High Growth Tech Stocks to Watch in the United Kingdom August 2024

The market in the United Kingdom has been flat in the last week, but over the past 12 months, it has risen by 12%, with earnings forecasted to grow by 14% annually. In this context, identifying high-growth tech stocks that can leverage these favorable conditions is crucial for investors looking to capitalize on potential opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

Filtronic | 21.64% | 33.46% | ★★★★★★ |

YouGov | 14.30% | 29.79% | ★★★★★☆ |

Facilities by ADF | 32.33% | 94.46% | ★★★★★★ |

STV Group | 13.43% | 47.09% | ★★★★★☆ |

Redcentric | 4.89% | 63.79% | ★★★★★☆ |

Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

Seeing Machines | 24.07% | 93.93% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our UK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

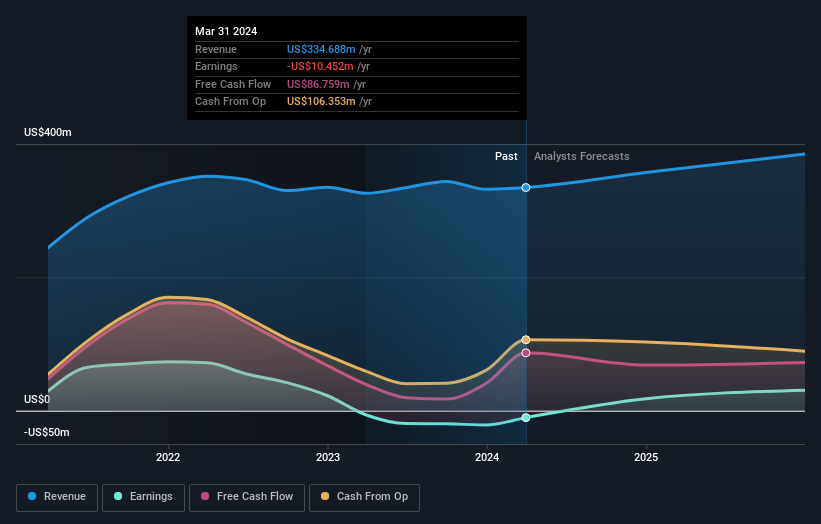

Nexxen International

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nexxen International Ltd. offers a comprehensive software platform for advertisers to connect with publishers in Israel, with a market cap of £414.56 million.

Operations: Nexxen International Ltd. generates revenue primarily through its marketing services, amounting to $339.02 million. The company focuses on providing a software platform that facilitates connections between advertisers and publishers in Israel.

Nexxen International's recent earnings report for Q2 2024 showed a notable turnaround, with sales rising to $88.58 million from $84.25 million last year and net income reaching $2.92 million compared to a net loss of $5.61 million previously. Their strategic data partnership with The Trade Desk enhances cross-channel targeting capabilities, leveraging Nexxen's exclusive ACR data segments for more efficient media investment across the premium internet space. The company's R&D expenses reflect their commitment to innovation, spending £15M in 2023 alone, representing 8% of their revenue. In terms of growth prospects, Nexxen is forecasted to achieve an impressive annual earnings growth rate of 71.87%, significantly outpacing the UK market average revenue growth rate of 3.7%. Additionally, their collaboration with Vevo expands programmatic advertising opportunities across CTV platforms by utilizing Nexxen's unique data for enhanced audience targeting and monetization efforts. With these developments and strategic partnerships in place, Nexxen is well-positioned to capitalize on emerging trends within the tech sector while driving future profitability and market share expansion.

Take a closer look at Nexxen International's potential here in our health report.

Gain insights into Nexxen International's past trends and performance with our Past report.

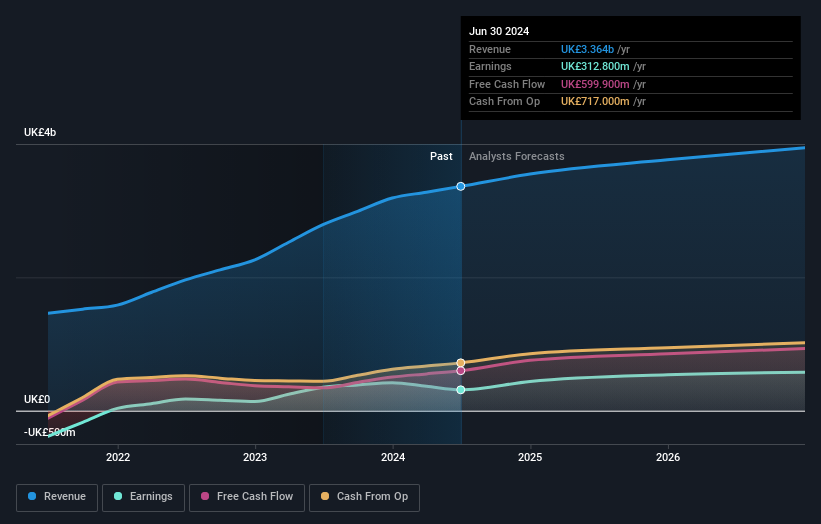

Informa

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £10.94 billion.

Operations: The company generates revenue from four primary segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million).

Informa's robust R&D expenditure of £120 million in 2023, accounting for 7% of its revenue, underscores its commitment to innovation within the tech sector. Revenue for H1 2024 reached £1.70 billion, a rise from £1.52 billion in the previous year, with earnings expected to grow at an annual rate of 21.5%. The company repurchased approximately 3% of its shares for £338.9 million in H1 2024, enhancing shareholder value amidst a forecasted revenue growth rate of 6.7%, outpacing the UK market average.

Click to explore a detailed breakdown of our findings in Informa's health report.

Evaluate Informa's historical performance by accessing our past performance report.

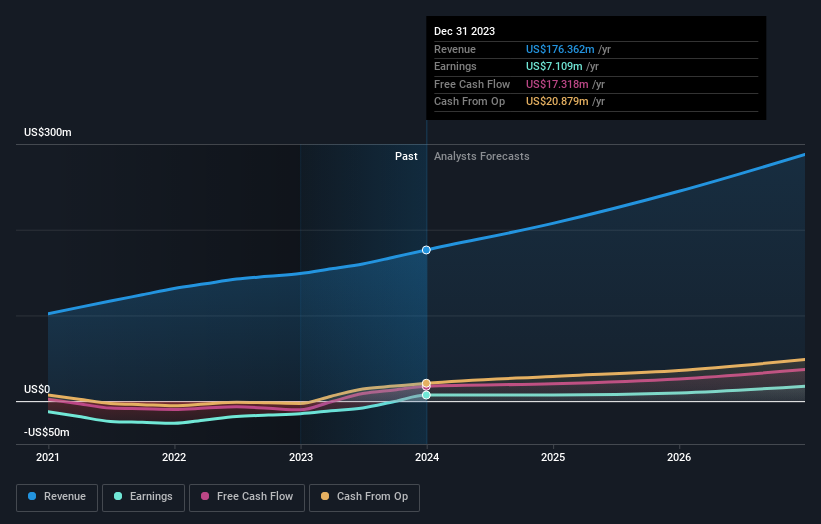

Trustpilot Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trustpilot Group plc develops and hosts an online review platform for businesses and consumers across the United Kingdom, North America, Europe, and internationally, with a market cap of £838.73 million.

Operations: Trustpilot Group plc generates revenue primarily from its Internet Information Providers segment, amounting to $176.36 million. The company operates an online review platform serving various regions including the UK, North America, and Europe.

Trustpilot Group's revenue is forecasted to grow at 16.2% annually, significantly outpacing the UK market's average of 3.7%. The company's earnings are expected to rise by an impressive 32% per year over the next three years, reflecting strong profitability prospects. In the past year, Trustpilot has become profitable and showcases high-quality earnings with a notable return on equity forecasted at 37.6%. Software firms like Trustpilot increasingly adopt SaaS models, ensuring recurring revenue from subscriptions and enhancing financial stability.

Taking Advantage

Investigate our full lineup of 48 UK High Growth Tech and AI Stocks right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:NEXN LSE:INF and LSE:TRST.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]