Why people with credit card debt are paying 18% more on everything

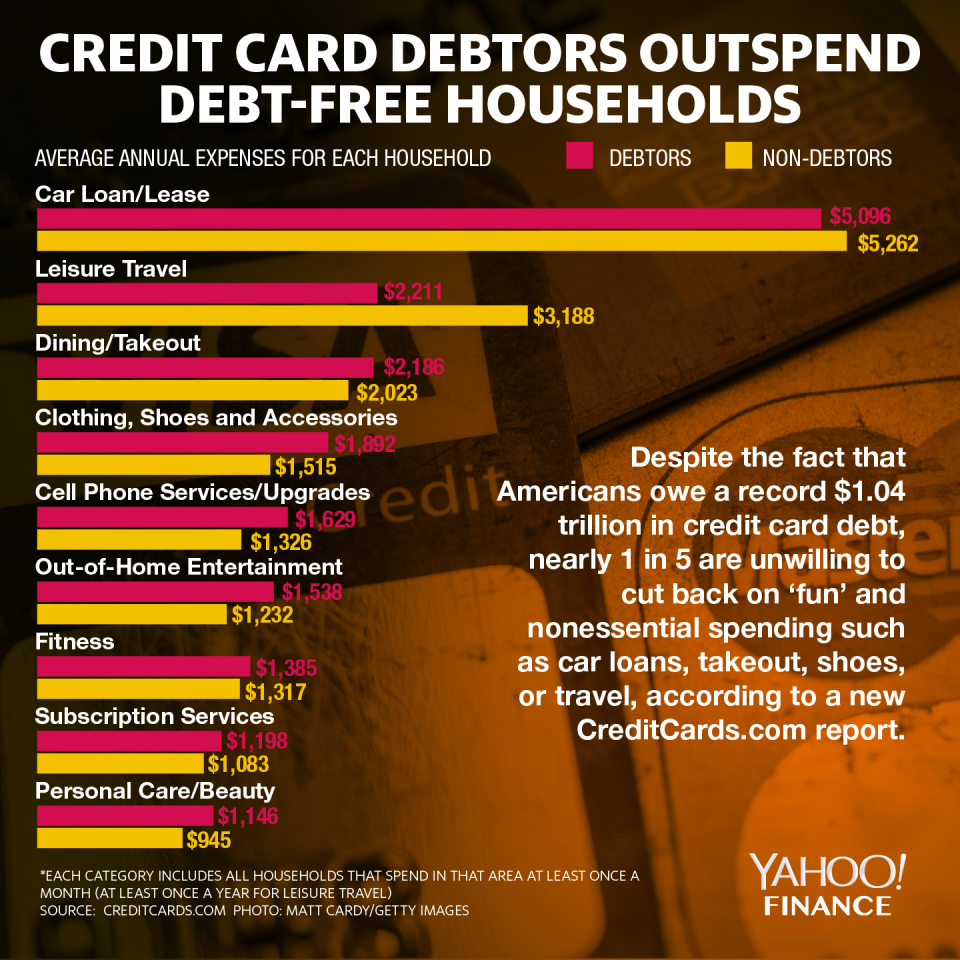

Americans owe more than $1 trillion in credit card debt. And according to a new CreditCards.com poll, households with credit card debt outspend those without debt in most discretionary spending categories. What’s more, 18% of households with credit card debt are unwilling to cut back on any nonessentials like takeout and leisure travel.

The average annual percentage rate (APR) on credit cards is at a record high of 17.8%. That means people are spending roughly 18% more on every purchase when they use their credit card. Many consumers do price comparison shopping online to save money on everything from airline tickets to soap – but borrowers who aren’t paying down their credit card debt end up losing that price advantage.

CreditCards.com analyst Ted Rossman says people are hurting themselves financially when they choose to stick with minimum monthly payments, carrying debt month to month. For an average household carrying $5,700 in debt, he explains that it would take 19.5 years to pay it off completely. Meanwhile, that household would be paying more than $7,000 in interest over that two-decade span.

People with credit card debt are outspending non-debtors in seven out of nine discretionary categories including takeout, fitness, subscription services, and beauty. (CreditCards.com surveyed 2,482 U.S. adults.)

The typical household is spending more than $10,000 annually on these nonessential categories. The biggest discretionary spending category for Americans with credit card debt is car loans.

For instance, households spend on average $5,096 annually on car leases. Getting a cheaper used car or holding onto your current car for longer, if possible, are some ways to cut back on that particular expense.”Whatever it is, spending this much on cars – especially new cars – is really pricey at a time that credit card rates have never been higher and people are carrying so much other debt,” says Rossman.

In 2018, Americans paid a collective $113 billion in credit card interest, according to MagnifyMoney – a 49% jump from five years ago. Millions of U.S. households also face mortgage, auto and student loans debt. Total U.S. household debt rose to $13.67 trillion in the first quarter of 2019, according to the Fed.

“It’s pretty clear that there are a lot of people that are living close to the edge and if that’s happening in good times, it is worrisome if the good times don’t last,” Rossman says. “So that would be the advice all the more, is pay [your credit card debt] down now, get the side hustle, cut your expenses.”

More from Sibile:

2020 candidates view Trump’s broken promise to working Americans as path to beating him

Democrats debate ‘who is this economy really working for?’

Here’s what graduates regret the most about college

Women are about to reach a new workplace milestone

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance