Grubhub falls 40% in its worst trading day, eliciting a laugh on its earnings call

When you suffer your worst trading day in company history you either laugh or cry.

For executives and at least one analyst forgetting he wasn’t muted on Grubhub’s (GRUB) latest earnings call, the answer was the former after shares in the food delivery company tanked more than 40% on the heels of mixed third-quarter results and disappointing forward guidance.

Revenue guidance for the current quarter was just $315 million to $335 million, compared to the lowest estimate of analysts polled by Bloomberg at $368 million. In a letter to shareholders ahead of the earnings call, CEO Matt Maloney and CFO Adam DeWitt noted that the company would be boosting efforts to add non-partnered restaurants to the Grubhub platform.

At the end of the call, Maloney responded to an analyst’s question on reasons as to why restaurants might want to be up-sold to pay to partner with Grubhub rather than selling through the platform as a non-partner.

“Why would a restaurant choose to partner when they have a non-partner option? It’s because the diner experience sucks,” Maloney said, immediately eliciting laughter from a non-muted analyst. “The volume is going to be way lower, the food’s not going to be as accurate … there’s no way to fix the issues, it’s less accurate delivery times, they’re not going to have promotion on our platform.”

Maloney provided an example illuminating that by explaining that a Grubhub diner looking to order a cheeseburger would be directed to a paying partner restaurant instead of a non-partner restaurant.

“We're going to do whatever we can to route demand to partnered restaurants where the economics are not so miserable and the experience is way better,” he said.

But Maloney conceded the need to add non-partnered restaurants to its platform to offer choice to customers in an increasingly competitive environment, as Grubhub sees an increasingly large number of “promiscuous” diners that are less loyal to just one food delivery platform. The company said that trend led to a 300 basis point impact to third-quarter growth, though it would be investing in loyalty programs in an effort to offset the drain.

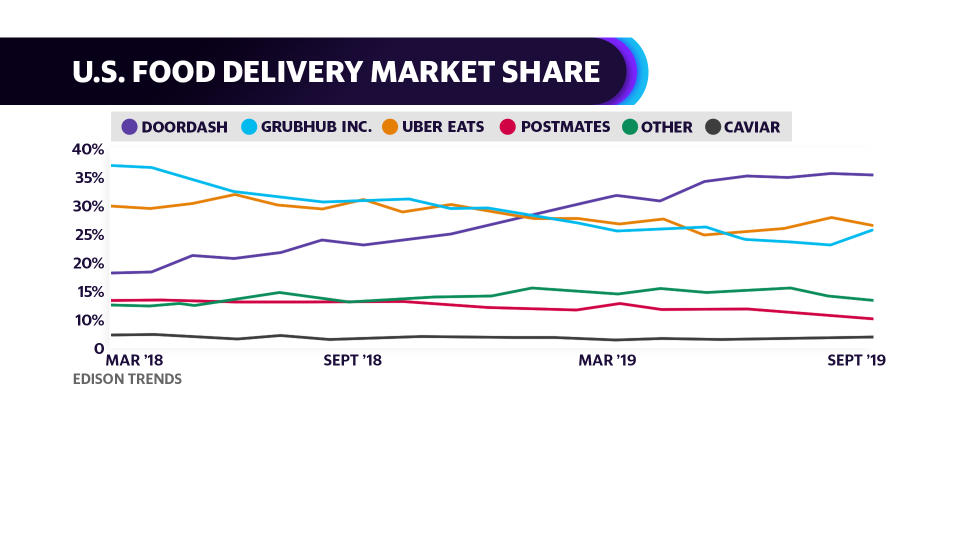

Third-party analytics platform Edison Trends has been documenting that trend for a while, with delivery competitor DoorDash accelerating its marketshare lead this year. As of October, the firm’s data shows DoorDash growing its share of the delivery market from 28% in February to about 35% while Grubhub has retreated from 27% to 23% over the same time period.

Wall Street was largely skeptical that Grubhub’s plan might stop the bleeding, with analysts at Oppenheimer and Bank of America Merrill Lynch delivering rare double-downgrades on the stock to Underperform, the same day the stock closed lower by 43%.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more

Why tipping is such a contentious issue in America

Andrew Yang's 257% fundraising surge blows away all other Democratic candidates

Nearly 60% of Americans never tip their Uber driver: study

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.