Here’s a scorecard for the Trump tariffs

It’s hard to say whether the United States is now in a trade war with its economic partners, or just a skirmish. What we do know is it’s escalating. So Yahoo Finance is initiating a new scorecard to help track President Trump’s actions on trade.

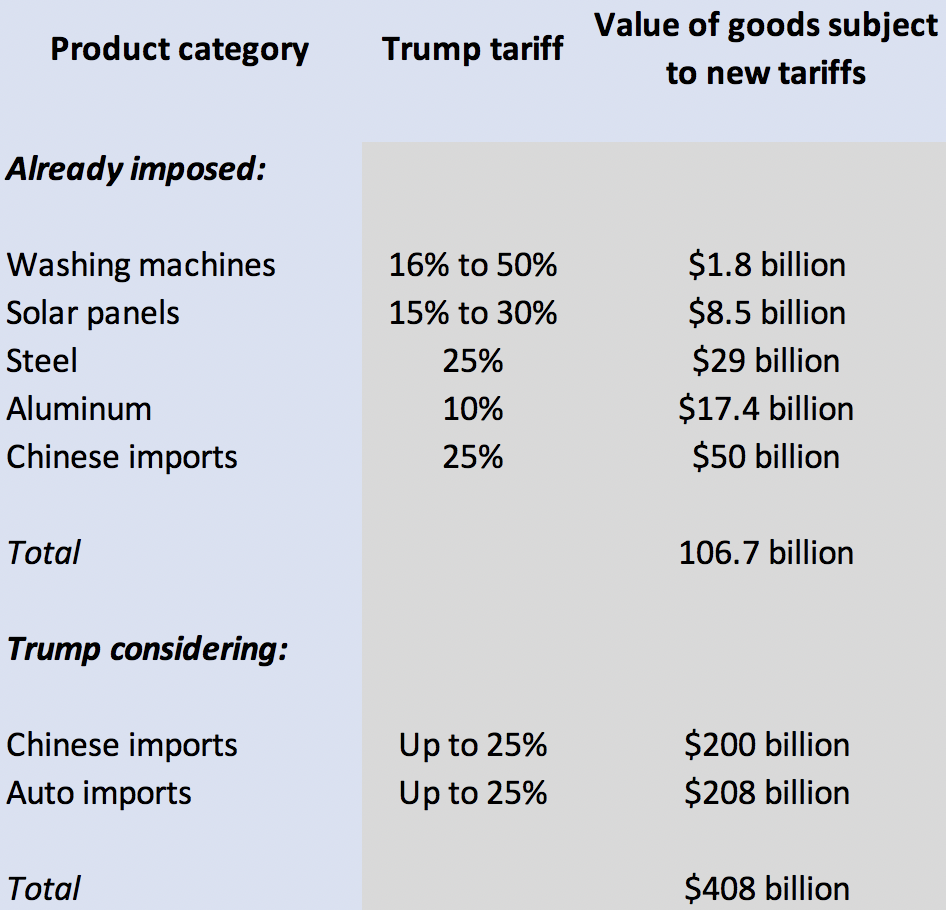

Trump has now imposed three sets of new tariffs on imports since the start of the year, with the promise (or threat) of more. He started with tariffs on washing machines and solar panels in January, followed by steel and aluminum tariffs in March. This month, he set new tariffs on more than 1,000 products imported from China, which will go into effect starting July 6.

He’s considering further tariffs on Chinese imports, and perhaps even a new levy on all imported cars. Here’s a rundown of everything that’s happened so far:

How important is all this? It’s obviously a key question investors, businesspeople and policymakers are trying to sort out. Financial markets have tanked several times on news of new tariffs, suggesting investors fear Trump’s protectionism is bad for the economy and for corporate profits. But then markets have recovered, as if correcting from an overreaction.

For the year, the S&P 500 index is up about 3%, a relatively weak performance, given the sharp cut in corporate taxes Trump signed into law late last year. That probably means protectionism fears are depressing stocks.

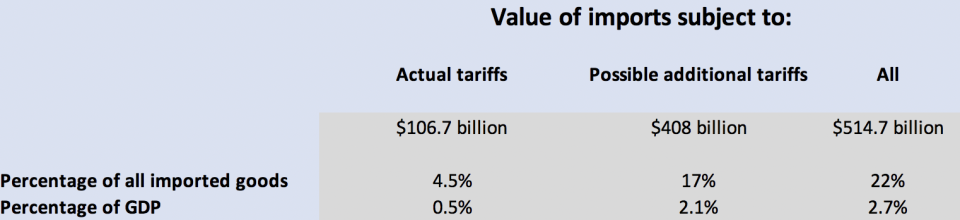

It helps to consider the amount of trade subject to new tariffs as a percentage of all trade, and relative to the overall economy, as well. So here are the aggregate numbers:

The tariffs Trump has imposed so far apply to just 4.5% of all imports, which is equivalent to a scant 0.5% of gross domestic product. A 25% tax sounds large, but not when it’s on such a small slice of the economy. This is the argument Commerce Secretary Wilbur Ross makes when he argues that the Trump tariffs are no big deal.

Markets aren’t so sure. Retaliatory tariffs imposed on US exports by China and other nations compound the damage, reducing sales of American products such as soybeans, bourbon and motorcycles. And as tariffs disrupt global supply chains, they can produce secondary consequences that are hard to predict but potentially damaging.

Tariffs also protect some industries while harming others, forcing investors to guess where the localized damage will be. Trump’s metals tariffs, for instance, will allow domestic producers to raise prices, produce more and hire additional workers. But they’ll also raise the cost of domestically built cars, which will reduce sales and kill some jobs. A Council on Foreign Relations study predicts auto-industry job losses will outnumber job gains in steel and aluminum.

There’s also major uncertainty about what Trump will do next. He has threatened, for instance, tariffs on an additional $200 billion of Chinese imports, twice what he has targeted so far. And the Commerce Department is studying the feasibility of imposing tariffs of up to 25% on some 8 million imported autos. If Trump did both of those things, new tariffs would affect 22% of all imported goods, equivalent to 2.7% of US GDP. Retaliatory measures would raise the stakes even more. All of that could stoke inflation, suppress demand and hasten a recession.

At the moment, the Trump tariffs are more of a nuisance factor than a real economic danger. But Trump hasn’t articulated a clear end-state or indicated where he might stop. Markets will probably continue to wobble.

Confidential tip line: [email protected]. Click here to get Rick’s stories by email.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn