Gundlach: Debt-financed share buybacks have turned the stock market into a high-risk 'CDO residual'

Bond king Jeffrey Gundlach, the founder of DoubleLine Capital, which oversees $121 billion in assets, warned that the corporate bond market has a "real potential for negative surprises."

"The corporate bond market has all kinds of problems. I think investors should use the strength of junk bonds that's happened as a gift and get out of them," Gundlach said on his "Just Markets" webcast on Tuesday.

Investment grade is often viewed as a sleepy part of the market, with many investors thinking of it as a stable place to tuck away money. Gundlach made a case for why that's not true in this environment.

Over the last ten years, with low borrowing costs, companies borrowed more. As a result, the investment grade market has exploded in size.

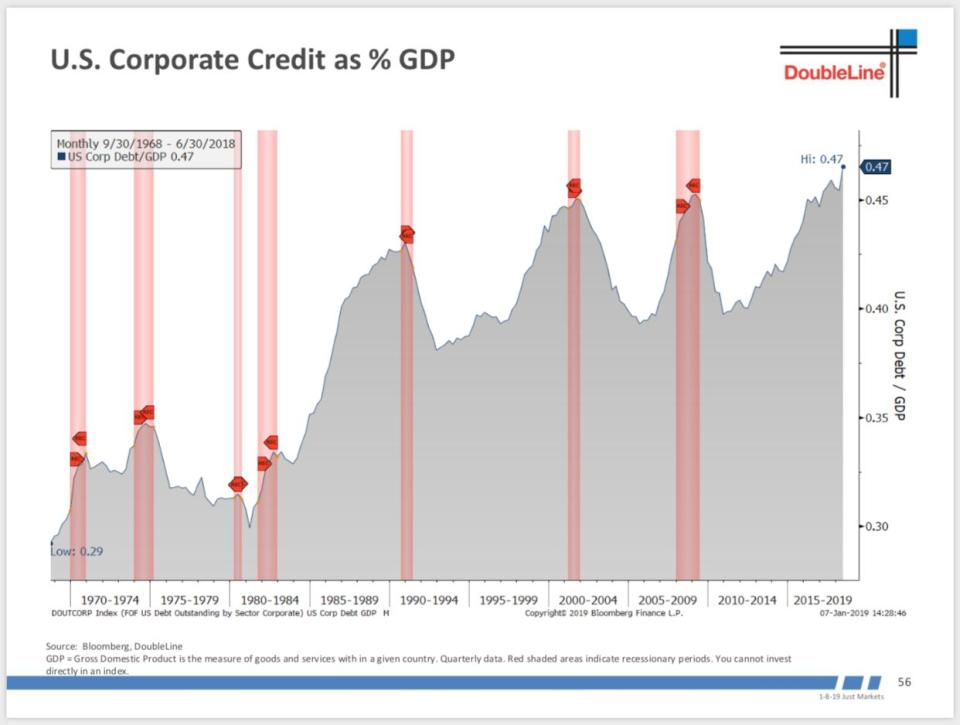

Corporate credit, as a percentage of GDP, has never been higher, Gundlach pointed out. He added that the scale is not all that huge, but it's still at "a really high level."

"So, the leverage in the corporate economy is very bad," Gundlach said, "There's been a lot of buybacks — borrow money at low rates, buy back stocks — which of course, it's just turning the equity market into a CDO residual, an equity piece, that's getting thinner and thinner, riskier and riskier.“

In the fixed-income markets, debt securities are sometimes bundled into collateralized debt obligations, or CDOs. In a process called tranching, the CDO is then sliced up into pieces with various levels of credit risk and those pieces are in turn sold to debt investors. The riskiest piece is referred to the Z tranche or residual tranche.

“So, the balance sheets of corporations are balanced on ever-dwindling equities as they buy back shares and increase their leverage ratios. And that's not good."

Pick strong balance sheets over strong earnings

While a lot of investors tend to focus on earnings, they need to be focusing on balance sheets.

"I think investors need to go to strong balance sheets," he said, adding, "Strong balance sheets are going to be the way to survive during the zigzag of 2019."

Gundlach noted that there's also a lot of maturities coming in corporate bonds. In other words, the principal amount of the bond comes due.

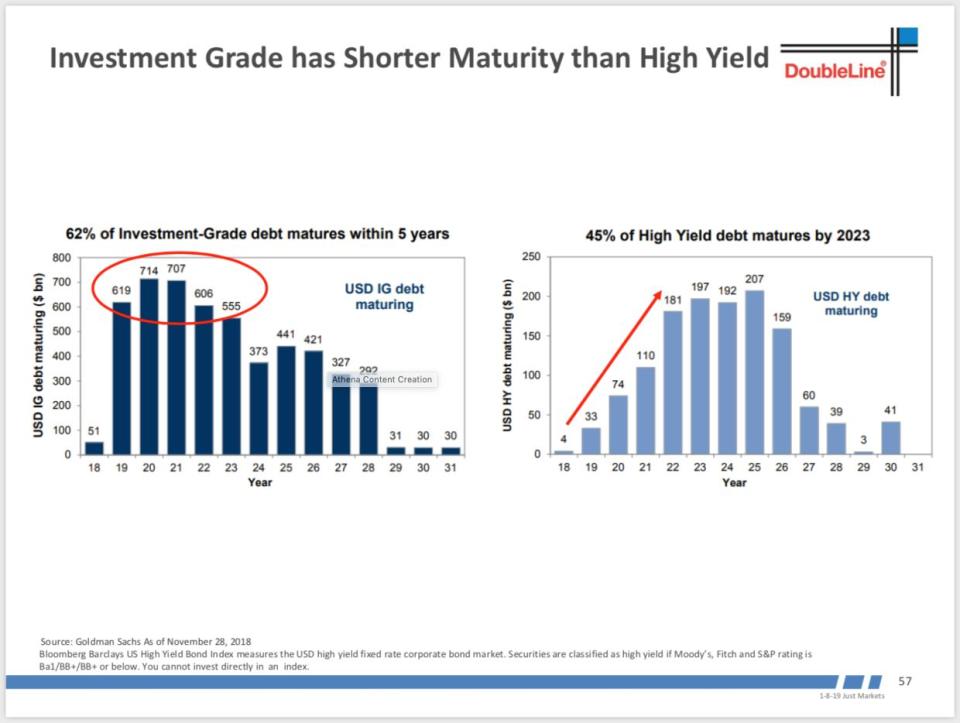

In 2018, only $51 billion in investment-grade debt and just $4 billion in high yield matured, one of Gundlach's slides showed.

"Corporate bonds did lousy even though there was really hardly any maturity supply to roll off. Sure, companies could borrow more money, but that was pretty easy to do with a market that wasn't being waterlogged with a lot of rollover maturities."

In 2019, the amount of investment grade debt maturing number leaps to $619 billion and continues in a range of upwards of $555 billion to $714 billion for the next five years. That works out to be 62% of investment grade debt maturing within five years, according to Gundlach. Elsewhere, 45% of the high yield debt market will mature by 2023.

Credit rating downgrades are on the rise

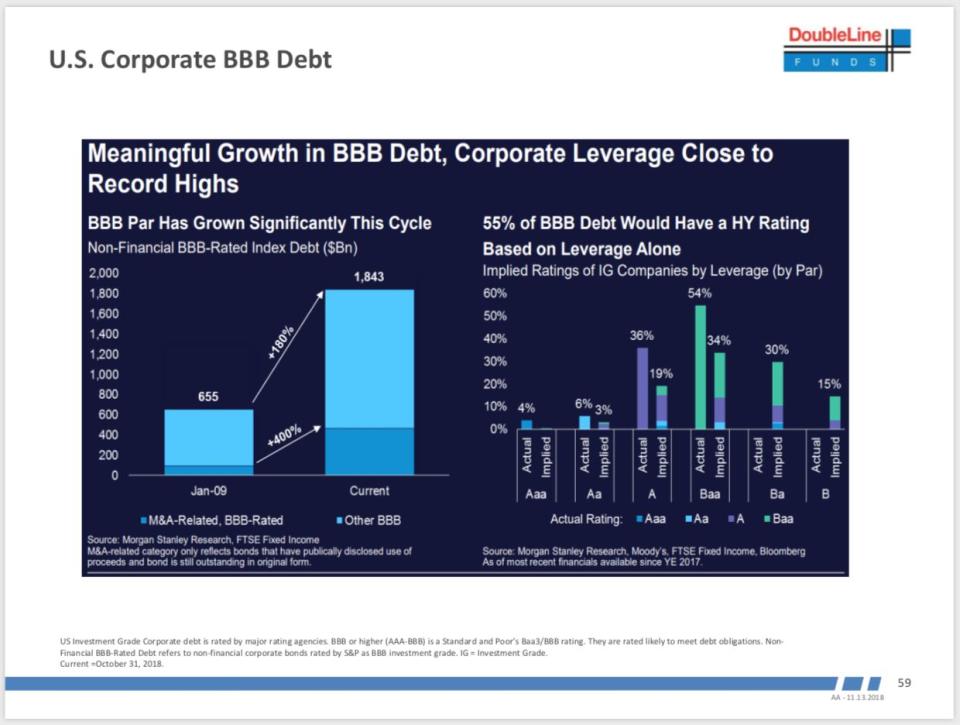

It's worth noting that the BBB part of the market, which is the lower rated investment grade debt, has grown significantly. In the fourth quarter of 2018, the pace of downgrades from the A territory into BBB is the largest since late 2015 when energy prices collapsed.

Using historical leverage ratio analysis, Gundlach pointed out that a massive portion of the BBB rated bonds would be junk status right now.

"Why aren't they? I think it's because companies have been saying reassuring things to the sympathetic ears of the ratings agencies about how, 'Yes, we are aware the leverage ratios are too high, but we are aware of the problem, we have our best people on it, and we're going to do something about it in the years ahead,'" Gundlach said.

He acknowledged that good companies are aware of the problem and intend on addressing it.

"But, what if the market doesn't let them? What if the economy does indeed slip into recession? Or there's a buyers strike, similar to what we saw in the second half of December 2018?"

The question, according to Gundlach, is who is going to buy as the prices are slipping?

"It gets worse than that," Gundlach said. "Because, actually, 45% of the entire investment grade bond market would be rated junk right now ... based on leverage ratios. Forty-five percent."

What's more, downgrades have begun to happen, though more should have happened already, he added.

"Maybe the ratings agencies don't want to repeat the sins of the way they rated mortgage-backed securities 12 years ago. Maybe, they have one last push for credibility."

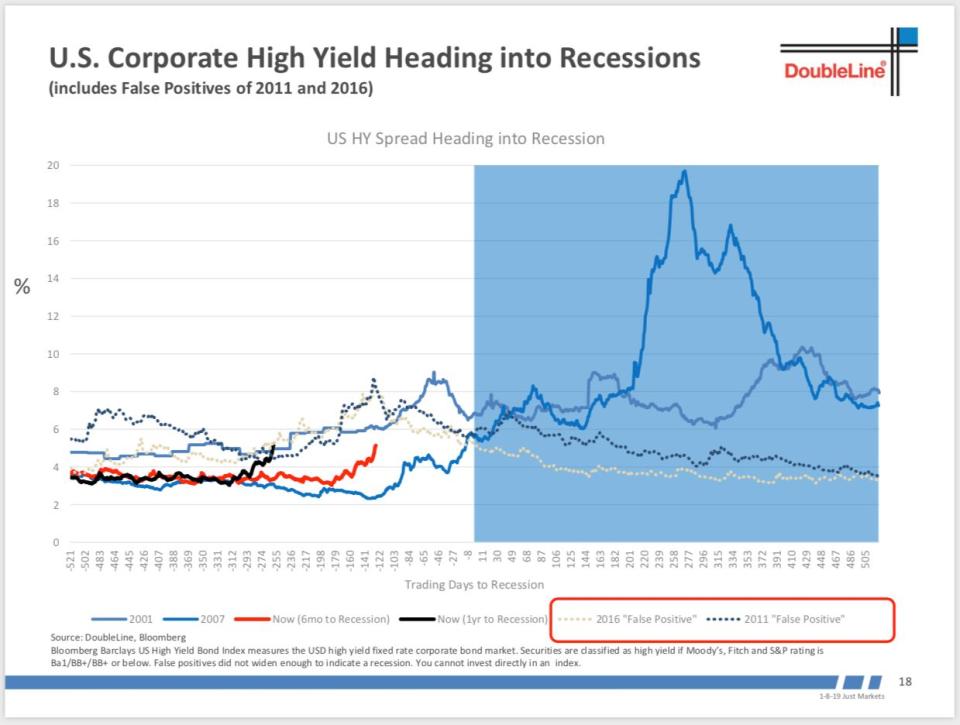

High yield is flashing yellow

Gundlach thinks that there could be a wave of downgrades to come, which is probably why spreads in high yield have widened. Earlier in the presentation, he said the high yield in the U.S. "does flash yellow now" as an indicator for a recession. He acknowledged that "maybe this is a false positive."

"This is something we're going to have to watch very carefully," he said earlier in the webcast.

Like the junk bond investors, those investors who bought bank loans "might get a second chance" too for an exit thanks to the recent rebound in bank loan prices.

"I think this is a gift. And, investors that bought bank loans and high yield — I can understand why. You buy the dip. I get it."

As he said about subprime in 2007, those who buy the dip suddenly turn into sellers when those prices head lower.

"With all the supply that's coming it's a really interesting issue — who is going to buy it? I'll tell you who is going to buy it —crossover buyers. Crossover buyers have the powder to do it or have other assets that held up better and decide, 'You know what? Maybe it's worthwhile to go to school on this junk bond asset class I really don't know much about because it's certainly down in value.' That's what finally had to happen to get subprime to bottom out and the credit markets to bottom out broadly in 2009."

That's the point when the prices are low enough for private equity and distressed funds to enter the space.

"Maybe we'll do the same for corporate bonds. But right now, you're on capital preservation side."

The Fed has raised a similar warning

Gundlach isn't alone in highlighting some of the issues facing the corporate bond market.

In its first-ever Financial Stability Report released during the fourth quarter, the Federal Reserve acknowledged that "the distribution of ratings among investment-grade corporate bonds has deteriorated" and that the share of triple-B has reached "near record levels."

"In an economic downturn, widespread downgrades of these bonds to speculative-grade ratings could induce some investors to sell them rapidly, because, for example, they face restrictions on holding bonds with ratings below investment grade. Such sales could increase the liquidity and price pressures in this segment of the corporate bond market," the Fed's report said.

In the last decade, mutual funds have piled into corporate debt, with assets more than doubling in that time to over $2 trillion.

"Corporate bond mutual funds are estimated to hold about one-tenth of outstanding corporate bonds, and loan funds purchase about one-fifth of newly originated leveraged loans," the Fed's report states. "The mismatch between the ability of investors in open-end bond or loan mutual funds to redeem shares daily and the longer time often required to sell corporate bonds or loans creates, in principle, conditions that can lead to runs, although widespread runs on mutual funds other than money market funds have not materialized during past episodes of stress."

Gundlach has made a name for himself for some of his big market calls. During last year's "Just Markets" webcast, Gundlach predicted that markets would go up early in the year, celebrating the narrative of synchronized global growth. He argued once bond yields on 10-year rose above 3% and the 30-year 3.25% that would be a “game-changer” that would take stocks down and that the market would end the year in negative territory.

"That's exactly what happened," Gundlach noted.

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.