High Growth Tech Stocks To Watch In August 2024

As global markets show signs of recovery and optimism grows for a soft landing in the U.S. economy, technology stocks have been at the forefront of recent gains, with the Nasdaq Composite leading the charge. In this favorable environment for growth stocks, identifying high-potential tech companies becomes crucial for investors looking to capitalize on market momentum and innovation trends.

Top 10 High Growth Tech Companies

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

Medley | 24.97% | 30.50% | ★★★★★★ |

Clinuvel Pharmaceuticals | 22.90% | 27.04% | ★★★★★★ |

G1 Therapeutics | 24.26% | 51.62% | ★★★★★★ |

KebNi | 34.75% | 86.11% | ★★★★★★ |

Seojin SystemLtd | 34.20% | 62.10% | ★★★★★★ |

Adveritas | 66.47% | 103.87% | ★★★★★★ |

Adocia | 59.08% | 63.00% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

BeiGene

Simply Wall St Growth Rating: ★★★★☆☆

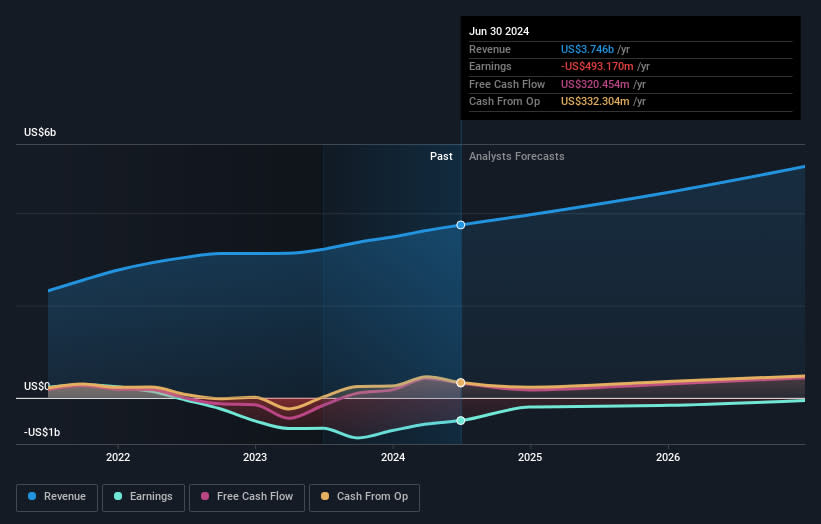

Overview: BeiGene, Ltd. is an oncology company that focuses on discovering and developing cancer treatments for patients globally, with a market cap of $20.61 billion.

Operations: BeiGene, Ltd. generates revenue primarily through its pharmaceutical products, amounting to $3.10 billion. The company operates in the United States, China, Europe, and internationally.

BeiGene's revenue surged to $929.17 million in Q2 2024 from $595.26 million a year ago, reflecting a robust 56% increase. Despite a net loss of $120.41 million, the company significantly narrowed its losses compared to the previous year's $381.14 million. With an impressive R&D expenditure of $800 million for its new U.S. facility, BeiGene is poised to enhance its oncology pipeline and production capabilities, potentially transforming cancer treatment modalities globally.

Get an in-depth perspective on BeiGene's performance by reading our health report here.

Gain insights into BeiGene's historical performance by reviewing our past performance report.

Roku

Simply Wall St Growth Rating: ★★★★☆☆

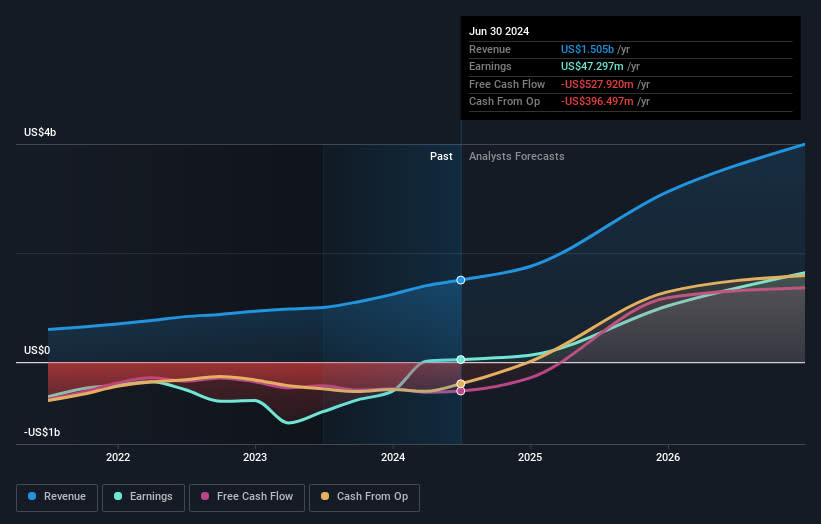

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market cap of $8.97 billion.

Operations: Roku generates revenue primarily from two segments: Devices ($551.17 million) and Platform ($3.19 billion). The company focuses on providing a comprehensive TV streaming platform with significant income derived from its Platform segment.

Roku's recent revenue growth of 10.7% year-over-year to $968.18 million and a forecasted annual earnings growth of 70.9% highlight its significant market potential, despite current unprofitability. The company's strategic partnership with XR Extreme Reach enhances ad performance and targeting on its platform, driving better engagement for advertisers across various verticals like Fitness and Health & Beauty. With an R&D expenditure reflecting substantial investment in innovation, Roku is well-positioned to leverage AI-driven ad optimization through initiatives like Roku Exchange, promising enhanced campaign effectiveness and market reach.

Click here and access our complete health analysis report to understand the dynamics of Roku.

Assess Roku's past performance with our detailed historical performance reports.

Sarepta Therapeutics

Simply Wall St Growth Rating: ★★★★★★

Overview: Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company specializing in RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for rare diseases, with a market cap of $13.68 billion.

Operations: The company generates revenue primarily from discovering, developing, manufacturing, and delivering therapies for rare diseases, totaling $1.50 billion. It is focused on RNA-targeted therapeutics and gene therapies.

Sarepta Therapeutics has shown remarkable progress with a 24.2% annual revenue growth forecast and a 44.9% expected earnings increase, outpacing the broader market significantly. In Q2 2024, revenues jumped to $362.93 million from $261.24 million year-over-year, while net income reached $6.46 million compared to a previous loss of $23.94 million, reflecting its transition to profitability this year. With substantial R&D investments and strategic collaborations like Roche for Duchenne muscular dystrophy treatments, Sarepta is positioned strongly within the biotech sector's innovative landscape.

Dive into the specifics of Sarepta Therapeutics here with our thorough health report.

Gain insights into Sarepta Therapeutics' past trends and performance with our Past report.

Turning Ideas Into Actions

Unlock our comprehensive list of 1270 High Growth Tech and AI Stocks by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:BGNE NasdaqGS:ROKU and NasdaqGS:SRPT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]