High Growth Tech Stocks to Watch in Hong Kong August 2024

As global markets respond positively to anticipated interest rate cuts in the U.S., the Hong Kong market has also shown resilience, particularly in its tech sector. With this favorable backdrop, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on market momentum and innovation-driven growth.

Top 10 High Growth Tech Companies In Hong Kong

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

Be Friends Holding | 33.82% | 32.27% | ★★★★★★ |

Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

Cowell e Holdings | 30.96% | 35.72% | ★★★★★★ |

RemeGen | 26.30% | 52.19% | ★★★★★☆ |

Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

Sichuan Kelun-Biotech Biopharmaceutical | 26.67% | 8.64% | ★★★★★☆ |

Biocytogen Pharmaceuticals (Beijing) | 21.35% | 100.10% | ★★★★★☆ |

Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our SEHK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

CanSino Biologics

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. develops, manufactures, and commercializes vaccines in the People's Republic of China with a market cap of HK$6.90 billion.

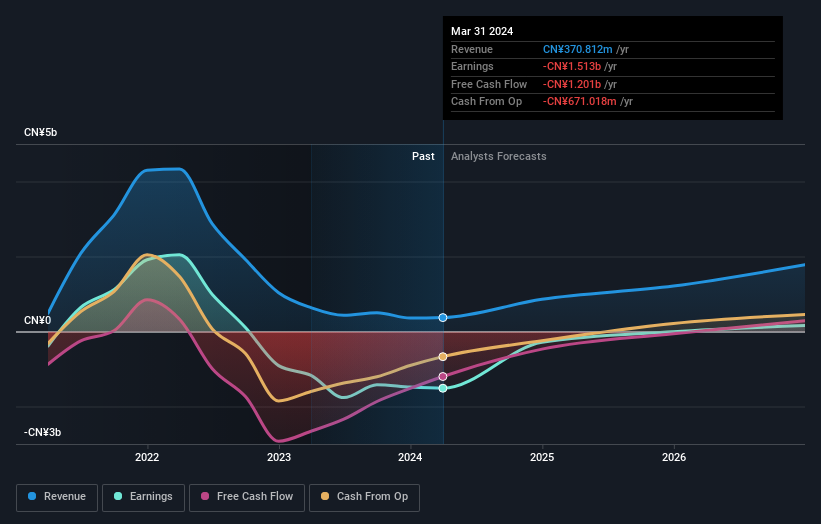

Operations: The company generates revenue primarily from the research and development of vaccine products for human use, amounting to CN¥370.81 million. Its focus on vaccine innovation is a key aspect of its business operations in China.

CanSino Biologics, a notable player in the biopharmaceutical sector, is forecasted to see its revenue grow by 34.3% annually, significantly outpacing the Hong Kong market's average of 7.4%. The company's earnings are projected to surge by an impressive 124.55% per year over the next three years, marking a substantial turnaround from its current unprofitable status. With a strong focus on innovation, CanSino's R&D expenses reflect this commitment; they have invested heavily in research and development to drive future growth and maintain their competitive edge in vaccine technology. Recent board changes include the election of Mr. Chi Shing Li as a non-executive Director and Ms. Nisa Bernice Wing-Yu Leung's resignation due to personal work arrangements, which may influence strategic decisions moving forward. Despite not being free cash flow positive yet, CanSino’s expected profitability within three years positions it favorably for investors eyeing long-term growth potential in high-tech biotech industries.

Beijing Fourth Paradigm Technology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd., an investment holding company, provides platform-centric artificial intelligence (AI) solutions in the People's Republic of China and has a market cap of HK$19.92 billion.

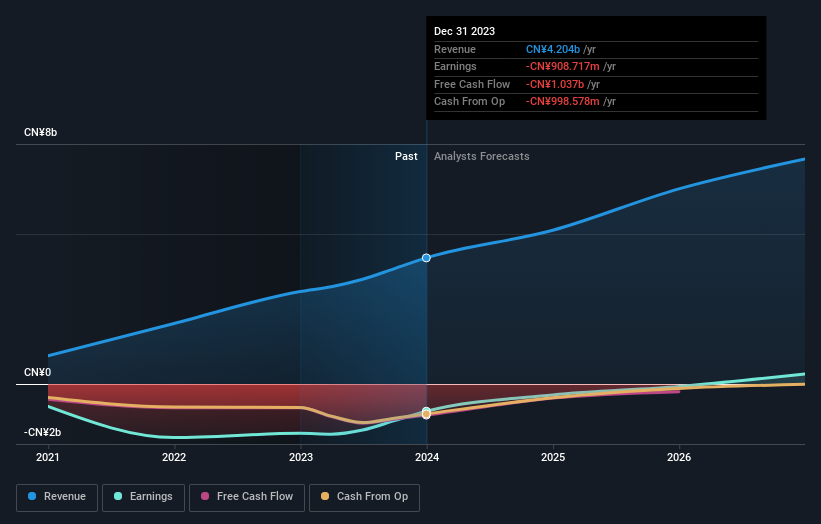

Operations: The company generates revenue primarily from its Sage AI Platform (CN¥3.00 billion), SageGPT AIGS Services (CN¥448.10 million), and Shift Intelligent Solutions (CN¥1.15 billion). The gross profit margin stands at 60%.

Beijing Fourth Paradigm Technology has shown a significant improvement in its financial performance, with sales rising to ¥1.87 billion for the half-year ended June 30, 2024, up from ¥1.47 billion the previous year. The net loss narrowed substantially to ¥151.6 million from ¥456.07 million, reflecting better cost management and operational efficiency. Their R&D expenses have been substantial, underpinning their commitment to innovation and future growth; this strategic focus is critical as they navigate the competitive AI landscape.

RemeGen

Simply Wall St Growth Rating: ★★★★★☆

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on the discovery, development, and commercialization of biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of HK$11.58 billion.

Operations: RemeGen Co., Ltd. engages in the discovery, development, and commercialization of biologics targeting autoimmune, oncology, and ophthalmic diseases with unmet medical needs in Mainland China and the United States. The company operates within a market cap of HK$11.58 billion.

RemeGen's sales surged to ¥741.76 million for the half-year ended June 30, 2024, a notable increase from ¥419.07 million the previous year. Despite a net loss of ¥780.46 million, up from ¥703.36 million, R&D expenses underscore their commitment to innovation and future growth; with significant investments in developing telitacicept for myasthenia gravis and rheumatoid arthritis treatments. The company's revenue is forecasted to grow at an impressive 26.3% annually over the next few years, outpacing market expectations of 7.4%.

Get an in-depth perspective on RemeGen's performance by reading our health report here.

Review our historical performance report to gain insights into RemeGen's's past performance.

Turning Ideas Into Actions

Navigate through the entire inventory of 48 SEHK High Growth Tech and AI Stocks here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:6185 SEHK:6682 and SEHK:9995.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]