High Growth Tech Stocks In Sweden To Watch This September 2024

As European markets continue to rally, driven by slower inflation and potential interest rate cuts from the ECB, Sweden's tech sector stands out as a promising area for high growth opportunities. In this favorable economic climate, identifying stocks with strong fundamentals and innovative capabilities becomes crucial for investors looking to capitalize on the burgeoning tech landscape.

Top 10 High Growth Tech Companies In Sweden

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Truecaller | 20.32% | 21.61% | ★★★★★★ |

Fortnox | 20.18% | 22.60% | ★★★★★★ |

Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

Scandion Oncology | 41.84% | 75.34% | ★★★★★★ |

Hemnet Group | 20.13% | 25.41% | ★★★★★★ |

Skolon | 31.76% | 121.72% | ★★★★★★ |

BioArctic | 42.38% | 98.40% | ★★★★★★ |

Yubico | 20.43% | 42.51% | ★★★★★★ |

KebNi | 34.75% | 86.11% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

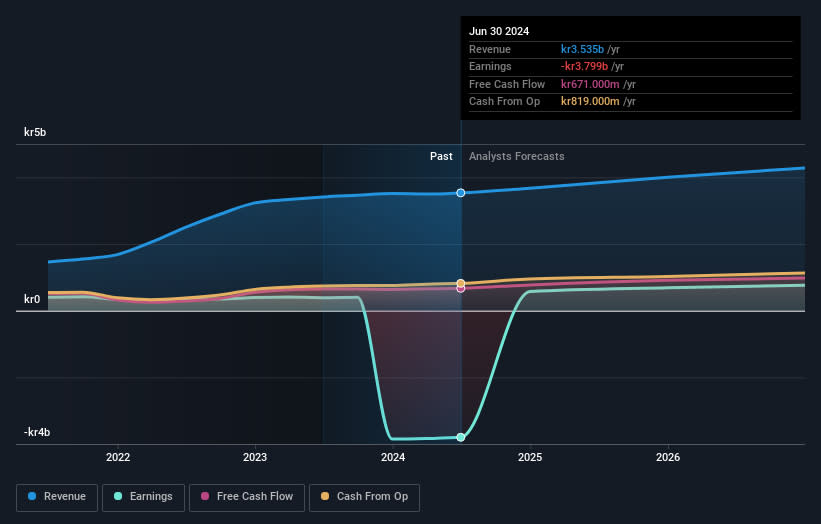

Telefonaktiebolaget LM Ericsson

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Telefonaktiebolaget LM Ericsson (publ), together with its subsidiaries, provides mobile connectivity solutions for telecom operators and enterprise customers across multiple regions including North America, Europe, Latin America, the Middle East, Africa, North East Asia, South East Asia, Oceania, and India; it has a market cap of SEK255.09 billion.

Operations: Ericsson generates revenue primarily from three segments: Networks (SEK157.93 billion), Enterprise (SEK25.83 billion), and Cloud Software and Services (SEK63.35 billion). The company focuses on providing mobile connectivity solutions to telecom operators and enterprise customers across various global regions.

Ericsson's recent collaboration with NRTC, Southern Linc, and Anterix to deliver private network solutions for U.S. electric cooperatives highlights its strategic focus on resilient and secure infrastructure. The company's R&D expenses of SEK 11.4 billion reflect a commitment to innovation despite a net loss of SEK 11,132 million in Q2 2024. With expected annual revenue growth at 2.7% and earnings forecasted to grow by 98.9% per year, Ericsson is positioning itself for significant advancements in the telecom sector while addressing current market challenges effectively.

Hemnet Group

Simply Wall St Growth Rating: ★★★★★★

Overview: Hemnet Group AB (publ) operates a residential property platform in Sweden, with a market cap of SEK36.43 billion.

Operations: Hemnet Group AB (publ) generates its revenue primarily through its Internet Information Providers segment, which brought in SEK1.21 billion. The company focuses on offering residential property listings and related services in Sweden.

Hemnet Group's revenue growth is forecasted at 20.1% per year, outpacing the Swedish market's 0.9%, while earnings are expected to rise by 25.4% annually, significantly higher than the market average of 14.9%. The company reported Q2 revenue of SEK 405 million, up from SEK 268.4 million a year ago, with net income rising to SEK 148.7 million from SEK 91.9 million in the same period last year. Hemnet has also repurchased approximately SEK 450 million worth of shares recently, indicating confidence in its future prospects amidst executive changes and ongoing innovation in Sweden’s largest property platform sector.

Vitrolife

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitrolife AB (publ) specializes in providing assisted reproduction products and has a market cap of SEK34.07 billion.

Operations: The company generates revenue through three primary segments: Genetics (SEK 1.25 billion), Consumables (SEK 1.57 billion), and Technologies (SEK 708 million).

Vitrolife's revenue is forecasted to grow at 7.8% annually, outpacing the Swedish market's 0.9%. Earnings are expected to surge by 105.8% per year, indicating strong future profitability despite current unprofitability. In Q2 2024, Vitrolife reported sales of SEK 941 million and net income of SEK 143 million, up from SEK 905 million and SEK 106 million respectively a year ago. The company’s R&D expenses have been significant in driving innovation within its biotech segment.

Take a closer look at Vitrolife's potential here in our health report.

Evaluate Vitrolife's historical performance by accessing our past performance report.

Make It Happen

Unlock more gems! Our Swedish High Growth Tech and AI Stocks screener has unearthed 79 more companies for you to explore.Click here to unveil our expertly curated list of 82 Swedish High Growth Tech and AI Stocks.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:ERIC B OM:HEM and OM:VITR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com