An 'unprecedented' effort to find a coronavirus vaccine has over 100 horses in the race

The gradual relaxation of coronavirus restrictions is stoking hopes for an economic rebound, with the biotechnology industry riding a wave of expectations in the hunt for an effective COVID-19 treatment.

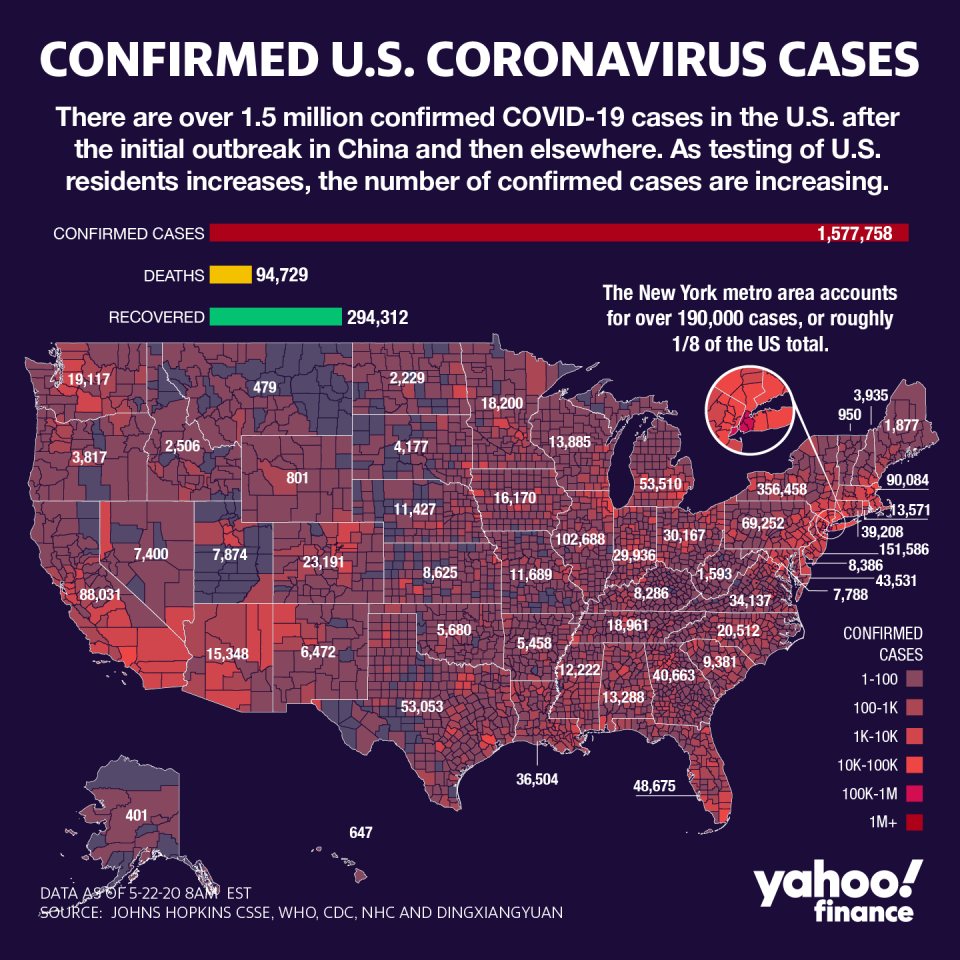

Vaccines are perceived as key to ending the restraints on work and life that have decimated the global economy, and returning to some sense of normalcy. Worldwide, there are nearly 5 million positive cases and over 300,000 have been killed by the virus.

With so much at stake, the global pipeline has become an intense space race for the new era. Nations are locked in an intense effort to demonstrate their biotech capabilities in the worldwide fight against COVID-19.

In collaboration with branches of the U.S. Health and Human Services (HHS) and National Institute of Health (NIH), small and large drug companies have been working on vaccines.

For now, the furthest along are Moderna (MRNA) and Pfizer (PFE), both of which are using messenger RNA technology— a newer technology that doesn’t exist in the current drug market. Both have entered human clinical trials. Abroad, all eyes are on China’s CanSino, and a project underway at Oxford University in the U.K.

Currently, “there are at least a hundred horses in the race, and we've got some leaders up front,” Marc Poznansky, the director of the Vaccine and Immunotherapy Center at Massachusetts General Hospital, told Yahoo Finance recently.

He added that it was “unprecedented to have that many platforms at play putting a product into testing to try to get to first in human” trials.

The World Health Organization is tracking the growing field, where less than a dozen of which have entered clinical trials. Some are being developed in coordination with governments, while others are through industry or academic collaboration.

The expectations have placed an unprecedented demand on a “pandemic market” that could eventually be valued anywhere between $10 to $30 billion, analysts at Morgan Stanley said last week. But an effective treatment is unlikely until the first half of 2021 at the earliest, with many health experts cautioning that aggressive development timelines are “aspirational” at best.

Still, pharmaceutical companies are repurposing existing drugs and trying to find treatments for those currently sick with the virus, with investors trying to determine the winners and losers of this high stakes race.

A ‘Warp Speed’ race

The world’s two largest economies are engaged in fierce competition to find a vaccine. China is moving to bolster its nascent biotech industry and expand its reach globally, while the U.S. is fighting to balance urgency with safety and serving the needs at home first.

In order to winnow down the widening field of vaccine candidates, the U.S. has rolled out Operation Warp Speed, using $3 billion appropriated by Congress to fund vaccine development. Meanwhile, the U.S. Food and Drug Administration is working closely with drug companies to follow expedited timelines for clinical trials, as drug companies aim to produce billions of doses as soon as a candidate is viable.

Global collaborations through the WHO, and a concerted effort in the European Union are also at play. WHO officials also recently said they are working with both the public and private sector in India, which has a massive capacity for vaccine production, to produce the vaccines for the world.

Private institutions, like the Bill & Melinda Gates Foundation and the Coalition for Epidemic Preparedness (CEPI), are also pursuing candidates.

In the U.S., Moderna has received $483 million in funding from HHS’s Biomedical Advanced Research and Development Authority (BARDA), and is developing its treatment in collaboration with the National Institute of Allergy and Infectious Diseases, the agency led by Dr. Anthony Fauci.

Recently, Moderna has tapped the capital market in an effort to produce a billion vaccine doses per year, which it is doing in partnership with Swiss manufacturer Lonza Group.

Separately, Pfizer has partnered with German biotech BioNTech to develop its own vaccine, pivoting from their work together on a flu treatment.

Sanofi (SNY) and GlaxoSmithKline (GSK) are engaged in a joint effort in the race; meanwhile, Johnson & Johnson (JNJ) are among the larger pharmaceutical contenders, and have also gotten BARDA backing.

Two smaller biotechs, Inovio (INO) and Novavax (NVAX), have received funding from CEPI and are also working on vaccines. Inovio, which had previously worked on another coronavirus vaccine, was the second company in the U.S. to enter into clinical trials with its candidate. While data on the clinical trials are pending, pre-clinical data showed positive results in animal studies.

China and the world

China has a young biotech industry, growing significantly in the last few years with government support, that is aggressively trying to prove itself to the world. That includes committing to supporting WHO and plans to share its vaccine with the world.

CanSino Biologics, along with partner Beijing Institute of Biotechnology, are leading the world with a vaccine to be approved by fall 2020 in China. The company recently hired a former Sanofi executive to run its international business operations.

Two other leading contenders are Sinopharm — which is working on clinical trials with both the Wuhan Institute of Biological Products and the Beijing Institute of Biological Products — and another from Sinovac.

Meanwhile, the U.K. has also invested in a vaccine candidate coming out of Oxford University, which also plans to supply its treatment globally. The university is partnering with the pharmaceutical giant AstraZeneca and the Serum Institute in India to distribute its potential vaccine.

The U.K. government is also investing a new production plant to ensure mass-production by next summer.