Poor, minorities shoulder more of the burden of government shutdown

The partial government shutdown has now dragged on for more than a month, impacting 800,000 federal workers, scores of government contractors, and companies that have contracts with the government or have a large federal employee clientele list.

Civilians also feel the strain. Some have faced long lines in airports, while others can’t get business or home loans approved.

But the shutdown is disproportionately impacting minorities and those who are living in poverty.

As the shutdown passed the one month mark, those relying on government assistance for housing, food, and health care have started to worry. Roughly 40 million Americans rely on food stamps — officially called the Supplemental Nutrition Assistance Program. Funding for the program lapsed at the end of December, but certain provisions allowed the Department of Agriculture to make payments for an additional month. To give recipients benefits for February, states rushed to disburse funds by Jan. 20. But if the shutdown continues through February, it’s unclear what recipients will do.

“We're literally watching as our federal government starts to starve its people,” said New York City Mayor Bill de Blasio last week.

SNAP funding

According to the New York City Mayor’s office, the city receives hundreds of millions of dollars each month from the federal government for SNAP, Temporary Assistance for Needy Families (TANF), Women, Infant & Children supplemental assistance (WIC), Section 8 housing benefits, and more. In New York alone, nearly 2 million people rely on these social welfare programs.

“Federal money pays for school breakfast and lunches for our kids. That will be gone. It pays for rent support to keep low-income people in their homes. That will be gone,” said de Blasio. “Our public housing will immediately be hurt if federal support is suspended. What I also need to emphasize to everyone is, it gets worse each month.”

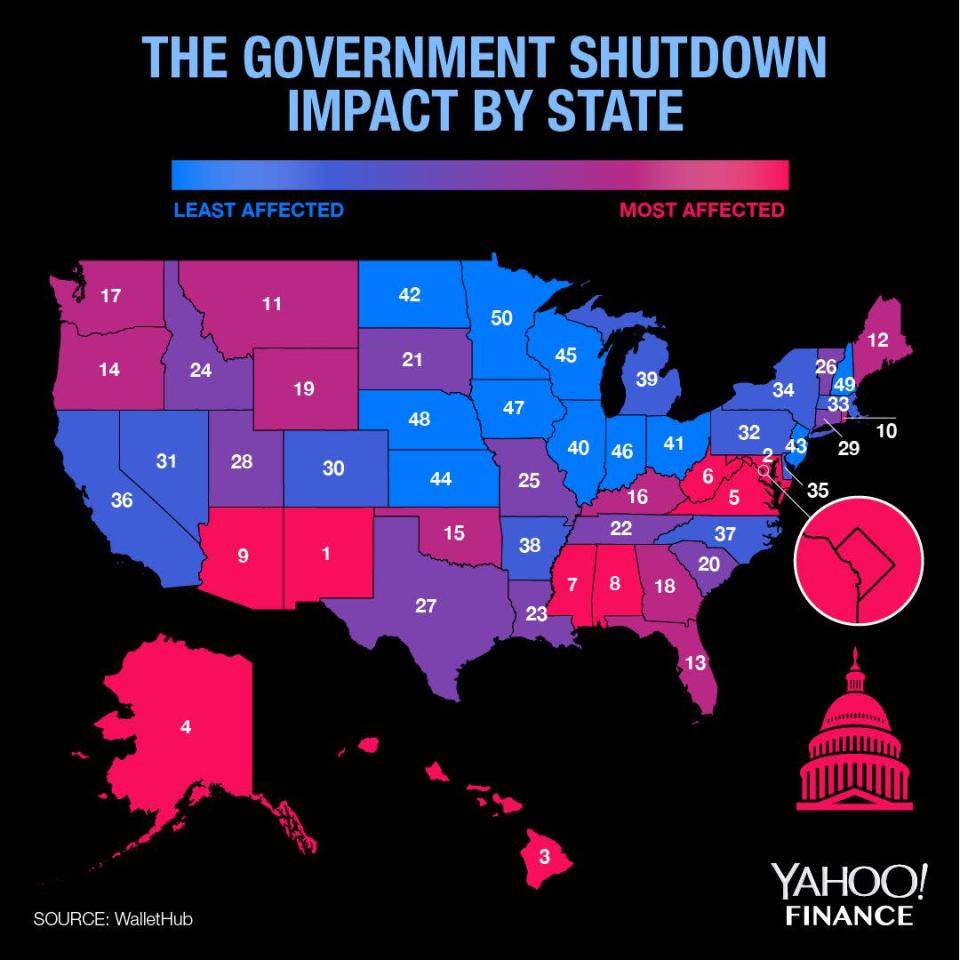

Other states and cities are worried too. Washington, D.C., New Mexico, Maryland, and Hawaii are the hardest hit by the shutdown, because they have the most federal workers impacted as well as households relying on SNAP, TANF, and WIC benefits.

Rejane Frederick, associate director of the Poverty to Prosperity Program at the left-leaning Center for American Progress, is also concerned about the long-term effects the shutdown will have on those living in poverty.

She points out that SNAP benefits — which disburses an average of $252 per household a month – often aren’t enough.

“SNAP, at its current benefit levels, struggles to cover increased cost of living,” she said. “Those turning to SNAP are already dealing with food insecurity. So they’re weathering the storm already, so this is insult to injury.”

Housing subsidies also on the line

Like the Department of Agriculture, the Department of Housing and Urban Development (HUD) is impacted by the shutdown. HUD funds for Section 8 and public housing will run out at the end of March, according to a spokesman for the Mayor’s office when asked about funding to the NYC Housing Authority (NYCHA). According to the city, approximately 400,000 NYCHA residents will feel the effects of the government shutdown.

Elsewhere in the country, HUD payments started to end starting Jan. 1, hurting low-income renters who rely on HUD funds to pay landlords. HUD was also unable to renew rental contracts with landlords that ended in December, putting many tenants and landlords in limbo until the shutdown ends.

According to the progressive think tank Center on Budget and Policy Priorities, housing contracts that end in February will impact another 16,000 households. It the shutdown drags through March, funding for the government’s largest rental assistance program (Housing Choice Vouchers) will end, putting roughly 2.2 million households at risk.

Without vouchers and benefits from HUD, low-income households could face eviction as they struggle to make up the difference as HUD payments cease. In Maryland and Arkansas, some residents of low-income housing received notices telling them they would still be responsible for rent, despite the shutdown.

Minorities affected

Among federal workers, minorities are hit particularly hard, says Frederick.

According to federal diversity statistics, minorities comprise over 36% of all federal employees. Agencies like the TSA have high rates of minority employees; and they are also some of the lowest-paid government employees.

“It used to be federal employment was assured,” Frederick said. “Most government jobs have good benefits and pay, which form the foundation for a middle-class income. That’s especially true for African-Americans.”

While African-Americans comprise more than 18% of the federal workforce, they only represent 11% of the civilian workforce, and 13% of the American population. Historically, government employment served as a route to the middle class for African-Americans.

“Historically, for black Americans, government employment provided a measure of protection from rampant discrimination in the private sector,” Frederick said. “The same is true for those with disabilities. And that’s still true today.”

The shutdown has effectively “shattered security,” she said.

Kristin Myers is a reporter at Yahoo Finance. Follow her on Twitter.

Read more:

Federal workers detail their worries as shutdown drags on

Government shutdown to potentially cost millions