Hong Kong's Top Dividend Stocks For February 2024

The Hong Kong stock market has recently shown signs of vitality, with a 4.9% uptick in the past week, although it remains 14% lower compared to last year. With earnings projected to grow by 13% annually, investors may find reassurance in stocks that not only withstand market fluctuations but also provide consistent dividend payouts.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Medical System Holdings (SEHK:867) | 4.74% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 3.95% | ★★★★★☆ |

Fu Shou Yuan International Group (SEHK:1448) | 3.33% | ★★★★★☆ |

Industrial and Commercial Bank of China (SEHK:1398) | 7.94% | ★★★★★☆ |

Agricultural Bank of China (SEHK:1288) | 7.22% | ★★★★★☆ |

Far East Horizon (SEHK:3360) | 7.58% | ★★★★★☆ |

Anhui Expressway (SEHK:995) | 7.01% | ★★★★★☆ |

Zhejiang Expressway (SEHK:576) | 6.69% | ★★★★★☆ |

Tian An China Investments (SEHK:28) | 7.14% | ★★★★★☆ |

Jiangxi Copper (SEHK:358) | 4.56% | ★★★★☆☆ |

Click here to see the full list of 38 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

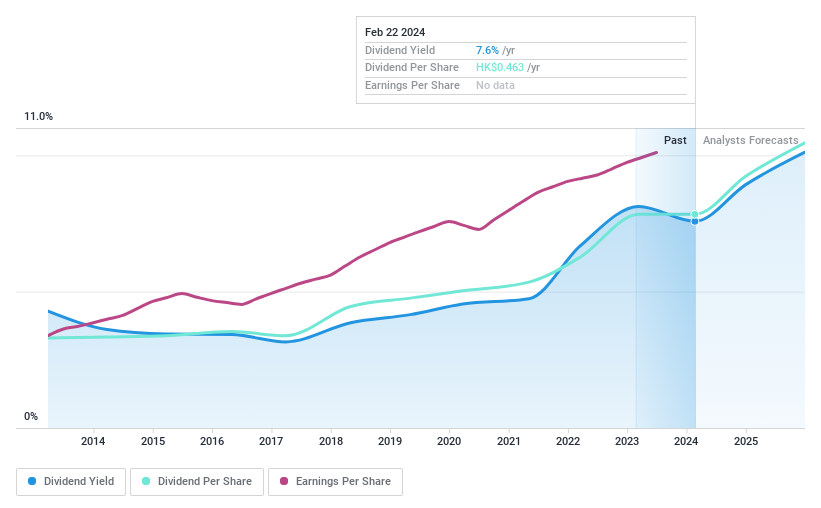

Far East Horizon (SEHK:3360)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Far East Horizon Limited is a diversified financial services provider operating primarily in Mainland China and Hong Kong, with an international presence and a market capitalization of approximately HK$26.37 billion.

Operations: Far East Horizon Limited generates its revenue primarily through financial, lease, and advisory services which contributed CN¥32.42 billion, and industrial operation and management activities accounting for CN¥5.34 billion.

Dividend Yield: 7.6%

Far East Horizon (SEHK:3360) presents a mixed picture for dividend investors. The company has demonstrated an ability to grow earnings, averaging an 11.5% increase annually over the past five years, and its net profit margins have improved slightly in the last year. Dividend payments are supported by earnings with a modest payout ratio of 28.5%, and cash flows seem adequate with a cash payout ratio of 71%. However, concerns arise from its high debt levels, with a net debt to equity ratio at 433.3%, and operating cash flow not sufficiently covering this debt load. While dividends have been reliable and growing over the past decade, the current yield is below that of top dividend payers in Hong Kong's market.

Click to explore a detailed breakdown of our findings in Far East Horizon's dividend report.

Our valuation report here indicates Far East Horizon may be undervalued.

Recognizing undervalued stocks is just the first step. To effectively track your investment's performance and make informed decisions, consider utilizing Simply Wall St's portfolio tool.

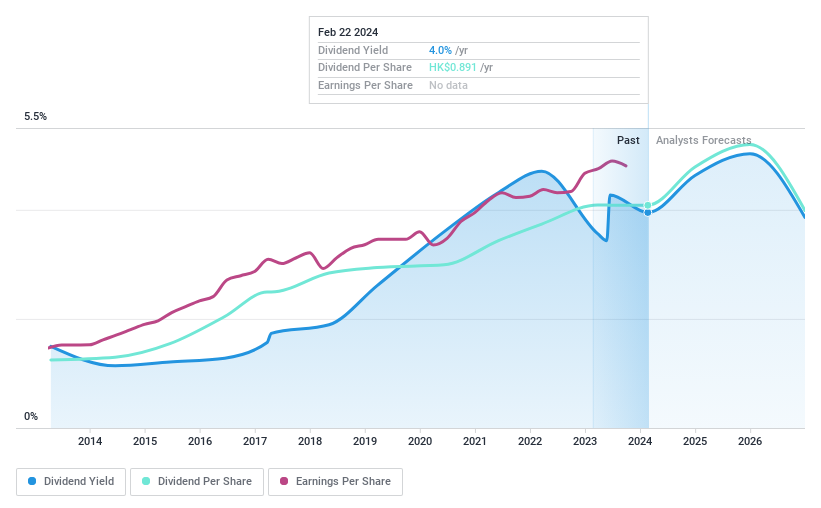

Sinopharm Group (SEHK:1099)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinopharm Group Co. Ltd. is a leading distributor of pharmaceuticals, medical devices, and healthcare products in the People's Republic of China, with a market capitalization of approximately HK$70.37 billion.

Operations: Sinopharm Group Co. Ltd. generates its revenue primarily from the wholesale and retail sales of pharmaceuticals, medical devices, and healthcare products within China.

Dividend Yield: 4%

Sinopharm Group (SEHK:1099) appears to be a prudent choice for dividend seekers, with its debt becoming more manageable over time, evidenced by a declining debt to equity ratio. The company's earnings have consistently grown, surpassing its five-year average this past year. Dividends seem sustainable due to low payout ratios and are well-supported by both earnings and cash flow, with a history of reliability and growth over the past decade. However, investors should note that Sinopharm's dividend yield is modest when compared to the higher echelons of Hong Kong's market dividend payers, and its operating cash flow does not cover debt as robustly as one might prefer.

Get an in-depth perspective on Sinopharm Group's performance by reading our dividend report here.

If you're considering adding this company to your holdings, or you already have, Simply Wall St's portfolio tool can help you manage and assess its performance within the context of your entire portfolio.

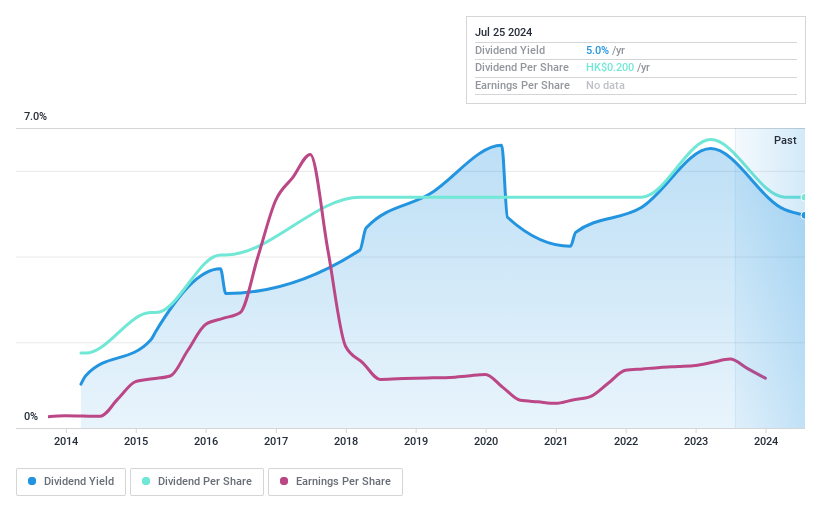

Tian An China Investments (SEHK:28)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tian An China Investments Company Limited is an investment holding firm that specializes in investing, developing, and managing properties across the People's Republic of China, Hong Kong, the United Kingdom, and Australia, with a market capitalization of approximately HK$5.13 billion.

Operations: Tian An China Investments Company Limited generates revenue primarily through property development, which contributed HK$4.58 billion, and property investment, with earnings of HK$575 million.

Dividend Yield: 7.1%

Tian An China Investments (SEHK:28) offers a nuanced picture for dividend investors. The firm has seen its debt to equity ratio rise modestly over five years, but maintains a satisfactory net debt position. Earnings have grown steadily, outpacing the five-year average recently, and dividends are well-protected by both earnings and cash flows, with a history of consistent growth and stability over the past decade. However, Tian An's current profit margins have dipped from last year's high, and its dividend yield isn't among the market's top tier. This suggests that while dividends appear secure and growing, there are aspects that may not align with all investor appetites for yield or profit margin performance.

Consider placing the stock on a Simply Wall St watchlist and revisit its valuation at a later date when it might be more favorable.

Taking Advantage

Harness the power of data-driven insights to navigate the world of Hong Kong dividend stocks with ease, thanks to the Simply Wall St screener. Delve into our full catalog of 38 Top Dividend Stocks here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]