High Growth Tech Stocks in Canada Featuring Kinaxis and Two Others

The Canadian market has been riding a wave of optimism, with the TSX reaching all-time highs last week, buoyed by the U.S. Fed's recent rate cut and ongoing enthusiasm for AI technologies. In this favorable environment, high-growth tech stocks like Kinaxis and two others stand out as potential beneficiaries of accelerating corporate earnings and broadening market leadership.

Top 10 High Growth Tech Companies In Canada

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Docebo | 14.71% | 33.96% | ★★★★★☆ |

Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

HIVE Digital Technologies | 48.71% | 94.27% | ★★★★★☆ |

GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

BlackBerry | 24.19% | 79.50% | ★★★★★☆ |

Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Kinaxis

Simply Wall St Growth Rating: ★★★★☆☆

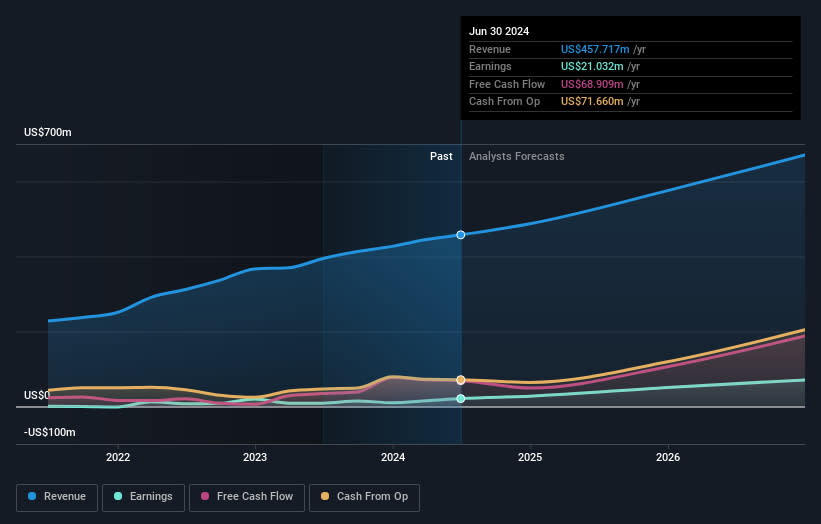

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.53 billion.

Operations: Kinaxis Inc. generates revenue primarily from its cloud-based subscription software, amounting to $457.72 million. The company operates in various regions including the United States, Europe, Asia, and Canada.

Kinaxis, a leader in supply chain management software, is poised for substantial growth with a 14.5% annual revenue increase forecast, outpacing the Canadian market average of 7%. The company's strategic client acquisitions, including Mahindra & Mahindra Ltd., enhance its robust portfolio in the complex mobility sector. Despite recent pressures from activist investors like Irenic Capital urging a sale to maximize shareholder value, Kinaxis remains focused on executing its strategic plans. This approach is underpinned by significant R&D investment aimed at advancing its AI capabilities and maintaining competitive advantage in the $16 billion market it serves.

Click here to discover the nuances of Kinaxis with our detailed analytical health report.

Gain insights into Kinaxis' past trends and performance with our Past report.

Stingray Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market cap of CA$498.87 million.

Operations: Stingray Group Inc. generates revenue primarily from two segments: Radio (CA$154.41 million) and Broadcasting and Commercial Music (CA$201.10 million).

Stingray Group, amidst a challenging landscape, is making strides with its innovative Stingray Karaoke app on VIZIO Smart TVs and in Ford's electric vehicles, enhancing its digital media presence. Despite a modest revenue growth forecast of 4.9% annually—below the Canadian tech sector average—the company is poised for profitability with expected earnings growth of 69.2% per year. This turnaround is supported by strategic share repurchases, signaling confidence in future performance; recently, Stingray committed to buying back up to 3.54 million shares, representing 6.39% of issued capital. These moves reflect a robust strategy to leverage unique entertainment solutions across diverse platforms and geographies while navigating financial complexities marked by significant insider selling and high debt levels.

Dive into the specifics of Stingray Group here with our thorough health report.

Gain insights into Stingray Group's historical performance by reviewing our past performance report.

Vitalhub

Simply Wall St Growth Rating: ★★★★☆☆

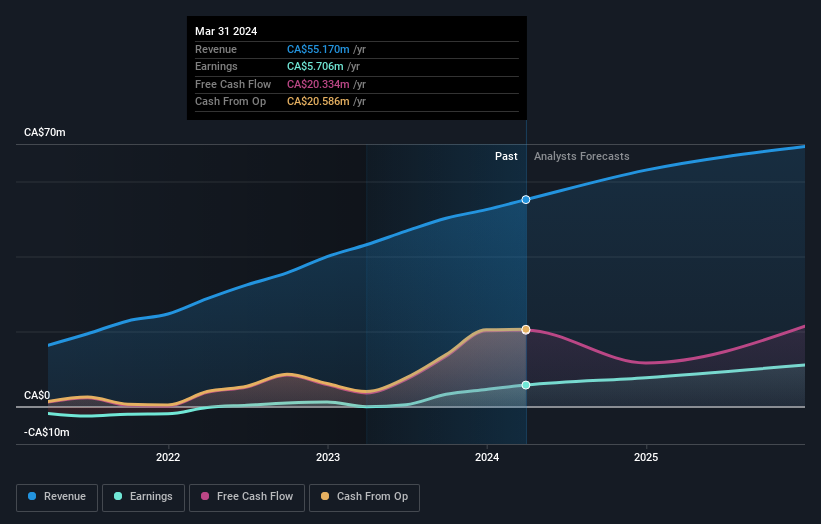

Overview: Vitalhub Corp., along with its subsidiaries, offers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$448.70 million.

Operations: The company generates revenue primarily from its healthcare software segment, which reported CA$58.32 million. The business focuses on providing technology solutions to health and human service providers across multiple international markets.

Vitalhub, recently added to the S&P Global BMI Index, exhibits robust growth prospects with its earnings expected to surge by 65.9% annually. This performance starkly contrasts the Canadian market's average of 14.9%, underscoring its rapid advancement within the tech sector. Moreover, Vitalhub reported a significant revenue increase to CAD 31.49 million in the first half of 2024, up from CAD 25.68 million in the previous year, marking a growth rate of 13.5%. Despite facing challenges like a net loss this quarter due to one-off costs totaling CA$3.1M, these figures highlight Vitalhub's potential for expansion and innovation in healthcare technology solutions—a sector increasingly reliant on digital transformation.

Get an in-depth perspective on Vitalhub's performance by reading our health report here.

Evaluate Vitalhub's historical performance by accessing our past performance report.

Key Takeaways

Click through to start exploring the rest of the 21 TSX High Growth Tech and AI Stocks now.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:KXS TSX:RAY.A and TSX:VHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]