In the last week, the Indian market has stayed flat with a notable 3.5% gain in the Utilities sector, contributing to an impressive 44% rise over the past year and an annual earnings growth forecast of 17%. In this dynamic environment, identifying high-growth tech stocks that align with these positive trends can offer substantial opportunities for investors.

Top 10 High Growth Tech Companies In India

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Tips Music | 24.69% | 24.16% | ★★★★★★ |

Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

Sonata Software | 13.29% | 29.79% | ★★★★★☆ |

Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

GFL | 44.50% | 49.42% | ★★★★★☆ |

Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Affle (India)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Affle (India) Limited, along with its subsidiaries, offers mobile advertisement services through IT and software development for mobiles both in India and globally, with a market cap of ?217.81 billion.

Operations: Affle (India) Limited, along with its subsidiaries, generates revenue by providing mobile advertisement services through IT and software development for mobiles in both domestic and international markets. The company has a market cap of ?217.81 billion.

Affle (India) has demonstrated a robust trajectory in its financial performance, with first-quarter sales rising to INR 5.2 billion from INR 4.1 billion year-over-year, and net income increasing to INR 866 million from INR 662 million. This growth is underscored by a strategic focus on R&D, evidenced by recent patent grants enhancing AI-driven consumer engagement technologies. Despite not outperforming the broader media industry's earnings growth rate, Affle's revenue is expected to expand annually by 17.4%, surpassing the Indian market forecast of 10.2%. Additionally, earnings are projected to grow at an impressive rate of 23.1% per year, indicating strong future prospects in a competitive landscape.

Navigate through the intricacies of Affle (India) with our comprehensive health report here.

Assess Affle (India)'s past performance with our detailed historical performance reports.

Happiest Minds Technologies

Simply Wall St Growth Rating: ★★★★★★

Overview: Happiest Minds Technologies Limited provides IT solutions and services across various regions including India, the United States, Canada, the United Kingdom, Australia, the Netherlands, Singapore, Malaysia, New Zealand, Mexico, Africa, and the Middle East with a market cap of ?123.81 billion.

Operations: Happiest Minds Technologies Limited generates revenue primarily from Infrastructure Management & Security Services (IMSS), contributing ?3.02 billion. Segment Adjustments account for an additional ?1.37 billion.

Happiest Minds Technologies, showcasing a robust growth trajectory, is forecasted to expand its revenue by 22.1% annually, outpacing the Indian market's 10.2% expectation. This growth is complemented by an anticipated earnings increase of 22.2% per year, highlighting the company's efficient operational execution and market positioning. Notably, R&D investments remain a strategic focus to fuel innovation and maintain competitive advantage in the rapidly evolving tech landscape, aligning with recent developments such as their AI-infused IT management solutions which enhance organizational IT efficiencies significantly.

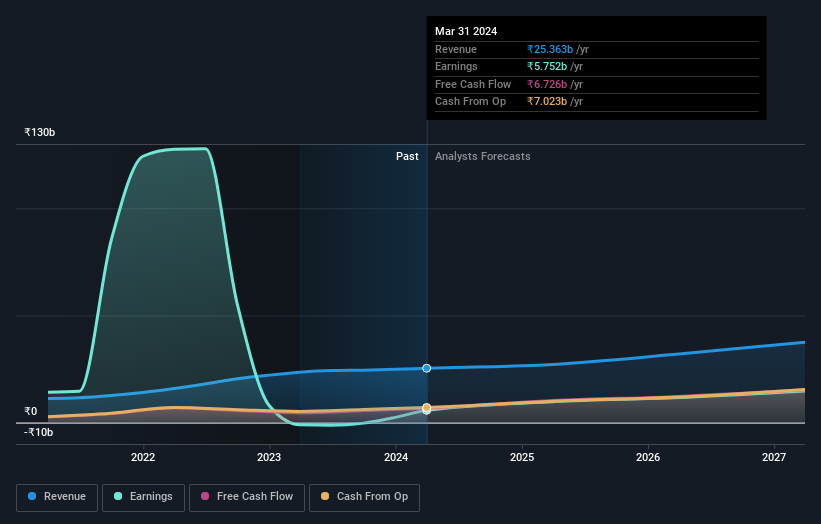

Info Edge (India)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited operates as an online classifieds company in recruitment, matrimony, real estate, and education services both in India and internationally, with a market cap of ?1.05 trillion.

Operations: Info Edge (India) Limited generates revenue primarily from recruitment solutions (?19.05 billion) and real estate services through its 99acres platform (?3.67 billion). The company focuses on online classifieds across various sectors, including matrimony and education, serving both domestic and international markets.

Info Edge (India) has demonstrated a significant commitment to innovation with its R&D expenses, crucial for maintaining its competitive edge in the dynamic tech landscape. In the fiscal year 2023-24, R&D spending rose by 13.0%, underscoring a strategic focus on developing new technologies and services. This investment aligns with an impressive earnings growth forecast of 23.6% annually, reflecting both the effectiveness of their current initiatives and potential for future revenue streams from emerging sectors like artificial intelligence and online recruitment solutions. Recent executive appointments and strategic leadership changes also suggest a proactive approach in steering the company towards these high-potential areas, aiming to capitalize on evolving market demands effectively.

Taking Advantage

Navigate through the entire inventory of 39 Indian High Growth Tech and AI Stocks here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:AFFLE NSEI:HAPPSTMNDS and NSEI:NAUKRI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]