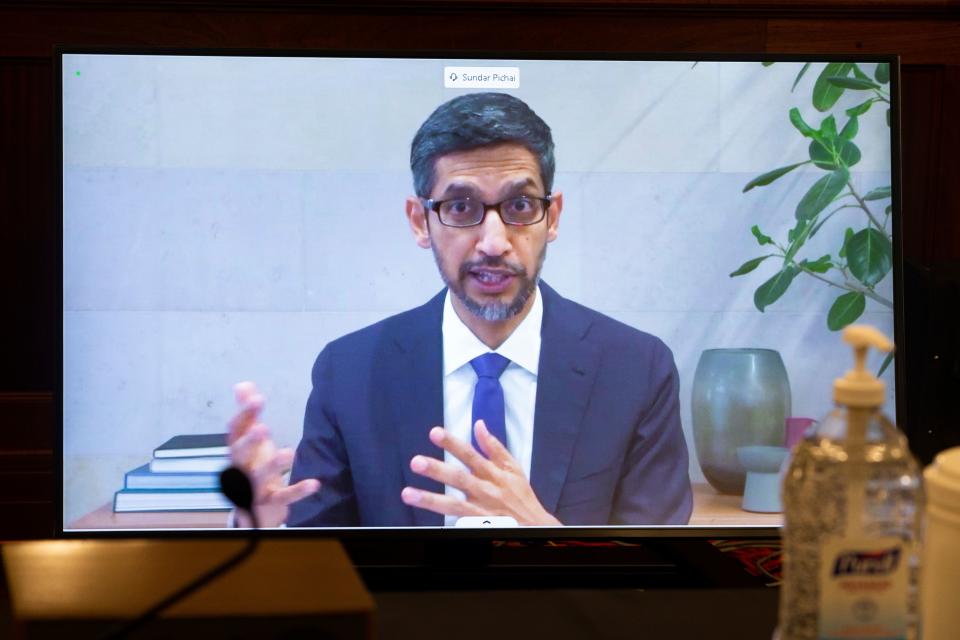

In response to the suit, CEO Sundar Pichai said the company believes “that our products are creating significant consumer benefits and will confidently make our case.”

He added that the company will continue to focus on building out a search product “that people love and value.”

Interestingly, the suit helped bring to light Google’s revenue sharing agreement with Apple (AAPL) that ensures Apple uses Google’s search engine as the default for its Siri, Spotlight, and Safari web searches. The deal nets Apple somewhere between $8 billion and $12 billion a year, according to the lawsuit. The suit also alleges that nearly 50% of Google’s search traffic came from Apple devices in 2019.

But Apple, according to The Financial Times, appears to be working on its own kind of search engine, which could spell trouble for Google’s future.

Then there are the continued conversations surrounding changes to Section 230 of the Communications Decency Act. Both Republican and Democratic lawmakers are hoping to alter the law, which shields websites from liability for “good faith” moderation of user-generated content and serves as a foundational element of the modern internet.

How Google responds to its various outstanding issues will be just as important as its quarterly performance going forward.

Got a tip? Email Daniel Howley at [email protected] over via encrypted mail at [email protected], and follow him on Twitter at @DanielHowley.

Read more Tech Support stories here.

More from Dan:

Bill Gates calls COVID-19 vaccine conspiracy theories “wild” and “unexpected”

Facebook, Twitter, and Google need to answer for disinformation — not a fake anti-conservative bias

What is section 230, the controversial internet law Trump wants to dismantle

Microsoft Q1 2021 earnings beat expectations on cloud strength

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.