Here's why Uber could be profitable by 2030

Uber Technologies may finally be a publicly traded company, but its next challenge is how to become profitable.

In 2018, Uber (UBER) reported an operating loss of $3 billion – that’s on top of losing more than $4 billion the previous year. Still, it didn’t scare away investors. Some analysts predict the ride-hailing app leader will turn a profit – eventually.

“They’re trying to disrupt a $5 trillion market and they’re not there yet,” Alejandro Ortiz, principal analyst at SharesPost, tells Yahoo Finance’s “The First Trade.”

“They’re going to have to spend heavily to get there,” he said. “So, could they turn a profit by 2030? Probably. Will they choose to? Remains to be seen.”

Anshel Sag, analyst at Moore Insights, is more bullish on Uber’s path to profitability.

“I think they have a new CEO that’s much more focused on bringing the company into profitability and repairing the company’s reputation,” Sag said.

Sag added that the IPO is a good example of Uber trying to take a more conservative approach to growth.

Uber priced its initial public offering at $45 a share, near the low end of its expected range, as the company deals with volatile markets and a disappointing market debut from its smaller rival, Lyft.

By comparison, Lyft priced its IPO at $72 a share, after raising its price range amid significant demand from prospective shareholders. The stock is down more than 20% from its IPO price on March 29.

Takes the pressure off

Ortiz said Uber was smart with its IPO pricing strategy.

“It gives gives Uber more runway and takes a lot of pressure off going forward. They’re taking that conservative approach that we’ve seen with other companies this year, like with Pinterest, which priced below its final funding round,” Ortiz said.

Ortiz said that while Uber and Pinterest are very different companies, “at the end of the day, the IPO game is weighing your risks of your price going down versus how much money you want to raise.”

Investors willing to be patient

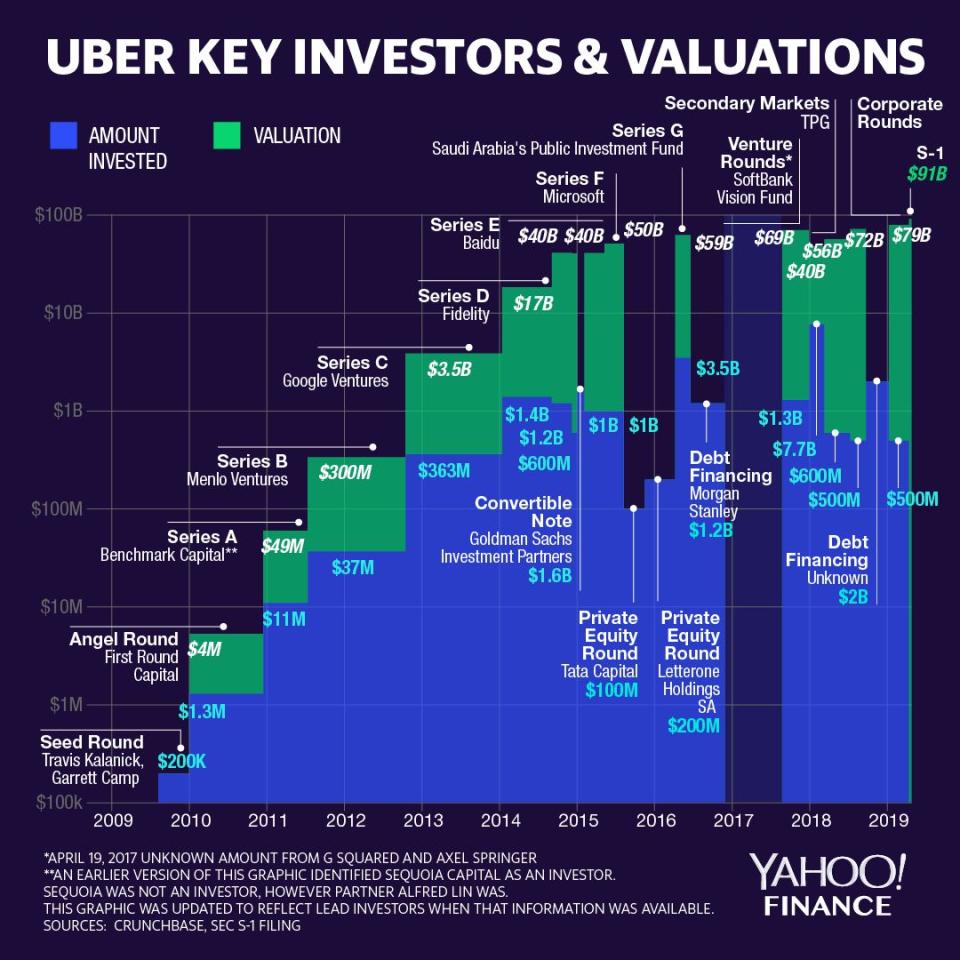

If history is any guide, investors appear to be banking on Uber as a long-term growth story.

“I think investors have shown, as they have with other companies like Amazon, that they’re willing to be patient,” said Ortiz.

After all, it took Amazon more than 7 years after going public in 1997 to turn a profit.

Uber has no shortage of capital, and despite deep-pocketed investors pouring millions into the company in the private sector, it still managed to raise $8 billion in its Wall Street debut.

Alexis Christoforous is co-host of Yahoo Finance’s The First Trade. Follow her on Twitter @AlexisTVNews.

Read more:

Early Uber investor sees 'the same kind of situation' as Tesla

China tariffs are a 'big deal' for this smart thermostat maker

Markets got 'way ahead of themselves' on China trade talks

Global Payments CEO: 'We are direct beneficiaries' of innovation

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.